Executive Summary

- Markets have entered a window of volatility in the run up to the US Election.

- The momentum of the economic recovery is fading amid a second COVID wave in Europe, a still pending fiscal deal in the US, and a vaccine still being at least several months away.

- Currently, the lack of fiscal clarity makes it difficult for the FED to provide additional easing.

- In consequence, inflation expectations have been declining while real rates and the dollar have been rising.

- We see the correction as an opportunity to accentuate our core positioning in quality assets. We believe that real rates will ultimately continue their downward trend and support the quality factor in the fourth quarter.

Big-Tech leads correction

It seems that positive economic surprises have peaked in the summer. The S&P 500 lost almost 11% from peak to trough and the Nasdaq 100 over 14%. Leaders, such as Apple, even corrected a full 25% from their highs. Real yields continue to drive markets, with risk assets falling when real rates rise and vice versa. Overall, this year remains one of the most volatile in recent history.

Market Development

World

Unsurprisingly, the first of three US presidential debates did not instill confidence in equity markets. On the other hand, encouraging news came from the consumer side. The conference board consumer confidence index rebounded sharply in September to 101.8 vs. 90.0 expected and 86.3 in August. Meanwhile, hopes of an imminent fiscal deal in the USA are waning and the recent news that President Trump tested positive for COVID-19 has further increased market uncertainty. As Trump’s campaign gets derailed by this development market commentators see an increasing probability for a Biden victory.

Europe

In Europe, the sub-zero headline September inflation readings for France and Germany ratchet up the probability of additional ECB easing. Regarding Brexit, market optimism that the two sides will clinch a deal at the last minute persists, as this has often been the case in the past.

Switzerland

The franc hit a five-year high against the euro earlier this year, though it has weakened again. In September, the Swiss National Bank reiterated its willingness to “intervene more strongly in the FX market.” Economists, including those at Goldman Sachs, have cautioned that the SNB’s massive liquidity injections this year are likely to raise red flags in Washington. In January, the U.S. Treasury added Switzerland to a watch list of possible currency manipulators. The next installment of the U.S. Treasury’s report could be published soon.

Is the glass half full or half empty?

Our view that markets would get bumpier into the fall is playing out. The correction has been overdue and was spurred by excessive risk-taking in the summer months. The remarkable US tech leadership has tired and needs to consolidate, as the liquidity driven rally loses steam without further stimulus. With that comes the danger of a new market narrative according to which a severe second wave may arrive before a vaccine is discovered and new fiscal stimulus announced.

While the short-term outlook has become more uncertain, we note that the recovery in Q2 was stronger than consensus initially expected. Corporate Q2 earnings were well received, as they exceeded low expectations. Yet companies’ outlooks were often still very cautious, and the path forward will strongly depend on the roadmap for a new fiscal package.

In the US, the momentum induced from the CARES 1 package can likely carry the economy for a bit longer, but ultimately the recovery is prone to failure if no additional stimulus is injected. Should congress fail to pass CARES 2, the loss of fiscal impulse would be sizable. It seems the Fed has hit the limits of what it can do without more bonds to buy, as for now it doesn’t seem willing to implement other measures. The crux is that the Fed won’t receive more bonds to buy until the Treasury department needs to fund another round of stimulus.

As a result of the correction, the risk-return outlook for equities now seems better balanced than a month ago. We note, however, that the decline in equity markets was very controlled and didn’t show the levels of fear we usually like to see for a tradeable bottom. From that view, the major indices could fall another 10%.

That said, the underlying drivers of the market recovery remain in place. These include negative real yields, improving earnings expectations and a highly accommodative monetary policy. A fiscal deal will eventually be reached or forced by market volatility.

Likewise, chances for a vaccine over the next 9 months are promising according to analyst consensus. However, there may be too much vaccine optimism in the short- term. In any case, volatility will remain elevated into the US elections.

Positioning

- Our positioning remains driven by the thought that the virus will fade eventually but easy money will stay, inflation expectations will trend higher and global supply chain inefficiencies will rise. Hence, we believe that the recent rise in real yields is only temporary and keep a preference for high quality companies, notably in tech, health care and consumer staples. Overall, we remain focused on real assets and stand ready to buy into what could finally be a sustainable reopening trade in the coming months.

- We argue that there is a good chance that with the coming winter the virus will finally lose its fear factor for markets. In our view better testing will result in lower uncertainty than in March/April and widespread lockdowns will be the last resort only.

- Looking into 2021, we remain convinced that equities and precious metals continue to offer the best risk-reward profile, given overall moderate positioning of market participants, supportive liquidity conditions and the expensiveness of other safer assets.

Chart

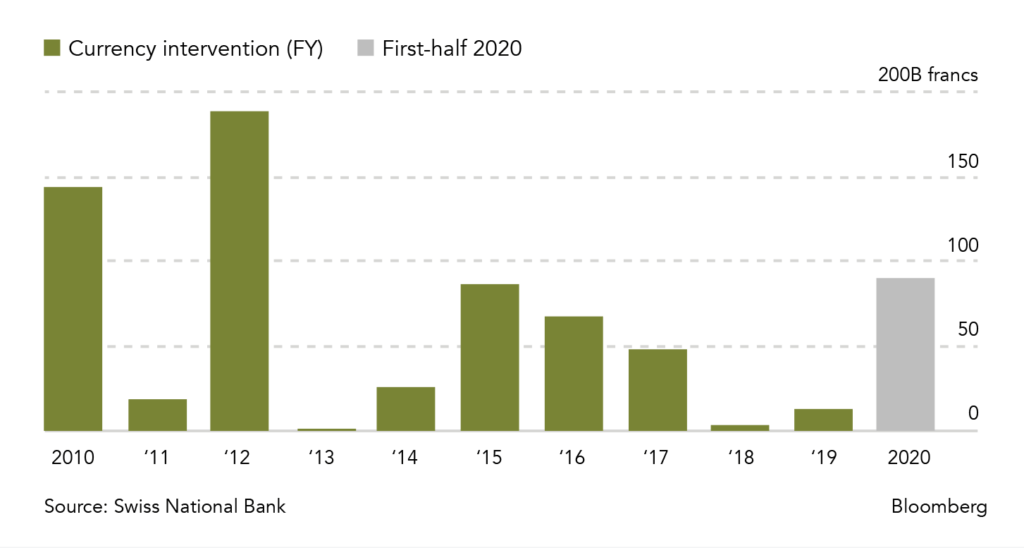

The Swiss National Bank bought 90 billion francs worth of foreign exchange in the first six months of 2020. It was forced to increase market interventions in an effort to dampen the franc’s strength as the coronavirus pandemic roiled markets. This figure shows that the SNB spent more in the first half of 2020 than in the previous three years combined.

Sources: Bloomberg, Saxo Bank, Goldman Sachs, JP Morgan, The Market Ear, Hightower Naples