- The S&P 500 Index is facing its third straight quarter of losses for the first time since 2008-09.

- On the positive side, we believe, markets have now finally priced-in that the disinflation process will not be as fast and linear as they hoped for and that the Fed is truly committed to bring inflation under control – and that this will involve pain in economic and asset-price terms.

- The “Fed will hike until something breaks” is as relevant as ever, given the latest bond-market dislocations.

- We think, a prolonged disorderly dollar funding market and/or US-Treasury market would eventually force the Fed to live up to its financial stability mandate and abandon quantitative tightening. Such an inflection point in the liquidity cycle would be bullish for risk assets – the timing is of course uncertain.

- At the end of September, market sentiment was extremely negative, which favored another rally. Just remember that strong, abrupt rallies characterize bear not bull-markets.

The 60/40 Nightmare

- A “hard landing” in the US is starting to look increasingly likely, given the Fed’s predicament with inflation.

- However, recent resilience in US activity and consumer data looks to delay a sharper US growth slowdown. Company surveys show that delivery times and freight costs are falling, and inventories are replenishing. US goods inflation should thus continue to decline.

- A recession in major parts of Europe, starting in Q4, should be the base case.

- In larger terms, we note that fiscal (spending) and monetary policies (tightening) work in opposite directions in many developed markets, putting FX and bond markets under severe tension.

Market Development

World

- On a cross-asset basis, we have never had stocks and bonds both down in 3 consecutive quarters (with data back to the 70s).

- The correlation between stocks and bonds over the last 2 years is the highest since 1993-1995.

- Q2 earnings season turned out much better than feared.

- Will this also be the case for Q3 earnings? After all, the global economy is now in worse shape than in Q2, with 53% of global PMIs <50 today, compared to 23% in Q2.

- The short-term trend for earnings estimates consensus has been sharply negative heading into the Q3 reporting season.

- As of the end of September, several sentiment and technical indicators signaled potential for a sizeable oversold bounce.

- So far this year, a 5-day average VIX above 30 has been enough to represent a near term low (@31.9 as of 30.09)

Europe

In September, inflation in the Eurozone was once again higher than expected. The annual rate jumped from 9.1% to 10.0%, thus reaching a new record high. Inflation in the energy sector rose from 38.6% to 40.8%, in food including alcohol and tobacco from 10.6% to 11.8%, in industrial goods from 5.1% to 5.6%, and in services from 3.8% to 4.3%.

Switzerland

The manufacturing and service PMIs sectors signaled continued growth in the Swiss economy in September. The PMI Manufacturing even halted its downward trend for the time being, rising again – and surprisingly – for the first time after five consecutive declines. The activity indicator improved from 56.4 to 57.1 points.

Will financial instability eventually force the Fed’s hands?

In hindsight, we got it right that new bear market lows were still ahead, despite the furious summer rally in risk assets. We think that markets have now understood that an early pivot based on quickly disappearing inflation is not in the cards. This also means that further negative surprises in sequential (month-over-month) inflation data may have a less adverse impact on financial markets going forward if consumer inflation expectations remain anchored.

The Fed is fighting a battle against inflation and loss of credibility. It is clearly afraid of easing-off too early as it did in 1980, when it prematurely cut rates due to an economic slowdown only to subsequently be forced to tighten even more aggressively and completely slam the economy as inflation would not behave.

Fed Chair Powell has told us repeatedly that he is looking to bring the whole curve into positive real yield territory. At the short end, the hurdle is the PCE Core rate running at 4.9% YoY in August. While this rate is expected to decline, it strongly implies a target fed funds rate well above 4% – a significant headwind for markets and the economy. This was again emphasized with the FOMC’s September economic forecasts which hinted at an approaching US recession.

Higher volatility and tighter financial conditions are currently central bank objectives as a means to deal with inflation rather than a reason to cave in. However, a move too far too fast can break things. The Bloomberg financial conditions index has made new lows and the USD trade weighted index has already reached historic intervention levels (e.g., Plaza Accord in ‘85).

Were the BoE emergency measures to prevent UK pension funds from collapsing the ‘canary in the coal mine’? In general, the bar for intervention is high as inflation remains the binding constraint. However, the ad-hoc BoE purchase of long dated UK gilts pointed at one thing: sovereign bond markets must be stable at all costs. Note that US pension funds – like their UK counterparts – have also been huge players in interest rate swaps (according to a BIS paper from 2018). The bottom line is, we now know that eventually there is a back stop if financial stability is in danger – which means that sovereign bonds may work as haven assets again.

Positioning

In our view, “don’t fight the Fed” still means to be defensive. This would change (and potentially flip around) if disorderly market conditions would force a Fed intervention.

For example, some analysts already expect coordinated measures to ease dollar funding conditions around the G20 meeting in mid-November. After all, a liquidity crisis can spiral out of control much faster than inflation.

In this context, the global USD money supply is shrinking rapidly. According to Morgan Stanley the global money supply in USD (combining the US, China, the Eurozone and Japan) is down approximately USD 4 trillion from its peak. Given this trajectory, a Fed pivot now seems likely at some point, the question remains when. In any case, we will likely only be able to identify an inflection point in the liquidity cycle ex-post.

Thus, we look to continue our laddered-buying approach into equity markets (we already brought in 3 steps, starting in June this year), which will bring us back to a neutral weighting and further reduce our still large cash position.

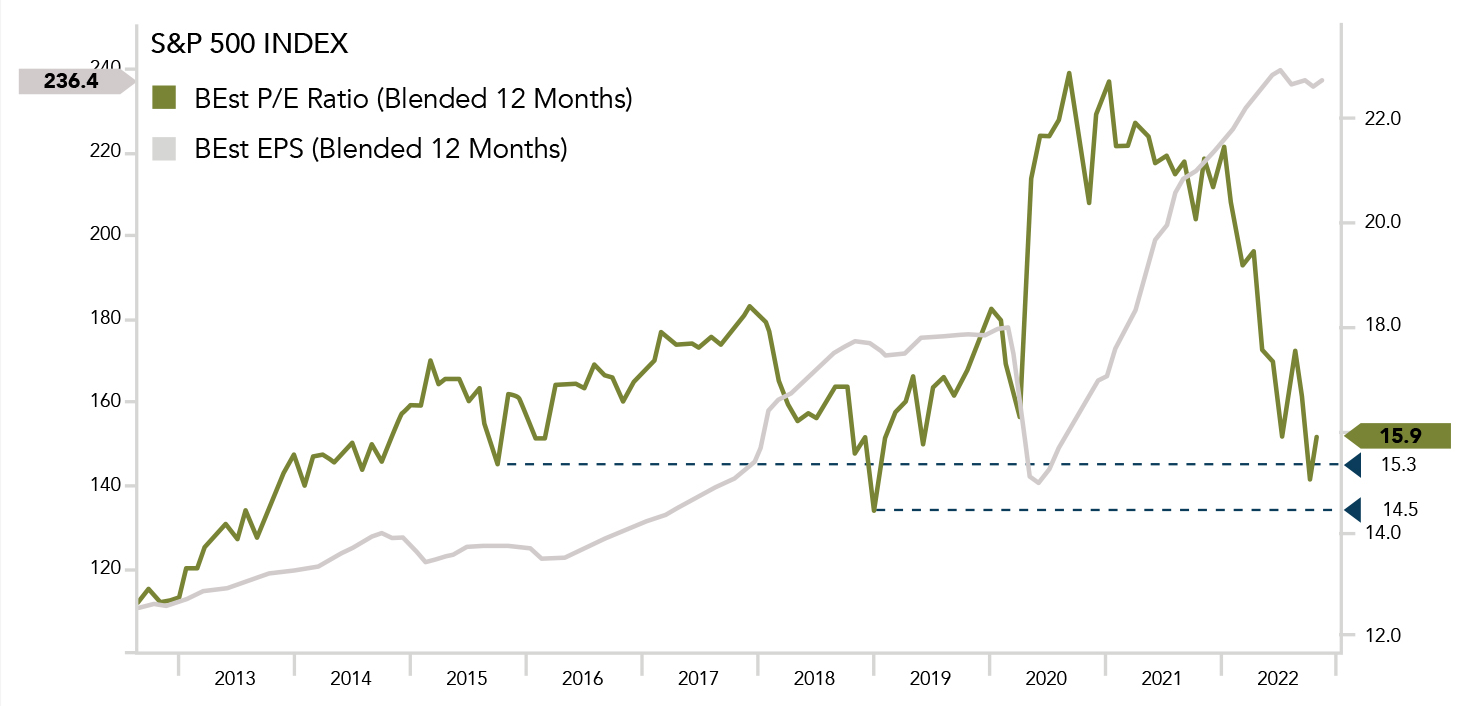

Chart

The S&P 500 and its valuation multiples have turned lower following a summer rally. Both made new YTD lows in September. Note how the 12M forward S&P 500 P/E (in white) has already briefly touched prior correction lows (red). A big question remains around forward EPS (blue) however, which we expect to turn lower.