- The result of the recent risk rally is that financial conditions have eased substantially. This is exactly the opposite of what the Fed wants, given its goal to dampen demand and control inflation.

- We don’t think the Fed can accept looser financial conditions at this point and expect them to turn up their hawkish rhetoric once again – particularly after the recent jobs report that highlighted the risk of a wage-price spiral in the US.

- Despite the recent resilience of the hard economic data, the most reliable forward-looking indicators suggest that a US recession is probable some time in 2023 (our best guess currently is late H2).

- This means, stock markets are probably in for a wild ride next year as they don’t yet reflect the risk of a US recession.

- Bottom line for us is to ride (but not chase) the current bear market rally with an overall defensive allocation and to be ready to reduce risk when the tide turns, as we expect it will already in December.

Eine weitere sich selbstzerstörende Bear Market Rallye?

- Im November ist der S&P 500 über 5% gestiegen während der US-Dollar um 5% gefallen ist. Haupttreiber waren die niedriger als erwartete Inflation und Powells Hinweise auf langsamere Zinserhöhungen. Der Yen und Euro sind gestiegen und die Anleihenrenditen gefallen.

- Das Problem ist, dass der Markt zunehmend Zinssenkungen für 2023 einpreisen wird, sofern die Fed nicht, wie bereits in der Sommer-Rallye diesen Jahres, dagegen vorgeht.

- “Die Geschichte warnt eindringlich davor frühzeitig die Geldpolitik zu lockern. Wir bleiben auf Kurs bis der Job erledigt ist.“ (Jerome Powell, November 2022)

Market Development

World

- Inflation drivers are diverging. In the US, inflation is now largely driven by the service sector, whereas in Europe it remains an energy related story.

- The current (but highly uncertain) path of US core inflation should permit the Fed to declare “mission accomplished” on inflation in mid-2023 when the core rate should fall below the Fed funds rate (expected to be approx. by 5% then).

- Fed rate cuts may very well happen in Q4 next year – but not without multiple months of disinflation and the market anticipating a recession first – risks markets do not yet reflect this, in our view.

Europe

- A recession in major parts of Europe, starting in Q4, should be the base case (despite milder weather in Q4).

- The unemployment rate in the euro zone unexpectedly fell from 6.6% to 6.5% in October, thus reaching a new record low. The range is from 3.0% in Germany to 11.6% in Greece and 12.5% in Spain.

Switzerland

- After two consecutive declines, year-on-year inflation remained at 3% in November.

- Core inflation of 1.9% is even within the SNB’s target. However, inflation rates are likely to rise above 3% in the coming months, as, among other things, increases in some regulated prices are only reflected in the consumer price index with a lag (e.g. electricity prices).

- The SNB is expected to raise the key interest rate by at least 50 basis points in December.

The massive tightening this year presents substantial growth risks for 2023

Recent resilience in US activity data looks to delay (but not avoid) a sharper US growth slowdown. Our base case for 2023 is thus for a global reset that will shift Fed tightening to easing in late Q4, underpinning treasuries and gold.

However, until the recession eventually materializes, we think there will be room for multi-months goldilocks equity rallies in 2023 as the market narrative will not instantly shift from inflation shock to growth shock – the transition period should be constructive for risk assets and coincide with a Fed pause in rate hikes.

Bank of America gives us the 3 R’s (the 3 key themes) for 2023: Reshoring (in US and EU), Reopening (in China) and Recession (US and EU) – this sounds very plausible to us.

What are possible investment implications of this set-up ?

China: A virtuous circle could be forming for equities with China exposure (low valuations, reopening, stimulus) but it will be some time before the macro data improves, so buying China is going to be a tricky leap of faith for foreigners as they have been burned badly the last 2 years. China is the factors that holds a possible upside divergence to our base case. In such a positive scenario, a strong China recovery could re-ignite global growth which would likely buoy industrial metals and the Euro.

Energy Sector: We note quite a divergence in YTD performance between oil (breaking to new lows), and energy stocks (still the strongest equity sector). In the past such massive divergences resolved via big decline in oil-stocks.

Treasuries: We’re seeing the deepest US yield curve inversion in 41 years. But most recessions don’t begin until we see some steepening from the lows. Longer-dated US Treasury yields may have passed the cycle peak and 2H23 could see significant bull steepening of the yield curve if a recession becomes more and more unavoidable.

US-Dollar: We have been observing signs of U.S. dollar exhaustion for several weeks now and consider it likely that the dollar has seen its peak for this cycle. Accordingly, the year 2023 could be characterized by dollar weakness. However, the dollar has fallen sharply in a short period of time and is now at the 200-day moving average, so it could first initiate a short-term recovery.

Positioning

The steepest wave of global tightening in at least a generation has delivered severe losses for most assets this year. Unfortunately, conditions typically consistent with sustainable bear-market bottoms have not been met yet (e.g. a significant decline in corporate earnings or a steep downturn in the credit cycle).

- That said, we believe that a tradeable multi-month bottom could become evident in the first half of 2023 as the liquidity cycle bottoms and turns up. In this context, the USD may already have peaked.

- More concretely, we are now defining stop-loss limits to reduce risk if the market rally rolls-over. We expect another leg lower into Q1 that should allow us to position for a goldilocks rally as liquidity improves.

- In the meantime, we will continue to shift away from beta exposure to single-names that we see as best positioned for this outlook.

Big risk (but not the likely outcome in our view) to this forecast would be inflation momentum picking up again (over 2-3 months), forcing the Fed to move the terminal rate significantly higher in 2023 and reset the clock for a pause.

Chart

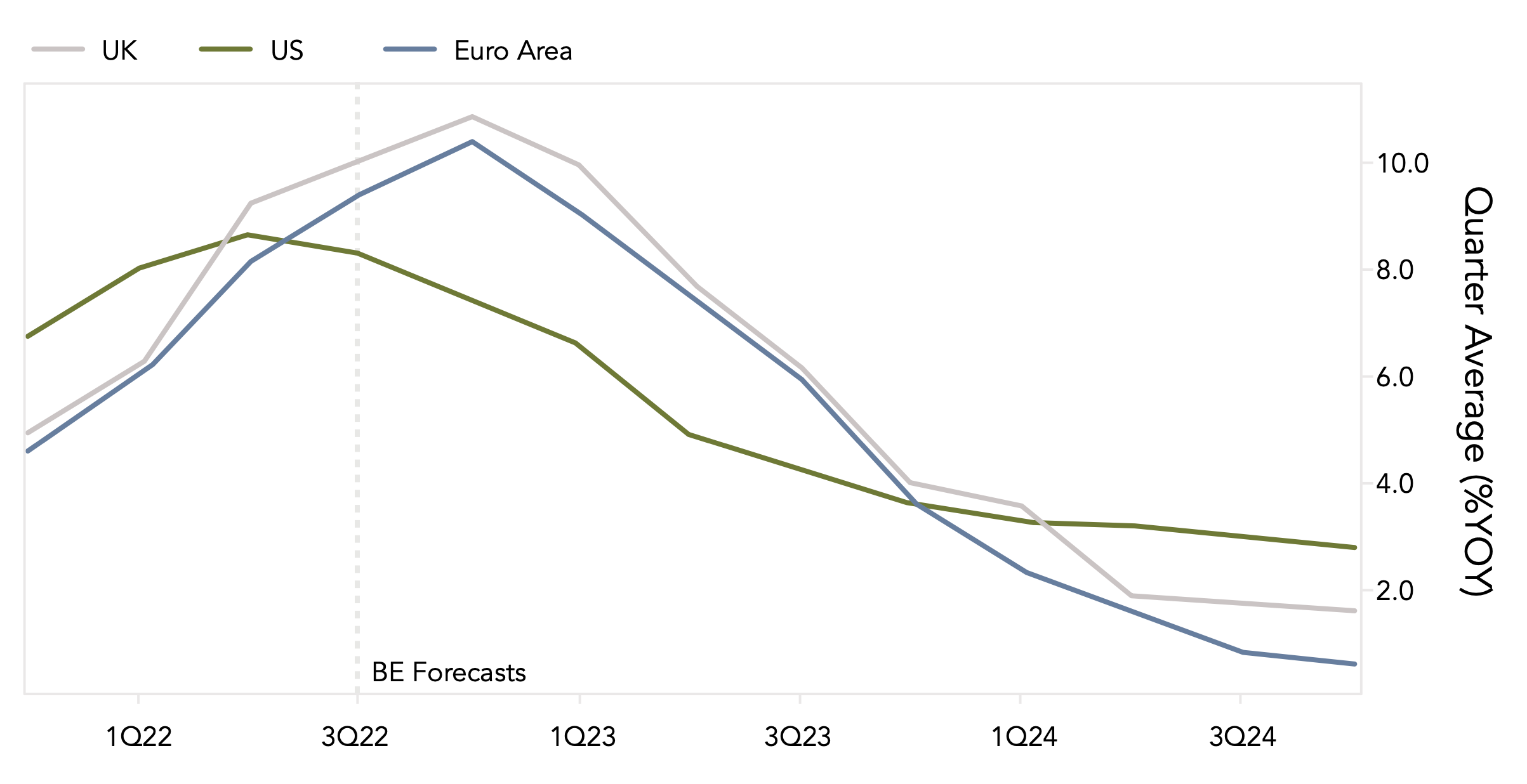

We observe various inflation forecasting models. For example, Bloomberg’s model attempts to capture inflation among the least volatile 20% of CPI sub-components (75 in the U.S., 94 in the EU, 85 in the U.K.) to derive a forecast for headline inflation. It now forecasts, after a rapid increase in year 22, a more drawn-out decline in inflation in 2023. Specifically, in 2023, inflation is expected to average 4.8% in the U.S.A. (down from 8.1% in 2022), 6.6% in the euro area (down from 8.5%), and 7% in the U.K. (down from 9%).