- Following the deeply oversold and depressed market sentiment at the end of September, October saw a forceful equity counter-trend rally accompanied by a softening US dollar.

- The rally, which started with a Fed pivot rumor by the WSJ, is now running into resistance, as Powell once again pushed back against hopes for an early Fed pivot (he wants to prevent any loosening of financial conditions).

- Unfortunately, the Fed’s inflation dilemma still remains unsolved. The disinflation process is proving sticky and real-time US macro data too resilient (i.e., not enough demand destruction yet) for a softer stance at the moment.

- At the same time, forward-looking indicators, such as an inverted US 3m/10-yr curve in October, are warning of the increasing likelihood of a US recession sometime in 2023.

The Fed remains firm with regard to its hawkish stance (for now)

- Prior to the FOMC conference, the S&P 500 had rallied approx. +12% from the lows (with small caps outperforming), which is in line with previous bear market bounces so far this year.

- The move could still have further legs if systematic strategies start to drive equity exposure back up again, but technically, the advance is now damaged post the FOMC sell-off.

- Bonds are continuing to have a historically bad year and bond volatility (the MOVE index) remains close to highs.

- Meanwhile, a new set of US restrictions on China’s semiconductor industry announced last month marks a major escalation of technology controls.

Market Development

World

- US Midterm Elections: According to the polling analysts at FiveThirtyEight,

the House is clearly expected to go to the Republicans, while the Senate is too close to call.- Markets generally react positively to a split Congress.

- Historically, the election cycle shows positive equity-seasonality for equities following the midterm elections.

- Maybe the inflation battle will become less important after the midterms?

- The October US ISM manufacturing PMI fell to 50.2, from 50.9 in September. This was accompanied by JOLTS job openings rising to 10.717k in September, which is still incredibly high, indicating the strength of the US labor market.

- Note that Powell called the labor market out of balance and expressed disappointment at the persistence of high inflation.

Europe

The Eurozone Manufacturing PMI dropped to a 29-month low of 46.4 in October, down from 48.4 in September, as output and new orders fell at rates rarely surpassed in 25 years of the PMI survey. These levels hint strongly at recessionary conditions in major parts of Europe in Q4.

Switzerland

The Switzerland Manufacturing PMI turned lower again, following its surprising increase in September, but remains in growth territory at 54.9 points. However, in view of the economic slowdown among the major trading partners and the rise in energy costs, a significant slowdown in growth is also expected in Switzerland in the coming months.

“We will stay the course until the job is done” – Jerome Powell, Nov 2022)

The Fed just delivered its 4th consecutive 75-bp rate hike. Fed Chair Powell stated that the Fed could slow the pace (down to 50 bps) as soon as December but called any discussion of a pause in hikes ‘very premature’.

Financial markets had started running with the narrative that many developed market central banks are beginning to pivot away from aggressive rate hikes. Indeed, that argument was boosted by the BoC end of October, when it hiked by only 50 bps versus expectations of 75 bps, and by similar dovish interpretations from the RBA, BoE and ECB in the past few weeks.

Powell’s challenge, therefore, was to signal a shift to a slower pace of hikes without communicating that the Fed is close to done with its tightening campaign. He accomplished that by declaring that rates would peak higher than officials had expected in September, even if the pace of hikes may slow as they move closer to that destination.

Where are we now in the tightening cycle – in our view?

- Phase 1: Raising rates rapidly to catch up (may have been concluded)

- Phase 2: Raising rates at a slower pace (could enter this phase in Dec)

- Phase 3: Holding rates at a given high level and wait for PCE Core Inflation to drop below that level (starting in March 2023 at the earliest)

- Phase 4: Turnaround and easing (not before H2 2023)

This path remains heavily data-dependent. Note that we will get two more CPI releases before the December FOMC meeting.

Powell also acknowledged that the path towards a soft economic landing is getting narrower. One of the big market themes in coming months will therefore be just how much economic weakness the Fed is willing to stomach while inflation remains elevated. They have claimed that the answer is “quite a bit,” but that proposition is now likely to start being put to the test.

- Rising borrowing costs (30-yr mortgage rates at 7.2%, the highest since 2001) have massively slowed the US housing market, which is widely accepted as a leading indicator for the broader economy.

- According to a recent Bloomberg survey, only 5% of economists still believe in a soft landing.

As relevant pausing indicators, we are keeping an eye on Fed rhetoric regarding a cap on the terminal fed funds rate. A shift to prioritizing growth would count too. Cynically, equity bulls may therefore have to hope for a quick weakening of economic growth.

Positioning

In our view, “don’t fight the Fed” still means continuing to be defensive, but we are seeing the first signs of a potential turnaround in the liquidity cycle in the first half of 2023.

Besides an inflection point in the liquidity cycle, we also look at the business cycle to determine when the bear has run its course. We consider a reset of earnings expectations as another necessary precondition for a bottom in equity markets. In this context, the earnings correction has now truly started with Q3 earnings and is likely to become even more pronounced with Q4 figures.

While full capitulation has not yet taken place, we believe that a sustainable market floor for this cycle could become evident in the first or second quarter of 2023.

We are therefore looking to continue our laddered buying approach into equity markets (we already bought in four steps, starting in June this year), which will bring us back to a neutral weighting and further reduce our still large cash position.

Furthermore, we have started to selectively shift our global beta exposure into high-quality single names.

Chart

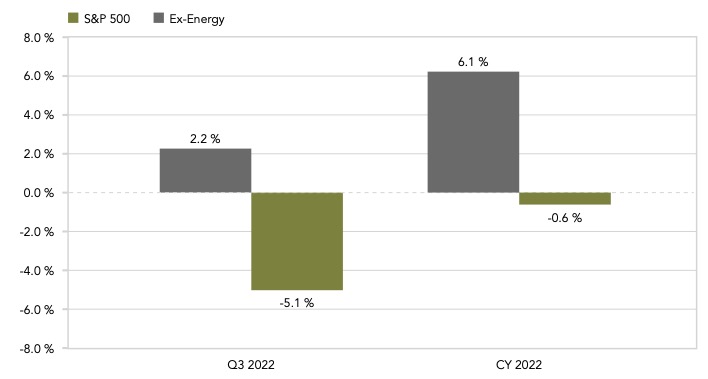

According to FactSet (as at October 28, 2022), half-way through the Q3 earnings season, the blended earnings growth rate for the S&P 500 is 2.2%. If 2.2% will be the actual growth rate for the quarter, it will mark the lowest growth rate reported by the index since Q3 2020 (-5.7%). Excluding the energy sector, earnings growth is tracking at -5.1% for Q3 2022.