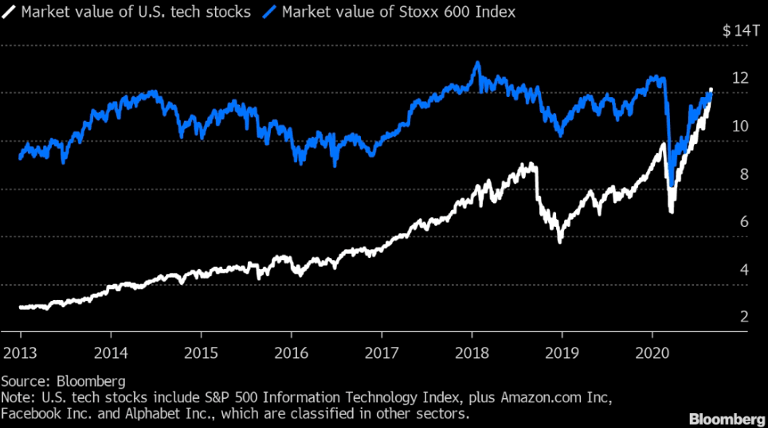

The stock market had its best August since 1986. Whereas in the last couple of years equity mar-kets tended to take a breather, this time all major equity indices advanced. Driven by large-cap technology and growth stocks, the US market once again was the leader. According to total market capitalization, the US tech sector surpassed the whole European market, as measured by the Stoxx Europe 600. To some degree, skyrocketing stock prices were reminiscent of the 2000 Dot.com bubble. Tesla’s stock rose another 74% in August, bringing the 1-year return to +970%. Yet during the same time period sales only rose by 3%.

Chart:

Recent market developments:

- Because of deflationary fears and a threatening Japanification of the US economy, the Fed altered its 2% inflation target. The new goal is to achieve 2% on average over a certain time frame. Thus, the Fed will accept an overshoot in inflation and keep interest rates lower for longer. This strategic shift has profound ramifications for different asset classes. An inflationary environment would be negative for bonds with nominal interest payments and supportive for real assets, such as gold or stocks.

- The economic recovery continued, albeit at a slower pace. China, which was the origin of the pandemic, is back in expansionary territory and may even achieve positive economic growth in 2020. In Europe, the outlook in the manufacturing sector improved, yet the services sector struggled again due to the second COVID wave. In the US, authorities could finally get the coronavirus better under control. As a result, the economic outlook quickly improved. The effects of lower additional unemployment benefits will, however, only be visible in the fall. ¹

- Earnings in the S&P500 index decreased by 47% in the second quarter of 2020, compared to the same period last year. For the third quarter, analysts expect a year-over-year reduction of -16%. In Europe, the Stoxx Europe 600 posted negative earnings in the second quarter, and for the third quarter -11% is expected. ²

- There are positive medical developments. Abbot Laboratories got the FDA approval for a new COVID-19 test which does not require laboratory equipment, and which provides the results in 15 minutes. The price of this antigen test is only 5 USD.

Market commentary:

The stock market rally, in particular in the tech sector, is continuing. Therefore, valuations have reached historic highs. Past recessions were characterized by deleveraging. The process of deleveraging then provided a fertile ground for a new growth cycle. This time, however, debt levels continue to rise due to support measures from central banks and governments. Consequently, we expect weaker long-term economic growth, coupled with a global stock market that offers below-average returns with above-average volatility. Yet in the short-term the TINA argument (“there is no alternative”) dominates, and the Fed has again reinforced it.

It is possible that the overall recovery narrative may reach a turning point. Although positive macro data continues to be released, the momentum of improvement is receding. The pandemic could gain traction again in the cold fall weather, even if a second lockdown seems unlikely. In addition, geopolitical risks are reaccelerating and future fiscal stimuli are still up for debate.

The weakening dollar could be a signal for a mid-term regime shift. This trend could accelerate after US election, when new fiscal stimulus will probably be enacted. As regards the presidential race, we think that it is a close race between Trump and Biden. As evidenced in the betting mar-kets, we believe that Biden’s lead is not as clear as often portrayed in the media.

Positioning:

- We remain neutral in our tactical equity market assessment. The economic recovery is under way and governments as well as central banks are strongly supportive, yet valuations are at all-time highs of the Dot.com bubble. Our stock selection remains strongly focused on quality stocks equipped with solid balance sheets and business models.

- We favor companies with high financial strength and give preference to technology, healthcare and basic food sectors. We are aware that this “quality trade” has already gone a long way and in many respects has now transitioned into the “consensus trade”.

- At a broad portfolio level, we strive for diversification, good liquidity and high quality of our risk investments, while we steer clear from strategies whose return prospects are inherently based on the use of leverage.

- Since worldwide interest rates are extremely low, long duration sovereign bonds cannot be expected to provide the desired hedging mechanism in the future.

- Given the increased money supply and the expected surging sovereign deficits, we view gold as the primary portfolio diversifier.

¹ Thanks to additional unemployment benefits of up to 600 USD per week, the average US household income rose during the crisis. At the end of July the program ended and has only been renewed at a smaller scale.

² Earnings are defined as Earnings per Share of the last 12 months.