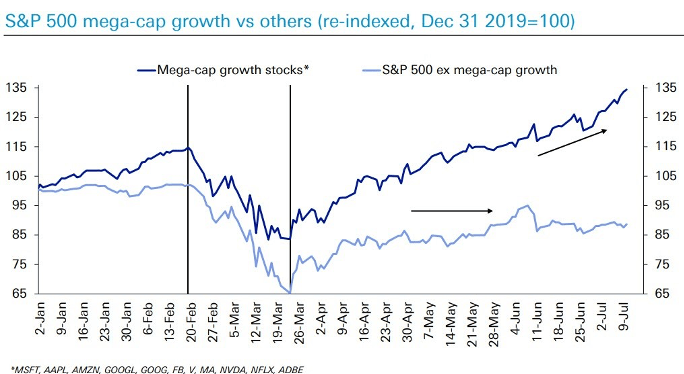

The persistently positive performance of stock markets continued over the course of the month of July. Especially in China and the USA, the market indices progressed significantly. Once again, the major US technology stocks were key performance drivers. Moreover, the 10 largest tech stocks (Microsoft, Apple, Amazon, Alphabet, Facebook, Visa, Mastercard, Nvidia, Netflix and Adobe) are more or less solely responsible for the overall annual performance in the S&P500. Aside from these stocks, the broad US market remained rather unchanged since April.

Chart:

Recent market developments:

- The USA continued to struggle with the containment of the coronavirus. In July, the spread of the pandemic has been most noteworthy in the southern states (Florida, Texas, California), causing a slowdown of the economic-reopening. Moreover, some activity indicators are already pointing towards a renewed slowdown. Consumer sentiment experienced a setback in July, following the recovery in June.

- The US company Moderna launched a Phase III study for their COVID vaccine at the end of July. Previous test results have been promising, same goes for potential vaccines of the University of Oxford/AstraZeneca and BioNTech/Pfizer. Expert predictions assume that a vaccination will be available in 2021.

- After intensive negotiations, the EU member states agreed on the conditions for the EU Recovery Fund. The stimulus deal comprises 750 billion euros, of which 390 billion euros are non-repayable grants and 360 billion euros are low-interest loans. Almost a third of the funds are in-tended to combat climate change.

- The political animosities between the USA and China have continued. After forced closures of diplomatic missions in Houston and Chengdu, the conflict now reaches up to the Chinese company ByteDance and its app TikTok.

- The US insider sales to insider purchases ratio arrived at the baffling extreme of 5:1 in July. In March, when the stock market bottomed out, insiders were net buyers.

- In contrast to the positive development of the US stock market, 10-year yields on US government bonds fell to new record lows. According to Jerome Powell, the FED is not even consider-ing raising interest rates. The market does not expect any increases at the short end within the next few years. In fact, long-term bonds are already trading as they would under respective yield curve control.

- Driven by recent lows in real interest rates (e.g. in the USA at just under -1% p.a.) the gold price rose to new all-time highs.

Market commentary:

Following an impressive rally of the global stock and bond markets, both asset classes now appear to be highly valued by historical standards. Past recessions were characterized by deleveraging. The process of deleveraging then posed as fertile ground for a new growth cycle. This time, however, debt levels continue to rise due to support measures produced by central banks and governments. Consequently, we expect weaker long-term economic growth, coupled with a global stock market that offers below-average returns with above-average volatility.

The adopted EU reconstruction fund is a potential “game changer” for the region. European equities are characterized by an increased outperformance potential since investors are still under-positioned, valuations are relatively cheap and the health crisis has been better managed than in the US. The weakening dollar could be a signal for a mid-term regime shift.

It is possible that the overall recovery narrative is about to reach a turning point. Although positive macro data is continued to be released, the momentum of improvement is already receding. In addition, the pandemic is still raging, geopolitical risks are reaccelerating and future fiscal stimuli are still up for debate. Therefore, the rest of the summer may cast doubt on the prospect of a “V-shaped recovery”, as weaker than expected macroeconomic data is likely to cause the Economic Surprise Indices to descend from their all-time highs.

On the other hand, a breakthrough in the search for a COVID vaccine would likely revive the recovery. Furthermore, unexpected stimuli could boost investor sentiment, whilst the TINA (“there is no alternative”) argument in favor of equities remains more relevant than ever.

Positioning:

- We remain neutral in our tactical equity market assessment. Our stock selection remains strongly focused on quality stocks equipped with solid balance sheets and business models.

- We favor companies with a high credit rating and give preference to technology, healthcare and basic food sectors. We are aware that this “quality trade” has already gone a long way and in many respects has now transitioned into the “consensus trade”.

- At a broad portfolio level, we strive for diversification, good liquidity and high quality of our risk investments, while we steer clear from strategies whose return prospects are inherently based on the use of leverage.

- Since worldwide interest rates are extremely low, long duration sovereign bonds cannot be expected to provide the desired hedging mechanism in the future.

- Given the increased money supply and the expected surging sovereign deficits, we view gold as the primary portfolio diversifier.