Executive Summary

- Vaccine news triggered a massive pro-cyclical rotation into stocks.

- The 90%+ efficacy of the vaccines is far better than the consensus expected and significantly improves the macro outlook for 2021.

- We believe that the market has now entered a transition-phase to a more fundamentally driven growth environment, given that analyst consensus expects world GDP to rise more than 5% next year.

- In the short-term, possible COVID restrictions in the US as well as seasonal effects lead us expect a mean reversion of the recent cyclical rotation back towards the quality factor. The pro-cyclical shift should then pick up again in the period following Biden’s inauguration.

- The Georgia run-offs leave the “Blue Sweep” scenario in play, but betting markets heavily favor the Republicans in this Senate race.

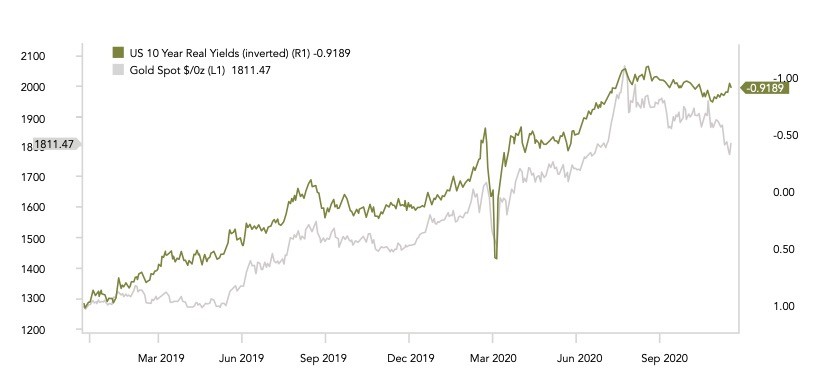

- The correction in the price of gold could be close to over as real yields are turning lower

Monthly Review

The new records in the major indices were sparked by the vaccine announcements and fueled by a massive short-covering rally, particularly of stocks that were largely left behind by the pandemic.

On a factor level, the rotation was so strong that markets registered a 15-sigma momentum crash, an incident which is close to impossible under the assumption of a normal distribution. Once more, the year 2020 has proven that extreme (tail-) events in capital markets occur more frequently than implied by most statistical models.

Market Development

World

Biden’s selection of Janet Yellen as Treasury Secretary hints at efforts to accelerate the economic recovery in tandem with the Fed through more fiscal aid. Earlier this year, Yellen spoke out about granting the Fed more leeway. This might be a glimpse of what’s to come down the road.

“It would be a substantial change to give the Federal Reserve the ability to buy stock. I frankly don’t think it’s necessary at this point. […] but longer term it wouldn’t be a bad thing for Congress to reconsider the powers that the Fed has with respect to assets it can own.”

(Janet Yellen on CNBC, April 6th, 2020)

Europe

The EuroStoxx50 rose by +18% in November. Laggards such as the ATX and IBEX Index jumped by close to +25%.

A no-deal Brexit remains a possibility, but most market commentators (including us) expect a deal to be reached in the final moments of the five-year Brexit crisis.

Switzerland

While Eurozone equities benefited from the pro-cyclical rotation, the Swiss market underperformed (SPI +8.4%) due to its inherent defensiveness.

On a positive note, the Swiss KOF economic barometer declined less than expected in November, which gives reason to hope that the second wave economic slowdown will be less severe.

Doves will fly under Biden’s administration

Recent weeks saw the strongest inflows into equity markets in 20 years. To us, these inflows seem justified, given the improving macro outlook as a consequence of the Biden presidency and the expected near-term availability of vaccines.

The biggest risk after such a move is the stretched investor sentiment. At time of writing, the CNN Fear and Greed Index has risen to 91 from just 35 a month ago. Similarly, the AAII’s survey now shows bulls at 47%, a big jump from the 27% in early October. From that perspective, it makes sense to expect a market consolidation. This might coincide with new COVID restrictions in the US.

That said, we believe that a pullback would be short-lived and would present a dip-buying opportunity, given the likely coming stimulus. We expect Jerome Powell to announce a step up in the Fed’s efforts to support the recovery in December. Plus, there might still be a chance of a fiscal package by the end of this year, as a bipartisan group of US senators has now proposed a USD 908 bn spending package to break the deadlock on fiscal stimulus.

On a sector and factor level, we are expecting a short-term mean reversion of November’s pro-cyclical rotation, since economic activity in the US could soon be taking another COVID induced hit. Additionally, there is a seasonal tendency for the momentum factor to outperform in December as active managers chase the YTD outperformers for their end-of-year reports to clients. We then expect the pro-cyclical trade to return post Bidens inauguration. It could be brought forward if the Democrats win the Georgia run-offs.

The bottom line is that it seems that stars are aligning for a potentially very good macro environment in 2021. Markets will eventually look past the winter wave of the virus and the return of Janet Yellen could even mean that the US economy will start to run hot towards the end of next year.

Our view remains that the improving outlook and further stimulus will accelerate inflation expectations, while monetary policy makers will try to contain nominal yields. A central bank over-compensation could push real yields further into negative territory.

Positioning

We intend to use a possible mean reversion of the recent sector rotation as well as a potential market-pullback to further position ourselves for a cyclical upswing in the coming year. We already made steps in that direction prior to and after the US election and increased our equity quota in early November.

2021 could see synchronized global growth in terms of GDP, corporate profits and inflation expectations – a potentially well-suited backdrop for a transition away from the liquidity driven multiple-expansion of recent years, towards a more “fundamentally justified” period for the market.

In consequence, we look for a broadening of market returns – away from the US exceptionalism. Europe and Japan appear to be well positioned for an industrial-led upswing, while Emerging Markets should benefit from a declining US dollar and an improving multilateral trade environment.

The recent drop in gold is largely based on investor re-positioning and other technical aspects in our view. The fundamental drivers – most notably negative real yields and rising money supply – remain very much in place.

Chart

The decline in the price of gold that started in August has reached -15%. A correction of this magnitude would be in line with prior bull markets. We note the divergence between real yields – which have turned more negative – and the gold price and believe that gold has significant catch-up potential to the upside here.

Sources: Goldman Sachs, Bloomberg, Saxo Bank, Gavekal, Morgan Stanley, The Market Ear, JP Morgan, Bank of America

FINAD CIO Team