Executive Summary

- Current market volatility is a function of rising numbers of COVID-19 cases and pre-election jitters.

- Polls indicate a significant lead for Biden in the presidential race, and a narrow lead for Democrats in the Senate race.

- Our base case is for a “Blue Sweep” which would be a good set-up for risk assets in 2021, with the caveat that the Senate is crucial for breaking the fiscal impasse.

- The Fed will be forced to bridge the period between the election and the arrival of a new fiscal package.

- We expect pandemic fears to peak in Q4 and believe this could provide opportunities for a pro-cyclical entry. Vaccine news will strongly impact markets in the next 6 months.

Market volatility amid virus fears and election uncertainty

The VIX is back above 30 amid pre-election uncertainty and Europe edging closer to a de-facto lockdown. Markets are responding to the threat of more economic damage from the latest wave of COVID-19. US markets are holding up better, based on the consensus view that a widespread lockdown is politically unlikely there. Europe looks notably weaker on a technical basis. Asia is still handling the pandemic well and is setting itself up to be the driving economic force in the next decade.

Market Development

World

Market participants are bracing for the election outcome. Barclays Research provides a good overview on key policy implications:

- A Democratic Sweep: a major expansion of fiscal policy, reduction in trade uncertainty, but higher taxes and more active regulatory posture.

- Biden and the status quo in Congress: significant risk of fiscal tightening, a more active regulatory posture, but reduction in trade uncertainty and a tax hike averted.

- The Status quo: neutral fiscal policy, heightened trade uncertainty, but deregulation continues, and a tax hike is averted.

- Trump and a Democratic Congress: scope for fiscal expansion, heightened trade uncertainty, but deregulation continues, and a tax hike is averted.

Europe

Although the current situation looks grim in Europe, we believe that the region has good chances of coming out of the crisis with new momentum. Markets have just started to discount European solidarity. The SURE bond emission was heavily oversubscribed, and S&P upgraded its outlook for Italy’s government debt. Over the mid-term, we expect the European risk premium to tighten. The region is also more leveraged to a potential cyclical upswing in 2021.

Switzerland

Nestlé, Europe’s largest company by market capitalization, benefits from staying at home and increased pet ownership. The firm raised its 2020 revenue forecast as people are eating more at home and are purchasing established brands, such as Starbucks capsules for Nespresso machines. The pet segment, where Nestlé offers high-quality pet food under the Purina brand, also grew significantly. 2020 revenue forecast as people eat more at home and choose established brands like Starbucks capsules for Nespresso machines. Petcare helped drive the fastest sales growth in at least six years.

Our take on the US Election

Many market commentators don’t trust the polls. We believe that this skepticism embodies a recency bias, given the 2016 surprise Trump victory. Our view is that this election is fundamentally different from 2016 because Trump has lost his “unconventional-newcomer factor”, there is no clear negative narrative around Biden as opposed to Hillary Clinton, the US is in a recession, and the pandemic is far from over. We strive to be rational investors and as such try to discipline ourselves to be thinking in terms of probabilities:

- At time of writing, our preferred forecast model (fivethirtyeight.com) puts the probability of Biden winning the Presidency at 88%, the probability of the Democrats winning the Senate at 73% and the probability that they will retain the House at 96%.

- The polls give Biden a clear lead in state and national polls. The lead implies that Trump would need an even bigger polling error than in 2016 to win.

- The election is not a point in time, but a process in time. At the time of writing, more than 65 million people have already voted. This favors the candidate ahead in the polls – we think of it as time decay of an option.

- COVID-19 is the election issue number one. The resurgence of the pandemic in the US is bad for Trump – past viral peaks have coincided with his worst polling data in the presidential race.

The Senate is crucial for the expected stimulus and the race for the Senate will be more close-run than the Presidency. If Republicans retain control of the Senate, the waiting period for the next fiscal package could be longer than the market currently expects, and any package eventually agreed upon would undoubtedly be smaller than in a democratic sweep. In any case, it will likely be up to the FED to provide markets with a supporting liquidity backdrop, in order to bridge the stimulus gap.

There is also a real chance that there won’t be a definitive election result for some time. A significant proportion of the ballots will be cast by mail, but the majority of the states cannot begin counting them until Election Day. If it becomes apparent that the result is too close to call for more than a week, we would likely see volatility increase further.

Positioning

We believe that a seriously contested election is less likely than most people fear and see a blue sweep as our base case. This outcome would likely result in macro tailwinds as the USD should depreciate and inflation expectations should rise. Consequently, we have added potential infrastructure-spending winners to our portfolio and slightly increased our equity allocation. Of course, we are aware that there are non-trivial probabilities that we are wrong on this call.

Once the election is dealt with, we expect the markets to re-focus on the virus. Keep in mind that the US has been roughly 2-4 weeks behind Europe in pandemic developments so far. Vaccine news will be crucial in this regard, with important phase 3 data expected to be released towards end of November or early December.

We still believe that there is a good chance that the virus will lose a lot of its fear factor during the coming winter, given better testing, better tracing, better treatments and a vaccine announcement likely within the next months. For now, however, we expect volatility to remain high.

Chart

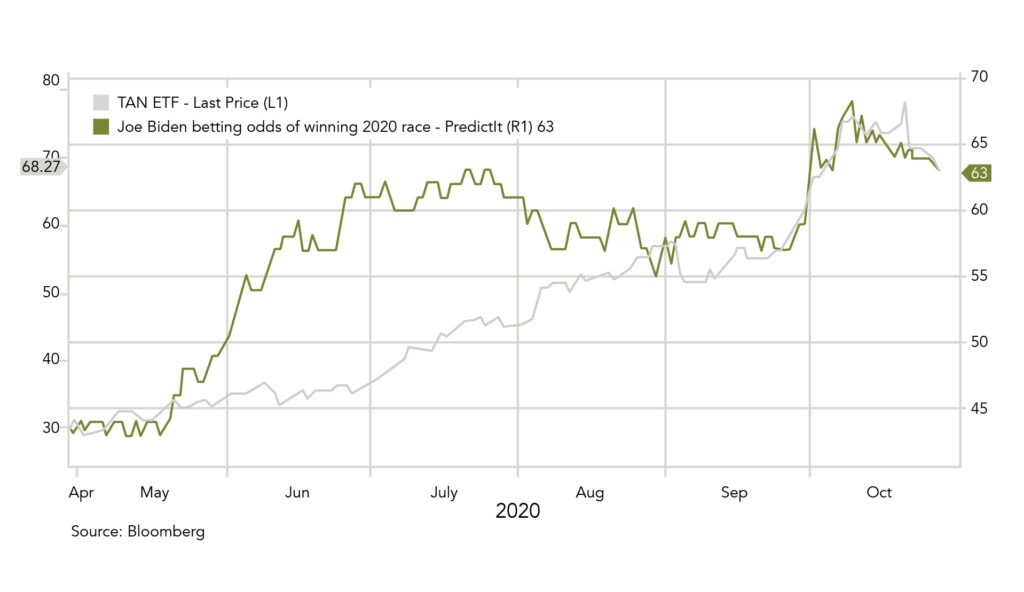

Is the market expecting a Biden victory? At least some of the sub-sectors that favor Biden reflect an advantage for Biden. The chart depicts a positive relationship between the Solar ETF (“TAN”) and implied betting market odds of a Biden victory. The ETF jumped in price after the first US debate, but is now correcting.

Sources: Bloomberg, Saxo Bank, Goldman Sachs, JP Morgan, The Market Ear, Hightower Naples, Barclays, Aon Plc, Ponemon Institute, fivethirtyeight.com, PredictIt

FINAD CIO Team