- Our take in September that market sentiment had deteriorated too dramatically and that equities would return to all-time highs, turned out to be correct.

- The Q3 earnings season has kicked off with positive surprises and liquidity conditions remain supportive for now.

- Hence, while we still see upside in equities in Q4, we are not increasing our equity position at this point.

- We believe that the excessive concerns over stagflation are misplaced, given that the 2021 economic growth picture remains well above the long-term trend, despite a weak Q3.

- That said, it is reasonable to expect price pressures to persist well into 2022, before eventually subsiding as supply-demand imbalances ease in the second half of 2022.

- Fiscal and monetary policies are becoming more restrictive as we move into next year. Currently, 2022 looks to become a difficult year.

- Equities have been volatile over the past few weeks, driven by inflation risks (from higher energy prices) and concerns over China’s slowdown.

- Major indices, such as the S&P 500, Dow Jones and Nasdaq, have rebounded from their September lows and have achieved new all-time highs on the back of a strong Q3 earnings season.

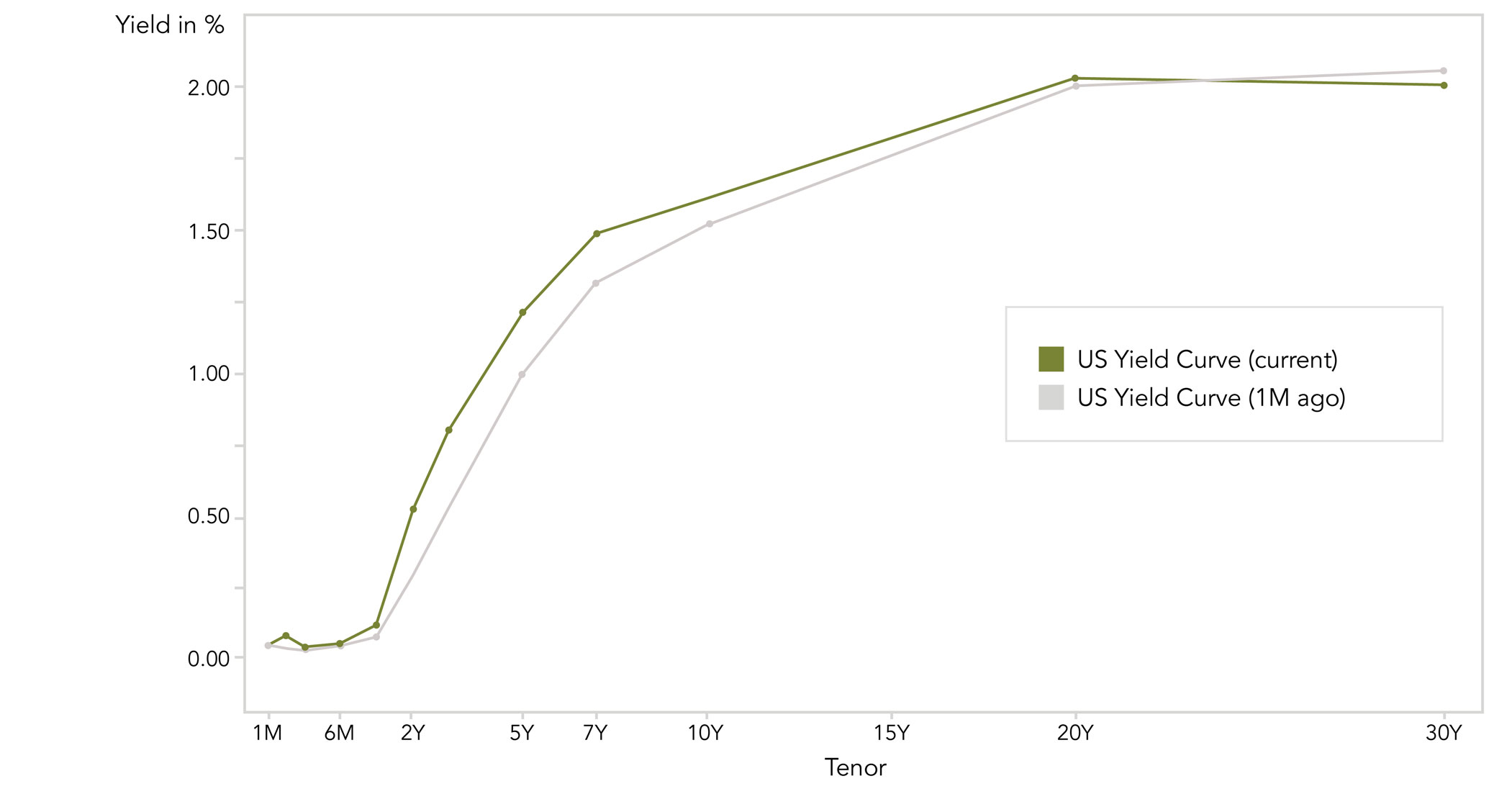

- Yield curves are flattening as bond markets are pricing in earlier monetary policy tightening in the face of rising inflation expectations.

- It is unclear whether we have seen the peak pain point in energy markets.

World

- US GDP increased at 2.0% annualized pace in Q3 vs. 2.8% estimated

- US fiscal policy is still missing a breakthrough (the fiscal package is now assumed to be around USD 1.75 tn, down from USD 3.5 tn)

- The pandemic is not yet over – curbs to contain the coronavirus are making a comeback in Eastern Europe and Russia.

- Tapering in Q4 is close to certain. It’s just a question of how and how fast. Powell’s renomination is in question after increased pressure from progressive Democrats.

- The market now expects two full hikes in the US next year but the probability of hikes in 2024 has decreased (“more now but less later”).

Europe

The German IFO business climate index fell to a six-month low in October in the face of persistent supply bottlenecks, rising prices and a renewed wave of the pandemic. This coincides with the purchasing managers’ index, which also fell sharply, as well as the Bundesbank’s latest warning that growth will slow in the 4th quarter.

Switzerland

In Q3, exports to North America rose by 8% in nominal terms and exports to Europe by 4.2%. Export growth in Asia was weaker at 1.0%. The increasing trade surplus with Spain is striking. Moderna’s vaccine is manufactured at Lonza in Visp and then filled in Spain. This special effect is now reflected in the trade statistics.

While a month ago, everyone was talking about a Q4 2018 stock market correction, few investors now feel adequately positioned for the upside risk of a Q4 2017 or Q4 2019 melt-up in equities.

- For such a bull case scenario to play out, stagflation fears would have to subside, and the growth outlook would have to improve materially.

- On the other hand, the bear case (not our base case) for markets lies in sustained rising inflation expectations that would handcuff central banks from providing further liquidity support when needed.

- While we believe that 2022 could become a difficult year for markets as stocks will have to digest various policy shifts, we remain positive for equities in Q4.

Reasons for a diminishing outlook for equity markets in 2022 are the unfavorable rates of change in important equity market drivers:

- The US fiscal impulse is expected to turn negative, regardless of the final size of the fiscal package. The comparables are simply too hard to beat for a 10-year package without direct payments.

- Monetary policy will be getting more restrictive as well. G4 central bank balance sheet growth rates have already fallen significantly from their peak and a Fed taper announcement in November/December seems to be a done deal.

- Aggregated earnings revisions – the extent to which analysts upgrade or downgrade the earnings outlook for their covered companies – for Developed and Emerging Markets have passed their peak and are now close to turning negative.

- China remains the wild card that could brighten the outlook. We expect easing steps in China to combat the economic slowdown. In fact, China could turn out to be the only major region that will be more accommodative in 2022. However, there is still an absence of clear announcements by policy makers.

Regarding the currently hot topic of inflation:

- We tend to agree with bond markets and expert surveys that inflation will prove “transitory” with regard to the rate of change but will level out higher compared to pre-pandemic times.

- However, we will not know for sure until well into 2022 (the development of wages and rents being the big question mark).

- We think that the secular disinflationary trends that dominated the last business cycle are poised to gather steam as we work through supply bottlenecks.

- In any case, the more incessant the inflation chatter becomes, the more we should think of inflationary concerns as ‘priced in’.

We are moving into a good seasonal period for equities and the net-liquidity conditions will remain supportive at least until the next debt ceiling deadline in December.

History suggests that it is imprudent to fight the coinciding trend in equities (currently a bull trend), as long as the Fed balance sheet is still increasing.

- On average, periods of balance-sheet expansion since 2009 offered stocks very strong returns, while returns flatten significantly if we look at episodes without growth.

- Each period of interim balance sheet stabilization or contraction appears to have sparked equity market corrections, including in 2011, 2015 and 2018.

The bottom line is that in our view, the “search for yield” for now still ends in equities. However, the risk/return set-up looks to become less and less attractive in 2022, potentially leading us to move towards a more neutral equity allocation as Q4 progresses.

Yield curves are flattening in Canada, the UK and, to some extent, in the US (see the graph depicting the US yield curve now compared to 1 month ago). Investors anticipate that central banks will tighten more aggressively than previously thought. The question for equities will be whether the growing certainty of imminent rate hikes can co-exist with a slowing economy in 2022.

Quellen: Bloomberg, Barclays, Morgan Stanley, Kepler Cheuvreux, Nordea, Goldman Sachs, The Market Ear, ZKB, Credit Suisse, PGM

FINAD CIO Team