Executive Summary

- Another very volatile month for the financial markets, during which essentially only commodities and haven assets rose in price.

- Russia’s invasion of Ukraine has added to growth and inflation uncertainty, as the conflict poses negative implications for global demand and is contributing to price pressures.

- The Fed remains on track to raise interest rates in March, but markets are already pricing a shallower tightening path.

- Credit spreads have risen further, especially in Europe, but have not yet reached a “stress level” that would seriously concern central bankers.

- Overall, we continue to expect further tightening of financial conditions and, therefore, further volatility in the coming months.

- While risk management remains our top priority in this environment, we wish to note that oversold conditions and a deeply negative sentiment have the potential to spark sharp relief rallies.

Yields drop globally as commodity prices spike

- The surging oil price has intensified inflation concerns. Likewise, the recent volatility in agricultural commodities may exacerbate price pressures and further erode discretionary consumer spending. Ukraine and Russia supply around 30% of global wheat exports.

- Broad commodity supply risks are likely to be persistently higher going forward, and growth and inflation outcomes in many places could change for the worse.

- In this environment, real yields have reverted sharply lower, thereby supporting precious metals. On a relative basis, this also favors US vs. Europe and Quality/Growth vs. Value/Cyclicals

Market Development

World

- Amid a ramp in geopolitical tensions, the market has essentially zeroed-out the odds of a Fed rate hike of 50 bps in March (which was firmly priced in at the start of the month).

- While the high degree of uncertainty demands a defensive stance on equities, we observe that short-term sentiment is deeply depressed and oversold, which increases the odds of multi-week rebound rallies.

- The S&P 500’s current intra-year low return of -11.3% (on a daily closing basis) is not yet particularly steep, compared to the average of -21.9% in other years when the S&P declined in both January and February.

- Unnoticed by many, macro data (PMIs) in China has improved recently. Rumors are also emerging that China may abandon its “zero-COVID” policy, and we think this would be an upside catalyst for Chinese growth.

Europe

- Sharp risk-off moves in European equity indices and bonds may indicate that Europe is now facing a GDP contraction. It will take some time to get clarity on this, however.

- European defense spending commitments are set to increase in the coming years, led by German rearmament.

- The renewable energy and nuclear sectors are also likely to see increased funding, based on an accelerated transition away from fossil fuels.

Switzerland

- Swiss quality stocks – often associated with a valuation premium – have shown strength recently, after a period of underperformance earlier in the year.

- The Swiss franc may keep to a steady pace of advance, especially if the ECB abandons any tightening ambitions it may have had for the next 12 months. We are expecting SNB interventions.

Are we heading for a growth slowdown?

Geopolitics are now amplifying the macro-economic destabilization that emerged from the pandemic. Russia’s invasion of Ukraine is causing increased energy price pressures while damaging growth at the same time. Europe’s strategic vulnerabilities can no longer be denied. America, the USD, the CHF and Gold are the safe havens in this environment.

While the events of the past two weeks have undoubtedly changed the geopolitical reality and have shocked supply chains once more, the market implications are not straightforward.

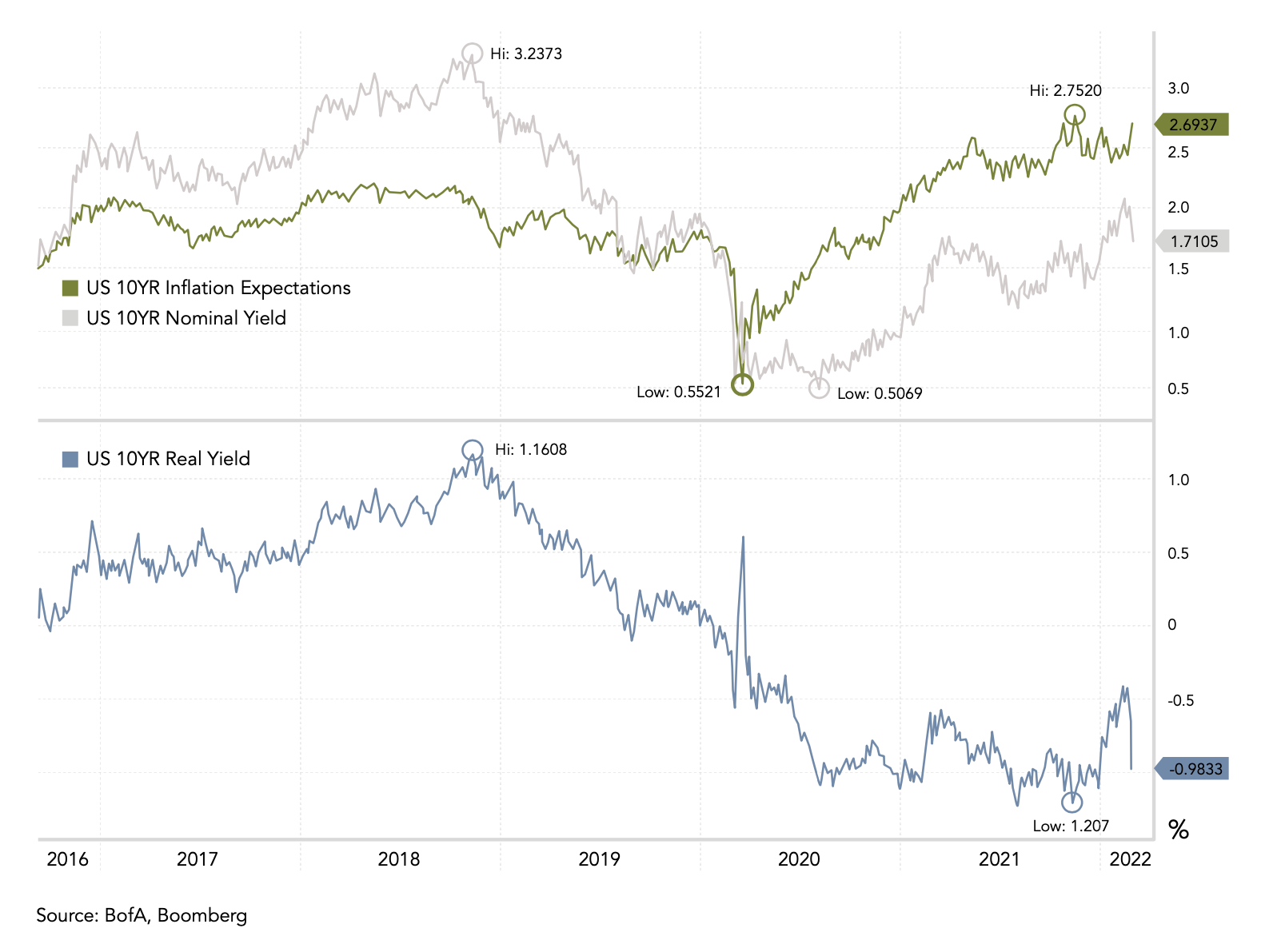

From a financial market perspective, the big question is to what extent the invasion and the accelerated growth slowdown are altering the central bank reaction function and the path for yields, and real yields in particular.

At the time of writing, we have yet to hear “post-invasion” statements from Powell and other high-ranking FOMC members. The problem is that the Fed – amid its focus on notoriously lagging indicators – remains trapped between politics, high trailing inflation and, we believe, an approaching growth slowdown.

- There will likely be less political pressure to combat inflation amid the conflict, but how much less?

- It seems obvious that the supply side has been further disrupted as the escalation adds a significant geopolitical risk premium to energy prices globally, but what about the demand side?

Consumer sentiment has been eroding for months (falling disposable income, a decline in real wages and the end of childcare tax credits) and this could accelerate further now. If this results in real demand destruction, the US could face a sharp growth slowdown soon.

We therefore maintain our base case that the final phase of this equity market correction will be characterized by declining US growth expectations.

- At the time of writing, consensus real US GDP 2022 growth estimates are still running at +3.7% (far above the ~2% trend in the 5 years prior to the pandemic).

We are continuing to expect that a repricing of growth expectations in H1 will result in lower equity markets and wider credit spreads, which will ultimately tighten financial conditions to such an extent that the Fed will have to pivot dovish again. Anticipating this will be key when finding attractive entries in equity markets.

Positioning

We have been expecting an extended period of volatility in 1H 2022 since October last year, based on a confluence of deteriorating market forces (but not in anticipation of a war in Europe). We have adjusted our portfolios by means of a gradual increase in the cash quota (above 20%) and a reduction in the equity quota to below neutral.

The latest adjustments were made in mid-February, when we cut exposure to the EU Banking Sector (CoCo Bonds) and sold REITs, while increasing our Gold quota to above neutral.

On a relative basis, our focus on high-quality companies has started to pay off again, as the quality factor has reappeared on investor radars after having been weighed down by worries over rising interest rates in January.

More broadly speaking, out-of-favor sectors, such as defensive-growth and renewables, have regained popularity. At the same time, recent big winners, in particular European cyclicals and banks, have gone into reverse gear.

We continue to prefer high-quality names, such as Big Tech, based on their relative macro-resilience, recurring cashflow streams and, once again, on their firmly negative real yields.

Chart

From a financial conditions and valuation perspective, the issue for markets this year has been a rise in the real discount rates. The US 10-year real yield spiked 70 bps from the start of the year until mid-February. Since then, it has plunged back lower by more than 50bps. We maintain our view that a lower real discount rate is lending support to real assets (e.g., Gold) and quality growth stocks.