- Equity markets made new highs in November, but recently got spooked by the discovery of the “Omicron” variant of COVID-19. Data on the new variant is still insufficient, but the number of mutations implies a potentially higher transmissibility and reduced efficacy of existing vaccines.

- While most confirmed cases have so far been reported to be mild, the international response to Omicron has already been notable due to the introduction of temporary travel bans and similar measures.

- A possible central bank reaction to this new risk to the global recovery would not be as straightforward as in previous cases, given the high inflation figures in the past few months and the recently emerged bias towards tighter policy.

- Irrespective of the new strain of the virus, we have been expecting a much tougher 1H 2022 for risk assets. This period of heightened volatility might be brought forward.

- We are not buying the dip but will continue our path towards a neutral equity allocation

- Following Biden’s decision to renominate Powell as Chair of the Fed, markets moved to fully price in a rate lift-off occurring in June 2022.

- Omicron now challenges this assumption and is creating significant uncertainty around the reaction function of the Fed.

- We note a clear outperformance of high-quality companies compared to lower-quality names.

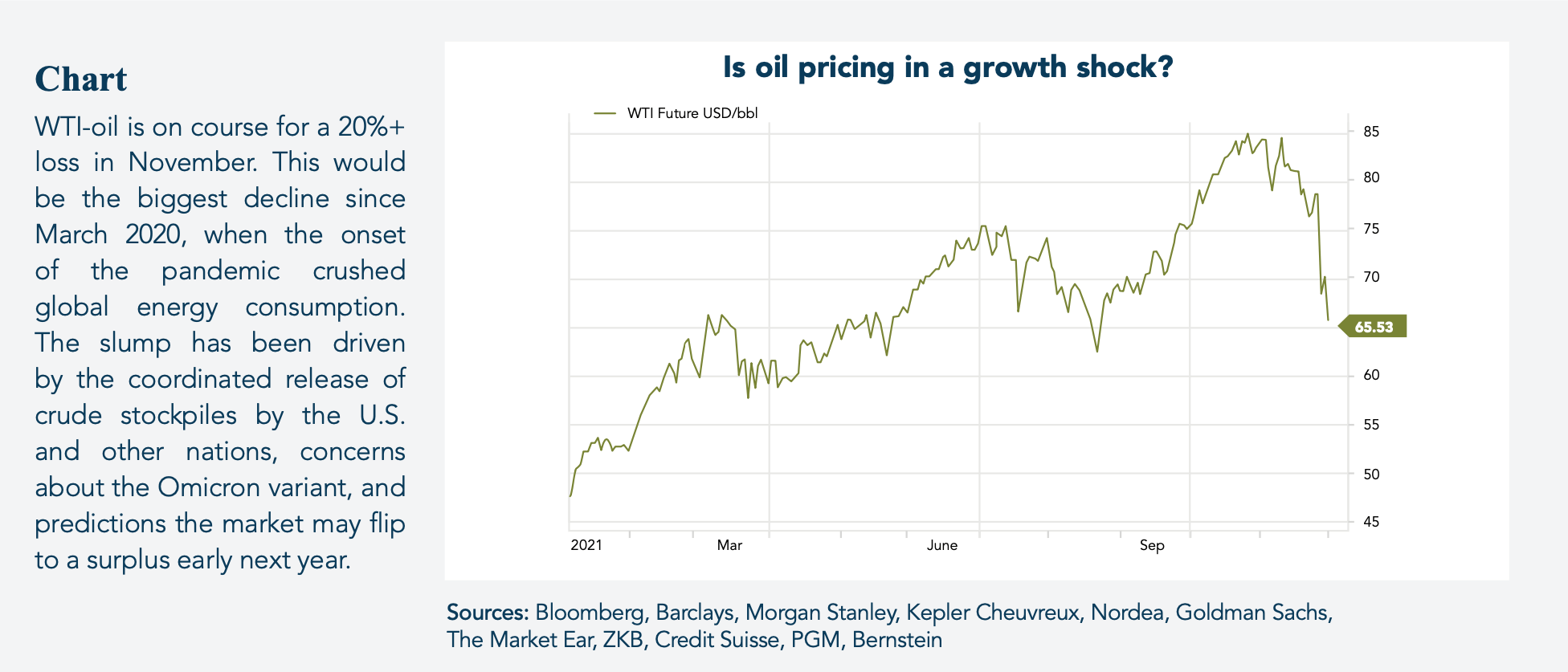

- Economically sensitive assets, such as crude oil or European equities, have experienced significant drawdowns.

- Some of the recent declines might be caused by profit-taking in sectors such as banks and energy that have outperformed so far this year during the pandemic rebound.

Welt

- Governments now face a tough task balancing health concerns while keeping the already battered recovery going.

- At the same time, the Federal Reserve looks as if it might accelerate the asset-purchase taper at its December 15 policy meeting, as mentioned by Chair Powell in his testimony before a Senate panel.

- “[transitory] … I think it’s probably a good time to retire that word” – Jerome Powell (30.11.2021)

- The 6.2% year-over-year increase in headline US CPI earlier in November makes a potential dovish pivot for the Fed a high hurdle at the moment.

- The Fed minutes highlighted the growing unease regarding inflation even among some dovish members.

- Omicron-induced mobility restrictions could aggravate global supply chain concerns.

Europe

Economic confidence in the euro zone declined only slightly in November, despite a fierce wave of pandemics and renewed restrictions. The European Commission’s overall index of sentiment in the monetary union fell from 118.6 to 117.5 points. An all-time high of 119.0 points was recorded as recently as July.

Switzerland

The economic recovery in Switzerland continued in the third quarter, driven by further easing of restriction measures. GDP increased by +1.7%, almost maintaining the pace of Q2 (+1.8%). As in the previous quarter, private consumption (+2.7%) remained the most important growth driver.

Several drivers that have underpinned our conviction that there has been an attractive backdrop for equity markets for the past year and a half – often referred to as Goldilocks – are now waning and could even turn negative. In this context, remember that financial markets are impacted most strongly by shifts in the rate of change and not the absolute level.

- Monetary Stimulus: The high inflation numbers are putting pressure on the Fed. We know that the FOMC is discussing a speeding-up of tapering and some members are pushing for rate hikes to start in mid-2022. This implies that the growth rate of the Fed Balance Sheet will diminish significantly.

- Fiscal Stimulus: No matter the final size, the upcoming US-fiscal package will be smaller than previous packages. It will be stretched out over multiple years and will not include substantial direct payments to consumers.

- Corporate Profits: Analysts’ Earnings Revisions have been trending lower since mid-2021, coinciding with the economic recovery peak in growth terms.

- Now, the new COVID-19 variant has been added to this mix.

On the one hand, Omicron threatens economic growth (a deflationary force), but on the other hand it could further increase inflationary pressure as a result of prolonged supply chain disruptions. As a result, uncertainty is growing as to how the Fed will proceed with the withdrawal of its monetary stimulus. The risk is that central bankers may be less inclined to act proactively to support markets this time around. In comparison, the emergence of previous variants had come as central bankers were roughly midway through an easing program. Hence, there was a backdrop of asset purchases and dovish forward guidance to counter a nervous market.

Recent surveys indicate that for now, investors have taken solace in the fact that the latest coronavirus variant, while potentially highly transmissible, has reportedly mild symptoms in the early known cases. Indeed, a divergent bull case for another leg higher in equity markets would lie in a “harmless” Omicron variant that displaces Delta, while the available vaccines retain significant efficacy. However, the data set, so far, is very limited in size and demographics and we therefore remain very cautious of any such conclusions.

The bottom line is that we expect risk assets to remain at the mercy of speculative comments and volatility to stay elevated during the coming weeks.

After being overweight in equities since Q2 2020, we started to trim our position in Q3 2021. We now think it is time to move to a neutral equity allocation, as the overall risk/return set-up is becoming less attractive for equities.

In September’s House View, we asked: “Key question for the next 12 months: What would it take to knock the U.S. recovery off course and send Federal Reserve policymakers back to the drawing board?”

The new variant has the potential to do just that. It may speed up our base case for market volatility, which, in turn, could trigger a dovish Fed-pivot and obliterate any rate hikes in 2022. That said, the visibility with regard to how this will play out is very limited. We believe it will not be without significant volatility, however.

In our view, there is a high enough chance for a real-economy impact that could challenge the valuation of financial assets without the Fed proactively coming to the rescue. We are therefore looking to adjust our risk positioning by increasing cash and rotation.

With regard to the composition of our equity portfolio, we continue to prefer high-quality names, such as Big Tech, based on strongly negative real rates and their relatively macro-resilient business models.

FINAD CIO Team