- The recovery is progressing, with the US outpacing Europe, driven by stronger fiscal stimulus and a more efficient vaccine roll-out. China is furthest ahead in the recovery process and is already curbing accommodation.

- Asset segments evolving around a steeper-yield curve, oil and commodities have delivered consistent gains this year, while broad equity index returns have stalled and have been choppy.

- The drivers behind this are a spike in interest rates and rate volatility.

- If we can see the 10-year treasury yield calm down, we expect equity markets to bottom and move upwards – the key to such a development lies in the reaction function of central banks.

- Overall, our outlook remains positive, in anticipation of a volatile bull market that may run until the US mid-term elections in 2022.

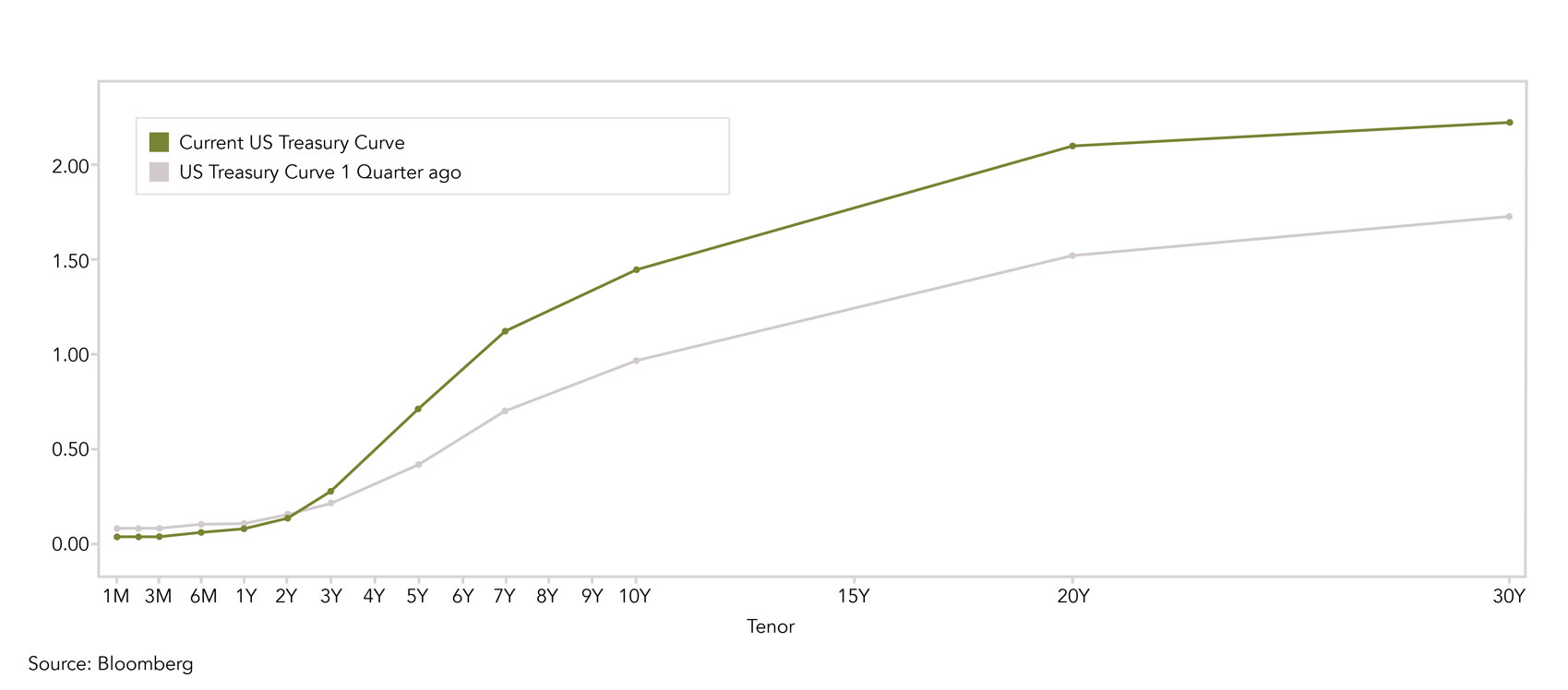

Markets are trying to digest the direction of yields, inflation, growth, and stimulus. A warning signal for the currently high fragility of the bond market was a poorly demanded auction of 7-year U.S. government bonds in the last week of February, which led to a quick but steep sell-off of government bonds. The yield on 10-year U.S. government bonds – arguably the most important market-based interest rate worldwide – briefly shot up to over 1.60%. At the beginning of the year, this yield was at 0.9%.

World

- US inflation expectations over the next 5 years have surged to their highest levels since 2011 and are now tracking at 2.50%, after hitting a low of 0.18% in March last year.

- The jump in nominal and real interest rates is having a negative impact on assets with high interest rate sensitivity. For example, the Nasdaq lost -5% in the last week of February, while gold experienced its worst month since 2016.

- The S&P 500 Energy sector, with its high sensitivity to inflation expectations, was up +22.7% in February compared to the S&P 500 with +2.76% total return in USD.

- Other “reflation winners”, such as Financials and Industrials, also outperformed.

Europe

The ECB’s chief economist, Philip Lane, recently emphasized the ECB’s willingness to take action to prevent an undue tightening of financial conditions.

The Purchasing Managers’ Index for the eurozone economy as a whole climbed from 47.8 to 48.8 points in February but has now remained below the growth threshold of 50 points for the fourth month in a row.

Switzerland

The rapid rise in interest rates weighed on defensive Swiss quality stocks (SMI -0.65% CHF in February vs. MSCI World +4.83%, both total return in CHF).

Nevertheless, the economic recovery continued. The Purchasing Managers’ Index for the Swiss industry rose significantly in February from 59.4 to 61.3 points.

What is pushing up nominal rates? Rising real growth, inflation expectations or a bond market dislocation? Our guess is probably all of them, but in recent weeks, the impact of real growth was not the driving force. To us, it seems like an inflation scare spooked the bond market and is now increasingly destabilizing it. The next question is, how strong a rate increase central banks are willing to stomach before they start to fear that rising debt servicing costs for governments and corporates will jeopardize the recovery. Remember that a lot of debt issuance is coming in the next two years to finance the fiscal packages.

While the ECB, RBA and BOJ have all, to varying degrees, pushed back against the recent backup in bond yields, FED officials have only slowly started to react. In our view, the divergence of reactive versus proactive stance of central bankers captures the different growth paths, with the U.S. powering ahead in its vaccine-led recovery and Europe mostly lagging behind.

That said, in the aftermath of the worst 7-year treasury bond auction in history, it seems that Fed officials are now starting to see the warning signals from the bond market. We expect the FED will strongly crank up its response if yields push back over the 1.6% level on the 10-year treasury and financial conditions worsen further. Policy action to flatten the yield curve could potentially be announced at the March meeting of the FOMC. The coming week will bring further auctions for 3, 10 and 30-year US Treasuries; another “failed auction” could roil the markets.

If rate volatility would calm down, we expect overall equity markets to push higher. The Tech sector could then even regain its leadership. However, as long as nominal rates rise faster than inflation expectations, we expect cyclical assets to continue their rally – with energy and commodities looking strongest.

On a larger scale, we believe that the bull market will remain intact for the timeframe in which further fiscal stimulus is delivered. A natural end could be marked by the US mid-term elections in November 2022. For now, we remain in a volatile bull market that is characterized by strong risk-seeking by market participants to fuel performance. The market therefore remains prone to melt-ups and sharp down moves alike.

In view of rising interest rate risks, we decided to take profits in highly valued stocks in the robotics and digitalization sectors. As a measure of risk management in view of rapidly rising real interest rates, we also reduced our gold weighting (just below USD 1800) back to neutral. Our expectation remains that over the medium term, real interest rates will resume their downward trend due to high inflation expectations and dovish central banks. Sooner or later, central banks will step up to cap any unwarranted spike in real rates.

We added a high-quality name in the Energy sector. The sector has a strong positive correlation to inflation expectations and is very cheaply valued compared to the overall market. Furthermore, we see reopening-induced rises in oil demand being faced with a supply that is severely constrained by years of underinvestment.

On an asset class level, we have decided to add convertible bonds to our balanced portfolios. Given our expectation of a bullish but volatile equity market, we view the convertible bond’s inherent convexity as very attractive.

The U.S. yield curve has steepened significantly in the last 3 months. An uncontrolled rise in interest rates at the long end could endanger the economic recovery. A possible measure by the FED could be a third iteration of “Operation Twist”, which would involve selling shorter-dated paper and buying longer-duration securities, thereby flattening the slope of the yield curve.

Sources: Goldman Sachs, Bloomberg, Saxo Bank, Gavekal, Morgan Stanley, The Market Ear, JP Morgan, Bank of America, Citi, Credit Suisse, QVR Advisors, Zürcher Kantonalbank

FINAD CIO Team