- Recent macro data confirmed our assumption that global economic growth has peaked in Q2 and has been on a slowing trend since May.

- Bidens approval rating has taken a severe hit in the wake of the Afghanistan withdrawal chaos. This will likely undermine his agenda, meaning less fiscal spending but also less tax hikes.

- We believe that – while less attractive compared to the start of the year – equities still offer an attractively enough risk-return setup to continue to justify our slight overweight position, with strong emphasis on high-quality stocks.

- Investor sentiment and forward guidance on monetary policy will be the key factors to watch in the coming weeks.

- Should current investor cautiousness transform into complacency and a “goldilocks” mindset, this would be our signal to think about reducing our risk allocation.

Led by the US, developed equity markets have shown strong performance over recent months, with very little volatility and relentless dip buying already at minor (<5%) pullbacks. Despite the stellar equity performance, the “wall of worry” in investors’ minds is evident. Market action often reflects a tug of war between growth worries and perceived taper risk.

In this context, Fed Chairman Jerome Powell gave his eagerly awaited Jackson Hole speech which analysts interpreted as a signal for a “dovish tapering”. So far, the speech has ignited new upward momentum in equity markets, led by the big tech sector.

World

- Economic Surprise indices have now turned negative (Delta, China slowdown, geopolitical uncertainty, fiscal delay in the US).

- The July US inflation prints may indicate a beginning moderation of inflationary pressure. We still need 3-6 months more of data to have a clearer picture.

- The private-sector crackdown in China may continue in some form or another until the 20th people congress in October 2022. China Tech companies now trade at a steep discount to developed market peers.

- However, given the economic slowdown, China may soon start to ease monetary and fiscal policy, given recent People’s Bank of China (PBoC) comments.

Europe

With Merkel set to step down, the SPD is ahead in the polls for the first time in 15 years, increasing the probability of a left-leaning government that could change Germany’s stance on fiscal spending and corporate taxes. Recent polls suggest any two-way coalition might be narrowly short of a majority. Hence forming a new government might take significant time.

Switzerland

The KOF Economic Barometer fell more sharply than expected in August (from 130.9 to 113.5 points, consensus estimate was for 125). After reaching an all-time high of 143.7 points in May, this was the third decline in succession. However, the barometer still clearly holds above its long-term average of 100 points and, thus, continues to signal ongoing economic recovery.

At the start of the summer, we expressed our view that the US Federal Reserve would be careful not to spook markets with an aggressive tapering stance in the face of the rampant delta variant. Powell’s Jackson Hole speech in late August confirmed these expectations.

We believe that the speech delivered a good outcome for equity markets and real assets. It moved the overall market environment one step closer to what we see as “goldilocks” conditions.

- Powell emphasized that the process of tapering would carry no indication of the future rate hike path and made clear that once started, would remain flexible and data dependent.

- While not giving a concrete date, consensus expectations are now for an official announcement in Sept/Oct and start of tapering in Nov/Dec of this year.

- As the Fed is very focused on labor market conditions, the coming employment reports will be important in determining the actual taper announcement.

Checkmarks for the “Goldilocks” environment:

- Rising corporate earnings, highlighted by continued strong earnings-per-share momentum in Q2, providing fundamental substance to elevated valuations.

- Peak growth is behind us, but global growth is still running above long-term trend.

- At the same time, inflationary pressure could be cooling off based on the recent decline in global PMI input and output prices (this remains too early to tell tough).

- Unlike in 2015 and 2018, the latest drawdown in China has not been contagious to global equities. Conversely, possible China easing could still positively affect global markets.

- Even despite beginning Fed QE tapering, monetary conditions will remain softer than at nearly any other point after the global financial crisis well into the second half of 2022.

- Finally, investor risk sentiment is muted despite strong equity performance.

All this implies a still attractive set-up for risk assets. Once the market really starts to embrace the “goldilocks” narrative, we could imagine two scenarios going forward: Either a transition back to a reaccelerating cyclical recovery (decreasing delta, fiscal delivery, factor rotation and higher yields), or the materialization of a deeper global growth scare (rising credit spreads, overall risk-off). Either way, we expect volatility to return once this crossroad arrives.

- The notion that “there is no alternative” to stocks remains a key mantra to investors, despite the cautious risk sentiment. This implies that the path of least resistance remains higher for now.

- Central banks will continue to be accommodative, real yields are negative, more fiscal stimulus can be expected and households have large excess savings as well as pent-up demand. Strong corporate earnings and the resumption of stock buybacks are further positive factors.

- We try not to underestimate how far this rally can run, but we recognize a multitude of risks: a monetary policy mistake, unexpected inflation, a significant COVID resurgence, a Chinese spillover, and rising geopolitical risk.

- We maintain our overall balanced allocation, with an emphasis on high-quality. We believe the ability to defend margins will become increasingly important as we move through the mid-cycle.

- China-sensitive trades, like European luxury-goods, may continue to struggle until China’s PMIs turn back up (likely on stimulus).

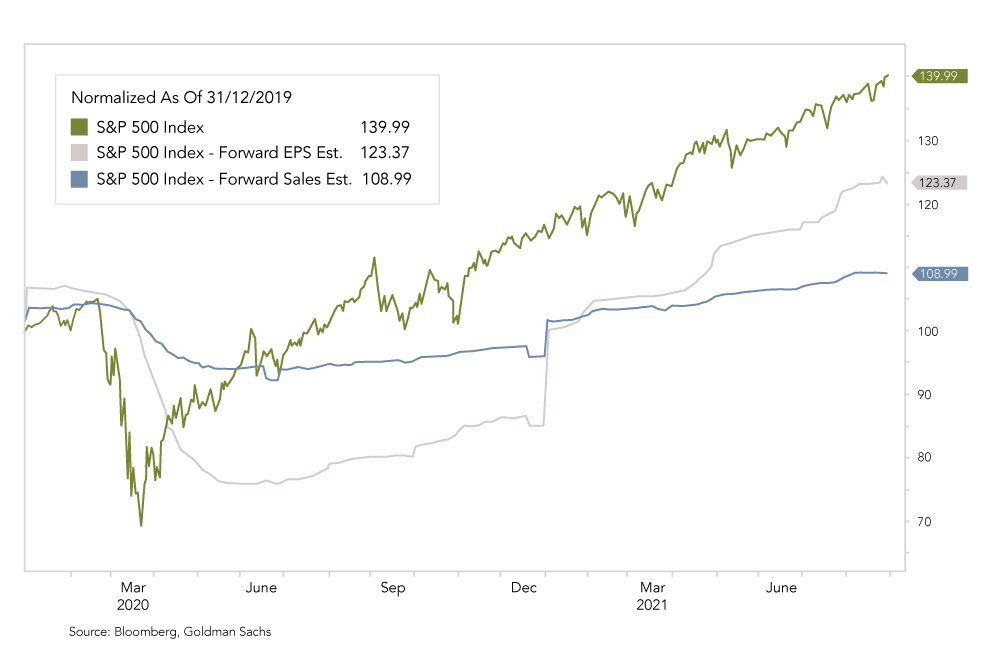

Since the end of 2019, the S&P 500 has risen 39% while estimated forward earnings-per-share have increased by 23% and estimated forward sales by 9%. This implies a price increase of 1.7x the expected earnings increase. In the 5 years prior, this factor was 1.5x. Since the end of 2019, the Fed’s balance sheet doubled.

Sources: Bloomberg, Barclays, Morgan Stanley, Kepler Cheuvreux, Nordea, Goldman Sachs, The Market Ear, ZKB

FINAD CIO Team