- “Don’t fight the Fed” now means playing defensive not offensive.

- Until now, the growth slowdown that began in mid-2021 has been gradual. While we think it is likely that the slowdown will continue well into 2023, its pace is the big question as far as the medium-term outlook is concerned.

- Our expectation has been for the slowdown to accelerate towards end of Q2. This should shift the focus from “inflation-scare” to “growth-scare” and would likely see credit spreads widen and equity markets getting into further trouble.

- Liquidity conditions lead the economic cycle. In this regard, financial markets are facing a period of significant tightening. The strength of the USD is already making this evident.

- Long duration Treasuries are quite oversold. They could stage a countertrend rally anytime and should perform in our slowdown scenario. We plan to build a position in multiple steps.

High volatility in most asset classes

- Deteriorating liquidity conditions imply rising cross-asset volatility. Indeed, we have seen volatility bursts in most asset classes (bonds, commodities, and, more recently, in currencies and equities).

- It seems that, in recent weeks (before the latest sell-off), equity and credit markets were pricing in some form of “soft landing”, while the bond market has been signaling that the probability of this is low, as the Fed is tightening pro-cyclically into a weakening growth environment.

- Consensus GDP growth estimates have come down since the start of the year (US 2022 real GDP from +4% to +3.2%) but are still too high in our view.

Market Development

World

- After a few days of heavy selling, broad equity markets are back in correction territory, with drawdowns of more than 10% from the peak.

- The Fed is very committed to tightening financial conditions on the demand side to fight their lagging inflation indicators.

- Powell recently described the US Labor Market as “not sustainably hot now”.

- This means that the Fed now accepts (or wants?) equity market volatility and declining equity prices (a reverse-wealth effect).

- On top of that, macro conditions in China have gotten worse, with around 40% of GDP currently under lockdown according to Nomura. Stimulus is still nowhere near where it needs to be to turn things around, unfortunately.

Europe

- In France, the pro-European President Emmanuel Macron won a second five-year term in office after facing his far-right rival Marine Le Pen in a run-off election.

- His victory prompted only short-term Euro gains, however.

- The Euro is struggling because the ECB is adjusting its monetary policy only slowly amid the fear of a recession driven by the war in Ukraine, an energy crisis and disrupted Chinese supply chains.

Switzerland

- For the first time since 2015, interest rates in Switzerland could start to rise again in the foreseeable future.

- At the moment, there is broad analyst consensus on the sequence of central bank interest rate hikes. The SNB has the greatest leeway (i.e., the lowest inflation) and can wait for the ECB to move first (potentially in September).

Fast-tightening into economic slowdown

Renewed China growth concerns, together with an apparent roll-over in some commodity prices, may signal the start of the transition from inflation to growth worries we have been anticipating.

- The recent emergency action by the PBoC to cut the Reserve-Requirement-Ratio for FX deposits by -100bps to 8% has for now stopped the sharp CNY sell-off vs USD. A bigger devaluation of the yuan could be a deflationary shock (similar to August 2015).

- Unfortunately, China, which lacks high-quality mRNA vaccines, seems trapped in its “Zero Covid Policy” and seems to be willing to sacrifice a lot of its near-term growth potential. A development we did not expect and a clear negative for global demand.

- Stimulus is increasing at the margin (the 3-Month Shibor, our preferred measure of credit availability in China, has started to fall in April) but has not yet reached critical mass.

- The bottom line is that any asynchronous positive impact on global growth we had anticipated from China has been delayed.

The latest bout of equity volatility also came with a seemingly sudden realization on equity markets that the FOMC will indeed be very aggressive in its attempt to tighten financial conditions.

- The problem is that higher stocks mean relatively looser financial conditions, which would be in direct opposition to the Fed’s goals at the moment.

- Even before the latest sell-off, we have seen underperformance in economically sensitive areas of the market, while defensive areas have actually seen valuations expand (we benefited from this through a Low-Volatility ETF).

- This suggests, that under the hood at least, the equity market has been worrying about higher rates and slower growth for longer than is obvious from headline price movements.

A rather new development involves the heavy equity outflows over the last 2 weeks (the heaviest since Mar/Apr 2020 according to Deutsche Bank). While it is too early to determine if this is a new trend, it suggests that the “stocks are a better inflation hedge narrative”, which propelled strong flows into equities from both retail and institutional, may have run its course.

Positioning

We believe that portfolio resilience and diversification remain vital in the current market environment. To us, this means underweighting equities and credit and overweighting cash, gold and alternatives.

We are also looking to gradually establish a long-duration US Treasury position.

- In our view, duration is very oversold in the short term and should start to perform over the medium term if our base case of an accelerating growth slowdown turns out to be correct.

- Furthermore, empirically long bond yields started to decline at the end of QE / the start of QT programs.

Where could our defensive stance be wrong? (We see these as possible upside divergences from our base case)

- The acceleration of the growth slowdown could be delayed or not materialize at all, while inflation cools-off quickly, allowing the Fed to be less aggressive – essentially a “Goldilocks” transition. Recently, we have noted green shoots in consumer sentiment and PMIs, which suggest that such a delay into the second half of 2022 is possible. We are therefore keeping an open mind, but still regard a revival of “Goldilocks” in advance of further market volatility as unlikely.

- Corporate earnings could turn out to be much more robust than we expect. However, the Q1 earnings season so far has been mediocre and analyst earnings revisions are pointing lower.

- A revival of the “TINA” narrative could suck remaining liquidity into equities – but this would likely lead to investor positioning that would be even less sustainable.

Chart

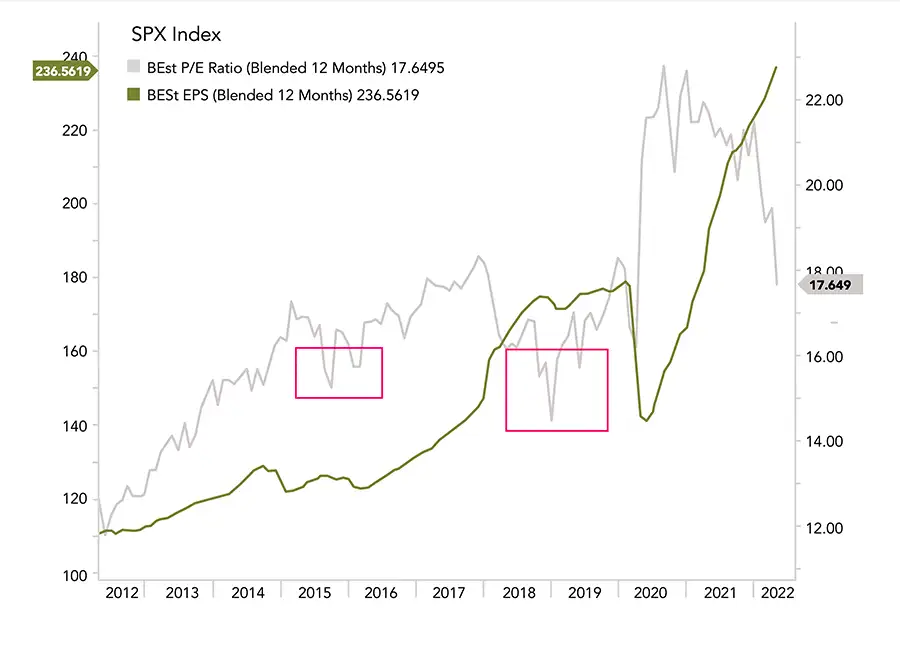

The 2016 and 2018 growth slowdowns saw 12-month forward PEs dropping to 15-16x within the S&P 500. A 16x forward PE (leaving earnings estimates unchanged) would give rise to approx. 3,750 as a level at which to begin re-risking into equities.