- We continue to take the view that markets are now transitioning to a mid-cycle environment, as the strongest recovery phase on a year-over-year basis will soon be behind us.

- Nominal yields have declined from their March peaks, rate volatility has stabilized, and real rates have turned lower again. However, we do not think that nominal yields have peaked for the year.

- The inflation narrative could stay with us for longer than communicated by the Federal Reserve, which still sees inflationary forces as “transitory”.

- The pandemic is raging in India, while vaccine rollout is progressing in developed markets. Global travel will likely remain restricted well into 2022.

- We recognize that equity markets have come a long way from the lows of March 2020, but we can still observe a setup for risk assets that is attractive overall.

- There could be further movement on the equity markets, based on the still strong liquidity impulse.

- We would adopt a cautious approach if the market narrative transitions into the “Goldilocks” stage.

- The decline in US real rates (from -0.63% at the end of March to -0.77% now) has been the driving force behind the recent outperformance of large cap tech and the broad quality and momentum factors.

- The Q1 earnings season is strong as corporate EPS growth is beating expectations, however, the market reaction is muted, suggesting that a lot was priced in already.

- Prices for commodities, construction materials, transportation, storage costs and intermediate goods are all showing significant increases. (for example, US lumber futures are up +135% YTD)

World

- The US ISM Index hit 64.7 in March, its highest level since 1984. While it may remain elevated for some time, room for further improvement is very limited at the present time.

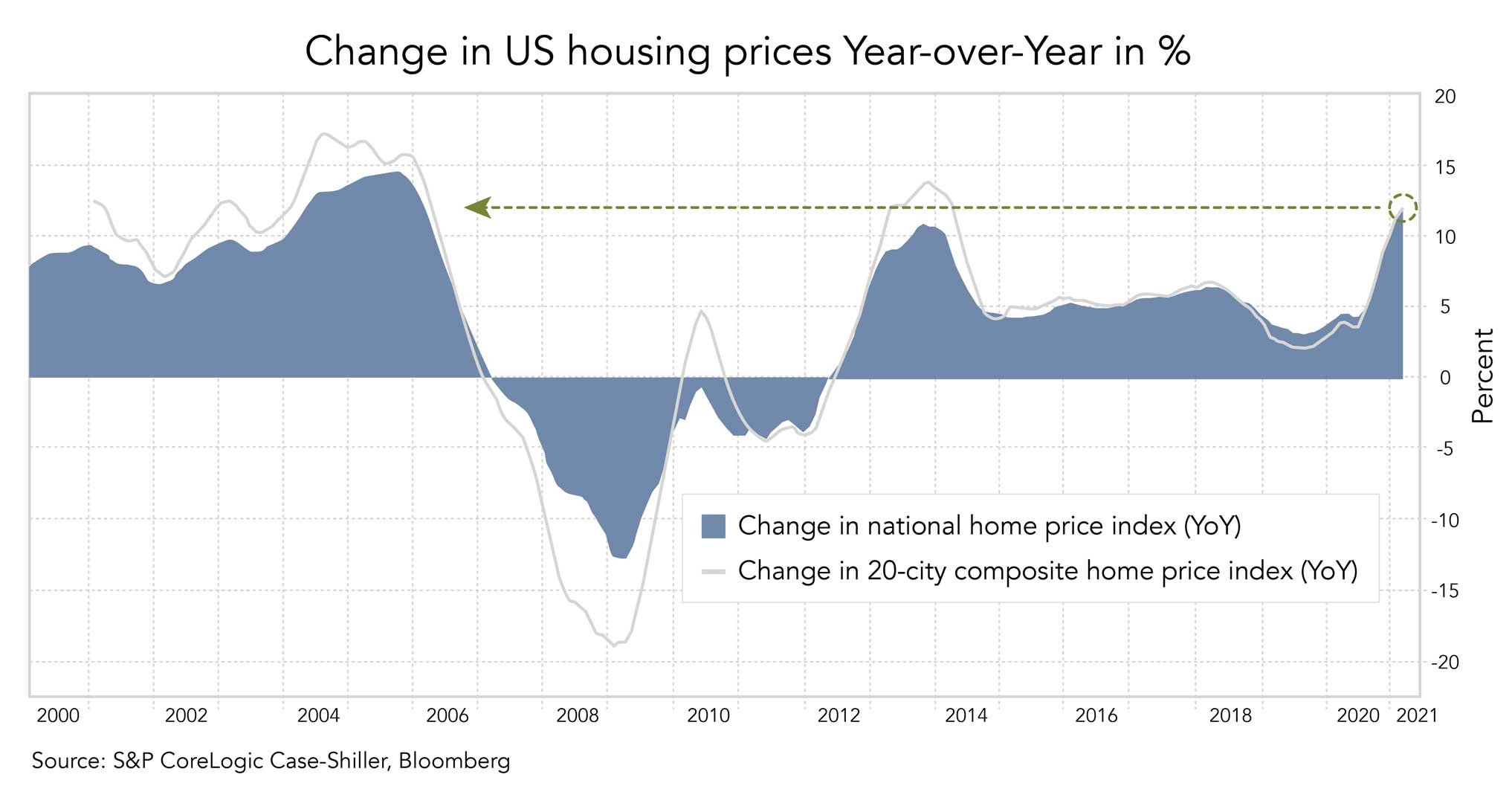

- US consumer confidence hit a 14-month high, and house prices experienced their biggest jump for 15 years in February.

- Supply chain constraints, input cost pressures and price increases are getting a lot of attention in earnings calls.

- Meanwhile, the ecological and green transition is gaining traction. Invited by US President Biden, political leaders announced ambitious targets for reducing greenhouse gas emissions last week.

- In our view, ESG criteria are well on their way to becoming the global standard for professional investors.

Europe

The Greens and the CDU have announced their candidates for Germany’s general elections in September. It seems that the Greens will play a significant role in the next coalition. This may increase pressure on polluting industries, while firms focused on the green transition should benefit. On a European level, more public spending and somewhat higher eurozone yields are also reasonable assumptions.

Switzerland

Swiss foreign trade picked up further in March (+4.5% MoM, mainly due to chemicals and pharmaceuticals). Exports are now higher than before the start of the pandemic. Leading indicators, such as purchasing managers’ indices, suggest that Europe, Switzerland’s most important trading partner, should also finally recover in the coming months. This bodes well for sustained growth in the months ahead.

Broad equity markets remain in an uptrend, pushed by the abundance of liquidity, the accommodative rhetoric of central bankers, the prospects for further economic recovery, and the return of corporate stock buybacks. In this environment and provided vaccines remain highly effective, it is our view that equity markets can continue to rise during the second quarter.

In early summer, the liquidity impulse, which started last year, is set to peak, according to a recent note from the research firm McClellan.

- The paper argues that excessive surges in US M2 money supply growth (compared to GDP growth) have resulted in significantly higher S&P 500 levels 12 months later. Since the M2/GDP ratio peaked in June 2020, the injected liquidity could continue to support equity markets into June 2021.

Meanwhile, the earnings season for Q1 is on track to show a strong corporate recovery. FactSet reports that the blended US earnings growth rate stands at 33.8%, up from 24.5% at the start of the earnings season and from the 15.8% expected at the start of the quarter.

- Alphabet, one of our core positions, grew sales by 34% to a record level and more than doubled its profits. Its digital ad business, YouTube and cloud services are thriving.

Biden’s “American Families Plan”, a USD 1.8 trillion spending and tax proposal (on top of the USD 2 trillion fiscal plan) is about to take the spotlight for the next weeks.

- The tax proposal is for a hike in the corporate tax rate to 28% and the Long-Term-Capital-Gains-Tax to approx. 40% for the highest income earners above USD 1 million.

- The analyst consensus view is for a more modest increase than proposed. We tend to agree, given that the Democrats will have to get all moderate Senate members on their side for the vote.

- Goldman Sachs estimates that the wealthiest US households now hold USD 1-1.5 trillion in unrealized capital gains on equities, equating to ~3% of US market cap.

In an environment in which stimulus is still ramping up, it is important to keep a close eye on market sentiment. Some of the speculative excess from Q1 (particularly in retail option buying) has ebbed off. That said, there is obviously a lot of leverage and risk-taking in the system. The “Archegos blow up” with big-bank losses now aggregating to more than USD 10 billion are a testament to that.

We recognize the strong rallies in commodity markets after a period of consolidation, and we suspect that inflation expectations and nominal yields have not yet reached their highs for the year.

In our opinion, rising input costs will increasingly favor the truly strong business models, as it will become difficult to pass on increasing costs to end customers. Only those companies which can raise their prices (brand power, market leader, high demand) will be able to maintain their margins. This gives us confidence in our core quality names with strong moats.

Inflation rates could certainly remain elevated for longer than the market consensus expects. At the same time, this may not pull forward any Fed tightening measures. The new “Average-Inflation-Targeting” regime and the growing fiscal deficit gives the Fed all the arguments and incentives it needs to let inflation run at 2 – 4% p.a. for a few years, at least in theory. That said, to what extent the new regime really has changed the Fed’s reaction function will only become apparent over time.

In this environment, a balanced portfolio focused on equities and other real assets remains key in our view.

Historically low mortgage rates and a limited supply are behind a surge in U.S. home prices. The S&P CoreLogic Case-Shiller index of property values climbed 12% in February compared to the previous year, the biggest jump since 2006. That followed an 11.2% gain in January. Meanwhile, home prices in 20 U.S. cities jumped 11.9%, beating the median estimate of 11.8% in a Bloomberg survey of economists.

Change in US housing prices Year-over-Year in %

Sources: Bloomberg, Goldman Sachs, Saxo Bank, The Market Ear, JP Morgan, Bank of America, Citi, Zürcher Kantonalbank, Scotiabank, Morgan Stanley, Kepler Cheuvreux, UBS, McClellan Financial Publications

FINAD CIO Team