- The bear market continued in June, making the first half-year of 2022 one of the worst in history, both for stocks and bonds.

- Once again, higher inflation prompted central banks to accelerate their tightening path. The FED in particular raised interest rates by 75bps. Surprisingly, the SNB also hiked by 50bps, while the ECB is mainly concerned about fragmentation risk in the Eurozone.

- Disappointing economic data points to a slowdown in growth and is raising recession fears.

- The upcoming earnings season will demonstrate how resilient company profits are. Earnings estimates of +10% for 2022 are still too optimistic.

- We are expecting declining growth, falling inflation and falling earnings in the second half of the year.

Historical half-year losses

June was another turbulent month, in which both stocks and bonds dropped significantly. Summing up the first half-year, the S&P 500 had its worst start since 1970 (-20%). After inflation and on an annualized basis, it was even the worst first half-year on record. Bonds did not fare any better, incurring the largest losses since 1900 (-14%, Bloomberg Global Aggregate). As a result, the classic 60% stocks and 40% bonds portfolio also proved to be undiversified and had its second worst start since 1900 (-18%).

Market Development

World

- Higher-than-expected US inflation numbers (8.6% year-on-year in May) caught investors wrong-footed and ended the recent bear market rally. In anticipation of more financial tightening, risk assets were sold off.

- Indeed, the FED increased interest rates by 75bps to the range of 1.50%-1.75%, marking its biggest rate hike in 28 years.

- Forward-looking purchasing manager indices are trending down and could soon enter contractionary territory, sparking recession worries.

- The crypto market was once again in turmoil as the bankruptcy of the largest crypto hedge fund 3AC affected a number of firms in that space which are now themselves bankrupt or had to be bailed out by competitors.

- On the bright side, COVID-19 lockdowns in China have mostly come to an end and the economy has reopened.

Europe

- Fragmentation is the current buzzword among ECB central bankers. High inflation makes financial tightening inevitable, but Italy’s large government debt will pose a threat should interest rates rise too much – more information on a new anti-fragmentation instrument is expected at July’s meeting, as is a 25-bps hike in interest rates.

- Germany moved to stage two of its emergency gas plan, as reduced Russian flows exacerbate fears of a winter supply shortage.

Switzerland

- Surprisingly, the SNB moved before the ECB and hiked interest rates by 50bps. The move is meant to preemptively tackle inflation and strengthen the Franc in order to dampen the effect of rising import prices.

- Although it is trending upwards, the inflation rate in Switzerland, at 3.4%, is low compared to the interest rate in neighboring countries (Eurozone 8.6%)

Recession concerns are growing

Incoming economic data substantiate our view that the economy is heading for a severe growth slowdown. While this view was out-of-consensus at the beginning of the year, it is now widely held on Wall Street. Investors are beginning to consider the consequences of a US central bank that seems willing to hike the world’s largest economy into recession in order to defeat inflation.

We were wrong in calling the peak in US inflation for April. In the short-term, the risk still seems to be on the upside. Energy prices, supply chain disruptions, stronger wage growth, or firmer shelter costs could keep inflation somewhat higher for longer. However, the recent drop in many industrial commodities opens up room for future surprises to the downside. For example, copper fell 14% in June despite China’s economic reopening. In any case, slowing economic growth should moderate inflation over the coming months.

Equity valuations have de-rated by a comparable amount to past bear markets. Year-to-date, the S&P 500 forward PE went from 22x to 16x at the June bottom. Yet the only driver of this multiple compression was price. Earnings estimates have not declined so far. Bloomberg’s consensus is still close to +10% for 2022. In our opinion, these estimates are too high and will come down during the Q2 earnings season, which kicks off mid-July. It is unreasonable to expect that company profits will not be negatively affected during an economic slowdown. Historically, forward earnings decline by 15% on average during a recession.

We believe that the second half of this year will be marked by declining growth, falling inflation and falling earnings. A repricing of growth expectations is a precondition for the bottom in this bear market. Furthermore, for the bear market to sustainably turn into a bull market, a shift in monetary policy is needed. A sooner-than-expected recession could potentially be a catalyst for a durable bottom, because it could bring down inflation and give central banks enough room to stop tightening financial conditions.

In a world of slowing growth, equity leadership will change, with history favoring quality-growth stocks over cyclical value stocks. Long-term government bonds should also be back in demand. Long-duration assets are more vulnerable to inflation, whereas cyclicals are more vulnerable to a recession.

Positioning

We observe a dangerous macro environment for risk assets. Preserving capital remains vital and risk management still has the highest priority. We are therefore continuing to underweight equities and credit, and overweight cash, gold and alternatives.

We are sticking to our plan to gradually increase our equity exposure at pre-defined levels, at which the overall market would be attractively valued according to our base case scenario of an economic slowdown. Our first limit was reached in June’s trough. The next limits for the S&P500 lie in the range of 3550 – 3350 (26% to 30% drawdown from January’s top). At these levels, we would reduce our current underweighting, yet still be cautiously positioned.

Should our bear case of a recession materialize, we would expect to see further downside for the S&P500 in the direction of 3100 – 2900, a range in which overweighting equities should be seriously considered in our view.

Historically, quality-growth stocks tend to outperform when earnings revisions are negative and economic growth is slowing. As a result, within equities, we expect that steady growers with recurring cashflows, high profitability, quality balance sheets and now more reasonable valuations will show relative strength.

Chart

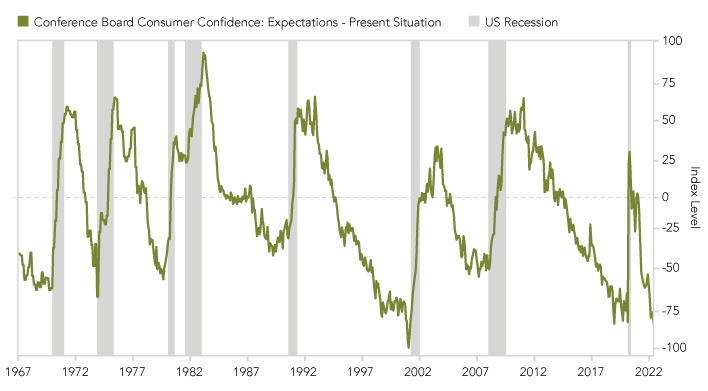

While consumers in the US still rate the present situation relatively favorably, their expectations for the future are bleak. When the spread between the future and the present reached similar negative levels in the past, a recession was close. The current reading of US consumer confidence is certainly a warning signal.