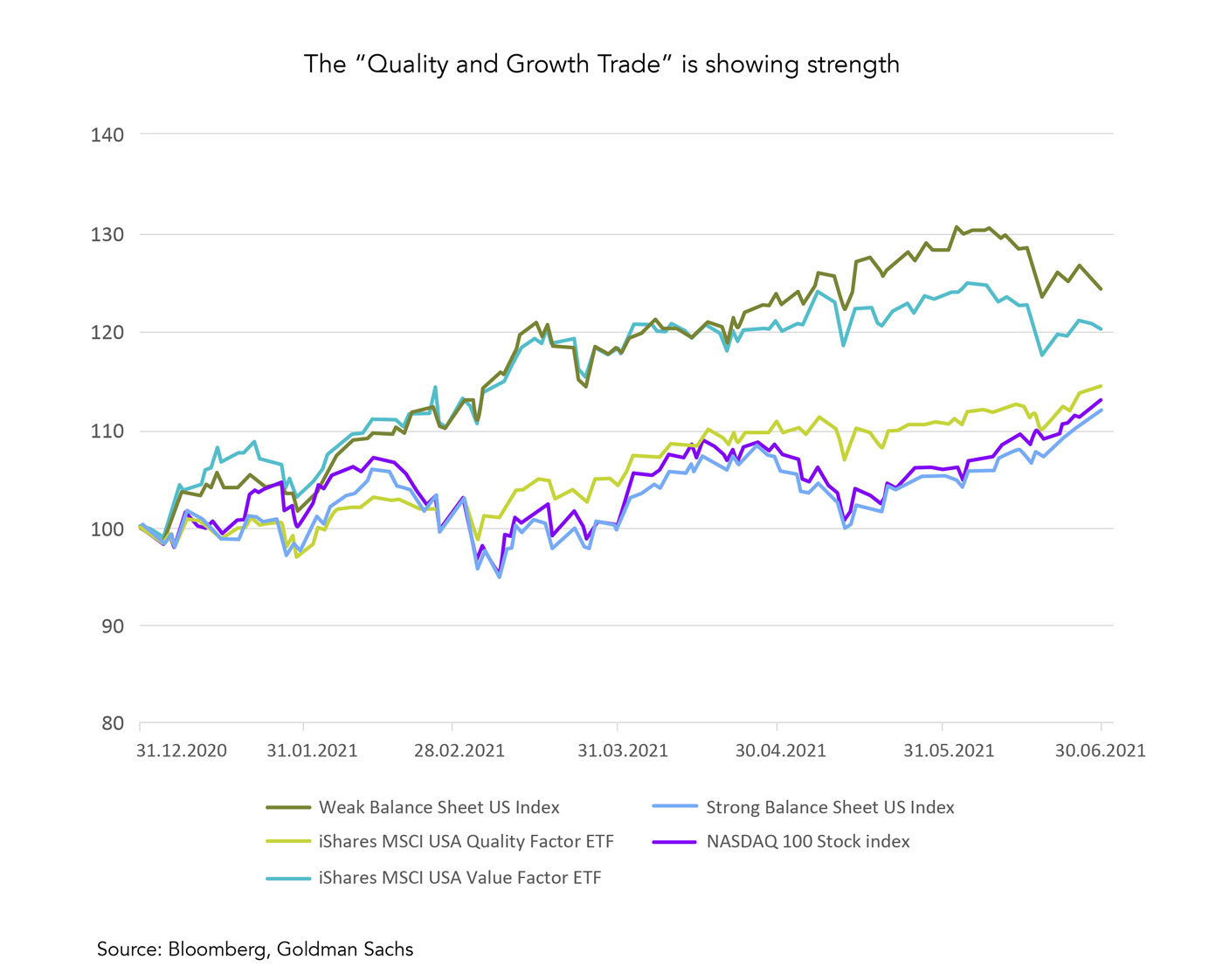

- The US Big-Tech sector is leading the quality and growth factors higher, as nominal yields retreat despite a hawkish surprise from the Fed in June.

- Many investors have been caught off-guard by the recent quality/growth rotation and Tech-Sector outperformance and will have to chase these trends if they prove sustainable.

- Yields on 10-year Treasuries peaked at the end of March and have been trending lower since. “Low-rates-for-longer” trades are working again.

- It seems that markets are pricing in a weakening macro outlook, which also translates into fading inflation fears.

- In this context, the U.K. recently reported the highest number of daily Covid cases in almost five months, as the highly contagious Delta variant becomes rampant. This will be a key factor to watch over the summer.

- We believe that the Fed will think twice before tapering into another potential virus-wave in the coming fall/winter.

- Growth stocks outperformed value stocks this month. Technology stocks led U.S. benchmarks (S&P 500 and Nasdaq 100) to new records.

- The US dollar made a strong move post the hawkish-toned FOMC June meeting. It reached overbought levels but so far has refused to move much lower. The short-term trend remains up within a mid-term down trend.

- In the US, the road to an infrastructure bill continues to be complicated. President Biden needs to find a way to unite his party, as many progressive Democrats have warned they will not support infrastructure if it is not paired with a broader bill for funding key priorities.

World

- Markets will look to the U.K. for clarity if the world intends to transition towards accepting living with COVID-19 as an endemic disease or if fall and winter are characterized by a return to more restrictive measures again. Caseloads are continuing to climb, but hospitalizations and deaths have remained subdued for now.

- The US economy is likely to have reached peak recovery in the second quarter. The PMI Composite, which tracks overall economic performance, decreased by 4.8 points in June. However, at 63.9 points, the activity indicator is still at a level that is historically exceptionally high.

- Growth vs. Value and “stay-at-home” vs. “reopening” look likely to remain the relevant debates for equities in the quarter ahead.

Europe

Growth momentum in the euro zone picked up again in June with further cancellations of coronavirus restrictions and increased confidence among companies and consumers. The PMI composite for the euro zone rose from 57.1 to 59.2 points, reaching its highest level since June 2006.

Switzerland

According to the KOF Index, the economic upturn in Switzerland has begun earlier and more strongly than was originally expected in March. The GDP growth forecast for the current year has been raised sharply from 3.0% to 4.0%, which would correspond to the highest rate in 14 years.

Nominal and real yields are falling and quality/growth stocks are outperforming. We have been expecting this in the form of a transition to a mid-cycle market environment. Still, it seems ironic that this is playing out after the Fed’s apparently hawkish pivot, a development that many would expect to lift yields across the curve and benefit value stocks.

That said, the Fed’s apparent step-back from its new “AIT framework” (Average-Inflation-Targeting) comes at a time when the macro growth outlook is actually slowing down in our view. It could be the case that the high inflation prints in April and May spooked some of the FOMC members and made them question their commitment to the new framework. However, while at least some of the FOMC members are looking in the rear-view mirror, markets have already moved on, are looking beyond the summer months, and are now asking questions regarding the further pathway to recovery.

Will vaccination rates drive stocks and regional asset performance? As of writing, close to 11% of the global population are now fully vaccinated. However, countries and regions with the highest incomes are getting vaccinated more than 30 times faster than those with the lowest.

Nobody knows, but new variants, lifted restrictions and colder weather will probably push new cases higher as fall and winter approach. The recent resurgence of the “2020 playbook” in the form of Nasdaq outperformance, driven by digitalization and stay-at-home winners could be an early signal for that. Why are stocks rising on the possibility of weakening economic momentum? We suspect it could be the market realizing that the Fed will likely not crank up its hawkish stance into another potential period of pandemic restrictions – even though some Fed members may be thinking so at the moment.

Coupling this macro outlook with a significant under-positioning of market participants in the technology sector coming into June, financial conditions that remain extremely benign and an investor risk sentiment which, despite new all-time highs, remains only moderate, causes us to believe that the quality/growth trade can continue to run for some time and will push broad indices higher.

Our big picture for equities remains essentially unchanged and supportive of equities. The central bank liquidity tailwind, negative real yields, fiscal stimulus, excess savings/pent-up demand, reopening momentum, strong corporate earnings, positive earnings estimate revisions, operating leverage, and stock buybacks will continue to support risk assets into the summer.

However, risks continue to loom in the background such as: unexpected inflation, a potential monetary policy mistake, a resurgence of the pandemic, excessive valuations, financial excesses, and technical signs of a narrowing rally.

In this context, we are maintaining a balanced allocation, with an emphasis on high-quality stocks, supplemented by segments with high-growth potential such as clean energy, which is now showing signs of life after months of consolidation.

Once the market narrative changes to an overall “goldilocks” state, this will be our signal to become more cautious.

The graph shows how the quality/growth trade – depicted on the basis of the Nasdaq 100, a US Quality Factor ETF, and the Goldman Sachs “Strong Balance Sheet” Index – has recently started to outperform the cyclical/value trade – depicted here as a US Value Factor ETF and the Goldman Sachs “Weak Balance Sheet” Index.

Sources: Bloomberg, Goldman Sachs, Saxo Bank, The Market Ear, JP Morgan, Bank of America, Citi, Zürcher Kantonalbank, Scotiabank, Morgan Stanley, Kepler Cheuvreux, UBS, McClellan Financial Publications

FINAD CIO Team