Executive Summary

- While most countries are now facing a rocky start to 2021 given the raging pandemic, the expected widespread availability of effective vaccines allows financial markets to look beyond the short-term pain in the real economy.

- Democrats winning the Senate means that another strong fiscal impulse is likely in 2021. In consequence, the inflation outlook will move more and more into investors’ focus.

- Analyst consensus is earnings-per-share growth of 25-30% and double-digit equity total returns across regions through to the end of 2021.

- Compared to the past two years, geopolitical uncertainty will recede, but will remain elevated based on a historical comparison. China and the U.S. appear locked together in structural rivalry.

- Risks remain around virus mutation, the logistics of vaccine roll-out and high equity valuations amid possible upward pressure in nominal interest rates.

Markets are looking through the Corona-Winter

The past weeks brought clarity on several important issues for financial markets.

- COVID vaccines were approved globally for emergency use

- A BREXIT deal was reached

- US stimulus cheques are being rolled out

- A “mini” blue wave has materialized in the US Senate

- Joe Biden’s victory was formally certified

All these issues have resulted in a generally favorable setting for risk assets, providing some much-needed fundamental support on a forward-looking basis to the high valuations in major equity markets.

Market Development

World

- Markets have taken in stride the storming of the US Capitol building and a potential further escalation of the US-China relationship based on the new US threat of blacklisting China Big-Tech companies.

- Markets seem – rightfully in our view – to discount an orderly transition of the presidency and a quick rollback of possible aggressive, last-minute Trump executive orders by the incoming administration.

- The US will now have at least two years of a moderate Democratic government. However, the Biden administration will have the slimmest of majorities to work with in Congress. This implies some, but not significant, potential for enactment of Democratic agendas.

Europe

European markets benefited from the rotation into cyclicals and value triggered by vaccine news. While the cyclical rotation took a breather in December, we believe that it may continue over the coming quarters. Fortunately, the euro zone’s response to the pandemic has slowly but surely taken a pro-growth and investment direction.

Switzerland

The Swiss Manufacturing PMI rose unexpectedly sharply in December from 55.2 to 58.0 points, reaching its highest level since September 2018. This implies that the industrial recovery continued up to the year-end, despite the adoption of further pandemic restrictions.

Inflation expectations on the rise

Amid a “Democratic-Trifecta” (Presidency, House and Senate), markets are starting to pick up on the reflation narrative that evolves around rising money supply, energy prices (mind the year-over-year base effects), global supply-chain inefficiencies and parallel fiscal and monetary stimulus.

This year will reveal how committed the Federal Reserve is to its new average-inflation-targeting regime. It seems clear that the Fed will not raise rates. However, risks to long duration positions loom in the inflation outlook. An absence of further intervention by the Fed, rising nominal rates (= real rates + inflation expectations) due to rising inflation expectations seem the most likely outcome to us. The Fed might have to move to some form of yield curve control and financial repression to keep control over the long end of nominal rates.

The key question will be whether market volatility will force the Fed to react to rising nominal yields or if it will act proactively to dampen them. The risk of a policy mistake appears elevated. Either way, we expect the result to be even lower real rates over the mid-term.

Keep in mind that central bankers use backward looking data as basis for their decision-making while equity markets are forward looking. In the short-term, COVID cases remain high and full employment far away. This means that the case for continued easing remains strong for now, while the longer-term macro-outlook has improved in the last two months – a potentially very good set-up for strong equity returns.

Risks to the outlook remain of course. The new virus-mutation that originated from the UK and South Africa is on track to become the dominant strain. Data shows that it is up to 70% more transmissible, however less lethal. A (not-yet peer reviewed) study by Pfizer and the University of Texas indicates vaccine effectiveness in neutralizing the new variants. Nevertheless, increasing pressure on the health care system seems a reasonable assumption, given the higher transmissibility. The likelihood of further/prolonged lockdowns has therefore increased as well. On the positive side, the Biotech sector looks primed for positive surprises, given the massive research funding it received in 2020. The new mRNA technology offers a larger number of potential applications than just COVID.

Positioning

The positions in the infrastructure sector that we took in October in anticipation of a US blue wave have performed nicely. In December, we added small-cap, pro-cyclical emerging markets stocks to our portfolio to reflect our expectation of a broad-based cyclical rally in the wake of global vaccine deployment and rising inflation expectations. That said, the fundamental case for tech remains strong in our view, with faster sales growth, superior margins, robust FCF and low leverage. We are therefore keeping a significant core position in this space.

The growth recovery and the possibility of lower real yields are the key themes that will guide our asset allocation decisions this year. We continue to overweight real assets such as equities and gold against nominal assets like cash and bonds.

Regionally – ahead of key general elections in Germany (autumn 2021) and France (spring 2022) – European leaders will likely put pressure on their European partners to implement green and pro-growth policies. The European stock markets will therefore have the chance to finally climb the political “Wall of Worry” in 2021.

Chart

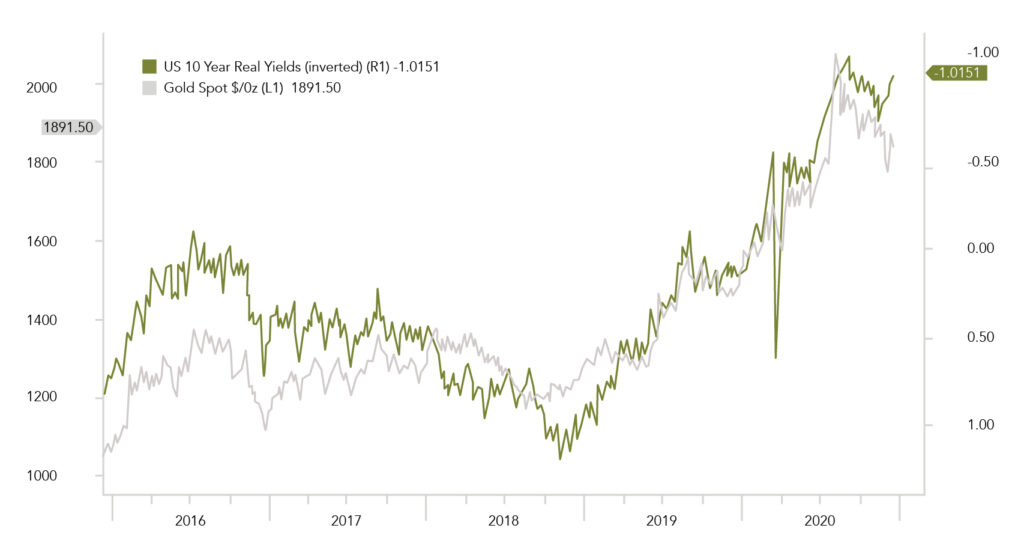

In the December Market View, we noted the divergence between gold and real yields and took the view that the gold correction could be close to over. A few weeks later, gold is now trading above the important USD 1.850 level and is catching up to the (inverted) negative real yields. In our view it has room to run.

Sources: Goldman Sachs, Bloomberg, Saxo Bank, Gavekal, Morgan Stanley, The Market Ear, JP Morgan, Bank of America, Allianz, Amundi, AXA, BNP Baribas, Evercore ISI, UBS, BNY, Citi, Credit Suisse, Pictet

Finad CIO Team