Executive Summary

- The last week of January was marked by a painful de-risking in the hedge fund world amid a massive short squeeze involving a handful of small-cap stocks. This led to a market-wide volatility spike, offering selective dip-buying opportunities in high quality names in our view.

- Leverage via options and margin accounts makes the retail crowd a real force in less liquid market segments.

- Possible delays in the U.S. fiscal package and the vaccine rollout may delay but will not halt the global recovery, as long as the effectiveness of the vaccines is not in doubt.

- The route to recovery is unlikely to be linear, given excessive valuations and speculative excesses in certain market segments.

- We continue to view the environment for equities as attractive, but emphasize that risk management will be very important in 2021.

A short squeeze for the ages

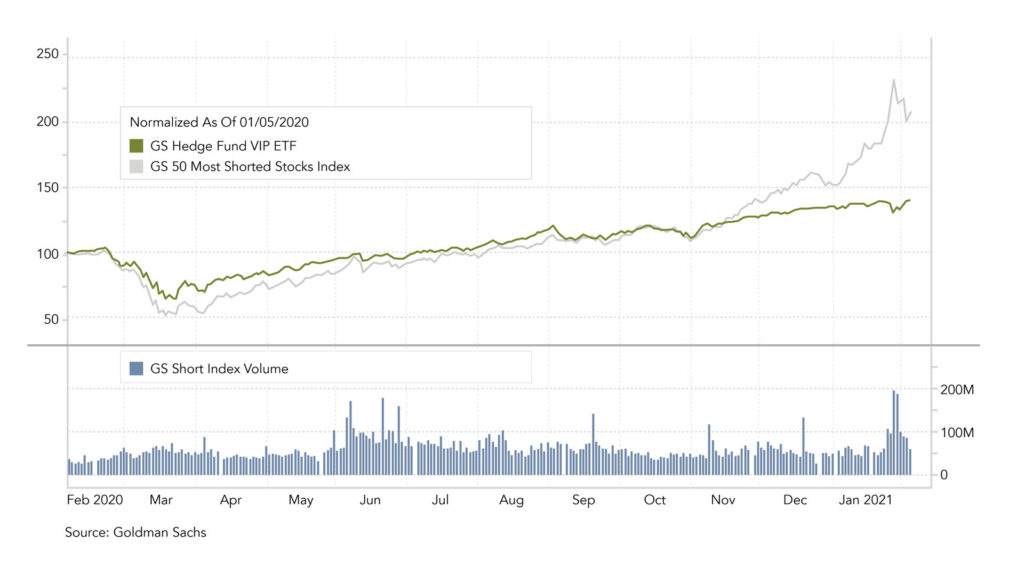

Once again, we have witnessed market movements that are considered virtually impossible by traditional market models. Rising prices and trading volumes in a handful of small-cap stocks – driven primarily by traders on the Reddit forum WallStreetBets – led to a short squeeze, which was further accelerated by the options market. This resulted in cascades of forced buying by short- positioned hedge funds and option market makers. In the end, we saw the largest deleveraging in the history of long-short equity funds.

Market Development

World

- Retail traders were only the trigger of the market moves, which then saw momentum-chasing algos and predatory hedge funds jump in.

- The VIX experienced its third-largest single-day spike in history (+62%) last week, followed this week by its largest 3-day drop ever, once the dust had settled.

- Despite a fierce third wave of the coronavirus, the US economy grew solidly at an annualized rate of 4% in the final quarter of 2020.

- If Biden’s USD 1.9 trillion stimulus package gets approved, it will take total fiscal policy support to ~25% of GDP, compared to the ~10% decline in the economy at the height of the pandemic.

Europe

The Eurozone Q4 GDP figures were not as bad as the consensus of opinion had feared. Spain and Germany posted slight quarter-on-quarter growth of 0.4% and 0.1% respectively, and in France, the decline of -1.3% was smaller than the -5% expected. That said, the chaotic start of the vaccination program could cause the EU to fall behind in the relative growth outlook.

Switzerland

The Swiss Industrial PMI surprisingly increased by 2.1 points in January. At 59.4 points, it is now clearly in growth territory. The SME PMI, however, lost significantly compared to the previous month, indicating business conditions for SMEs that were nearly as severe as during the first lockdown.

The “Reddit Revolution” was a long time in the making

Last week’s market events were simply the culmination of a retail-speculation trend that has been in place since late 2019, when US brokers started to offer zero- commission and fractional share trading to retail clients.

The removal of entry barriers to trading in an environment of abundant liquidity and negative real rates incentivizes aggressive risk taking. Meanwhile, Fed officials voiced that countering such excesses in small market segments is not a high priority to them, amid a still-raging pandemic.

Solvency rules demand that brokers post collateral with clearing houses to ensure that the 2-day settlement risk that their customers’ equity trades impose are covered.

When the “meme-stocks” rose to astronomical levels, the clearing houses had to demand ever more collateral, which overwhelmed the brokers. They in turn had to curb the trading ability of their clients. This system was designed to prevent broker defaults and it worked as intended. However, it seems nobody anticipated that things could unfold that quickly. The question is whether it can get even crazier in the future…

Smartphone apps, short-selling rules and broker leverage and solvency rules are all sure to come under closer scrutiny by the SEC, but what does all this mean for markets going forward?

The market structure has changed, suggesting a recalibration of risk models and subsequently a lower leverage for short-sellers. For long-only investors, such as ourselves, this means hedging via options will be more expensive. Volatility will remain high, as derivatives will be the substitute to outright short selling for hedge funds. Retail money will continue to chase weekly call options, as long as additional stimulus cheques increase their disposable income and they cannot spend it in the real world. One positive outcome may bet that the industry now is incentivized to work towards shorter settlement periods. Such a step would imply less risk in the overall system and would be good for everyone.

Positioning

- We recognize that liquidity conditions remain the strongest driver for equity markets in the short- term. As long as the current liquidity environment remains unchanged, it seems only a question of time until we will see new excesses pop up. While this leads us to expect more volatility, it also implies further upward momentum for equities. On a broader level, our macro-outlook also remains attractive for risk assets.

- We therefore took the view that the forced selling by hedge funds offered opportunities in high quality names and made use of the setback to add to or establish positions in the semiconductor and EV sector.

- On a portfolio level, we believe a balanced approach at asset class and sector level remains key. We continue to overweight real assets, such as equities and gold, versus nominal assets, such as cash and bonds.

- We believe that the recent rise in real interest rates does not represent a structural trend reversal. However, this needs to be monitored closely. Interest rate volatility is a serious risk in the current market environment.

Chart

Last week saw the largest active hedge fund deleveraging event since February 2009. According to Goldman Sachs, long positions were sold in every sector to raise cash in order to cover losing shorts and service margin calls. This becomes evident in the surge in trading volume and in divergence between the hedge fund “Most Shorted Index” and “Hedge Fund VIP ETF”.

Sources: Goldman Sachs, Bloomberg, Saxo Bank, Gavekal, Morgan Stanley, The Market Ear, JP Morgan, Bank of America, Citi, Credit Suisse, QVR Advisors, Zürcher Kantonalbank

FINAD CIO Team

Download PDF:

FINAD CIO – Market View – February 2021