- The S&P 500 (+9.2% in USD) and the Bloomberg US Aggregate Bond Index (+2.1% in USD) had their best month since November and July 2020, respectively.

- The rally was driven by systematic quant-buying and by the market pricing in a Fed pivot away from “inflation fight” to “growth rescue”. This is evident in rapidly declining expected rate hikes, increasing expected rate cuts and collapsing real yields – which boosted risk asset valuations.

- In our view, “don’t fight the Fed” still means to be defensive in this case, as the rally-induced easing of financial conditions is likely to be self-defeating in the long run. Inflation is not going to come down fast enough for the Fed to declare victory; given how fast the economy is weakening, that is going to put the Fed in the same dilemma it has been in.

- That said, the “pain trade” appears to be higher for now, with solid resistance from the S&P 500 at 4.200.

Bear market rally or turning point?

- An old adage on Wall Street says that “markets bottom when they stop falling on bad news”. While we think this adage will prove correct down the road of this bear market, we do not think that the conditions for a sustainable bottom are in place at the moment.

- There was a lot of bad news, however:

- Nordstream 1 is down to 20% capacity as Europe continues to head into a severe energy crisis.

- The US is in “Technical Recession”, with leading data indicating further weakness and the increasing likelihood of a “real” recession.

- China is holding on to the “Zero-Covid-Policy” while stimulating too little in the face of a potential real-estate/banking crisis.

Market Development

World

- The Fed has abandoned forward guidance and has acknowledged the slowdown but has stated that it sees greater risk in doing too little (about inflation) than in doing too much (i.e., overtightening).

- The US Q2 earnings season has been mixed so far but has been saved by Energy and Mega-Cap Tech. Keep in mind that earnings are reported on a nominal basis and the weakest part of the market (retail) has yet to report. Forward earnings estimates are continuing to fall at an unusually fast pace.

- Primary market conditions are notably weak. The number of companies that have delayed or canceled financing plans has soared. The missed deals, including initial public offerings, bonds, loans and acquisitions, amount to more than USD 254 billion.

Europe

- According to Barclays, should inflation peak in September. Italy would be paying about EUR 10 billion more in inflation compensation next year or double the 2021 level.

- Composition of Italy’s debt:

- 10% inflation-linked,

- 6.6% floating-rate

- Based on current market rates this burden is not big enough to raise serious concerns about sustainability, “assuming Italy’s fiscal position returns to a conservative stance”.

Switzerland

- Despite a slight decline, the manufacturing PMI remained at a high level in July and is therefore still signaling growth in the months ahead.

- By contrast, the forward-looking sub-indicator “order backlog” lost 7.8 points in July and, at 52.9 points, is no longer too far from the growth threshold.

- Hence, unlike the euro zone, the Swiss PMI is not yet in contraction. However, there are signs that even the Swiss economy is trending towards weakness.

Is the market too complacent?

The question is whether the market correctly interpreted Powell’s statements in the sense of a possible early dovish pivot. We would argue that it did not.

Powell didn’t flag a pivot to lower rates or even a pause, according to Fed watchers (e.g., Dudley, Ackman, El-Erian), who argued there was a disconnect between what the central banker said and how markets responded.

If the Fed is still committed to getting inflation under control, easing financial conditions is the last thing it wants to see. If it does not push back against this narrative, this will be interpreted as implicit confirmation. Going forward, there will be more Fed ambiguity and data dependency, meaning higher volatility for all asset classes.

The market is essentially hoping that inflation will quickly evaporate, so that the “Fed Put” can come back into play. However, we think that a quick reduction in inflation would be routed in a further severe downturn in economic growth (i.e., a real recession). This, in turn, would hurt equities before the Fed eventually comes to the rescue. In any case, current benign market action feels premature to us.

That said, we know that one can never determine a bottom in real time. So, what if this was the bottom for the S&P 500?

According to the Kobeissi Letter and BofA, this would mean that:

- The bear market was 4 months shorter than the average bear market

- The low was 12% higher than the average bear market bottom

- It was the fastest bottom while the Fed is raising rates

- It was the first bear market bottom without VIX above 45+

- Prior bear markets ended after EPS cuts, whereas today, forward EPS is still ~ +6% YTD

- Prior bear markets ended after the Fed started to cut rates, not while hiking

- Historical market bottoms were accompanied by over 80% of BofA’s bull market indicators being triggered versus just 30% today

To find a bottom in a “real” recession, the conditions get even trickier historically speaking:

- At the point of recessionary bottoms, the US unemployment rate was up at least 1.3 ppts from the low (currently it is still at the low)

- The ISM Manufacturing PMI was below 44 (currently at 52.8)

- The median decline in NTM EPS was ~11% from peak (currently down ~1%)

For these reasons, we are sticking by the base case that the bear market has not yet run its course. We will keep an open mind when it comes to changing this perception of course and will follow the data.

Positioning

We continue to observe a dangerous macro environment for risk assets. Preserving capital remains vital and risk management still has the highest priority. We are therefore continuing to underweight equities and credit, and overweight cash, gold and alternatives.

We re-affirm the view we expressed in the June house view, that for H2 we are predicting declining growth, inflation and yields. The market now seems to agree but is getting ahead of itself in declaring the Fed/Inflation problem solved, in our view.

Overall, this environment favors quality-growth (particularly Big Tech) on a relative basis if the bear market is not yet over, but also if the current “Goldilocks” narrative continues for a while.

We will stick to our plan to gradually increase our equity exposure at pre-defined levels, at which the overall market would be attractively valued according to our base case scenario of an economic slowdown. Our first limit was reached in June’s trough. The next limits for the S&P500 lie in the range of 3550 – 3350. At these levels, we would reduce our current underweighting, yet still be cautiously positioned.

Chart

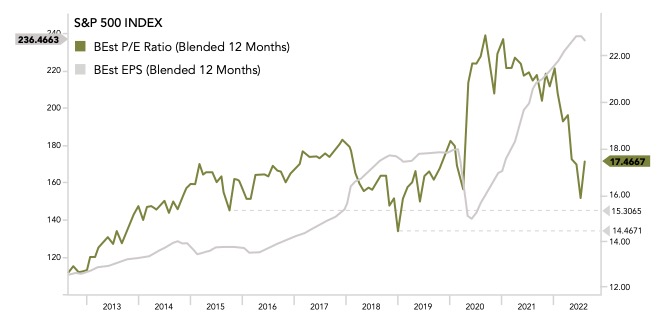

Crashing real yields have pushed forward valuations up again. Note that the 12M forward S&P 500 P/E (in black) never reached prior correction lows. At the same time, the forward EPS consensus (in blue) has only barely declined so far (more to come in our view).