- In July, we saw a brief growth scare, confirming the assumption that the fastest rate of economic expansion may be behind us.

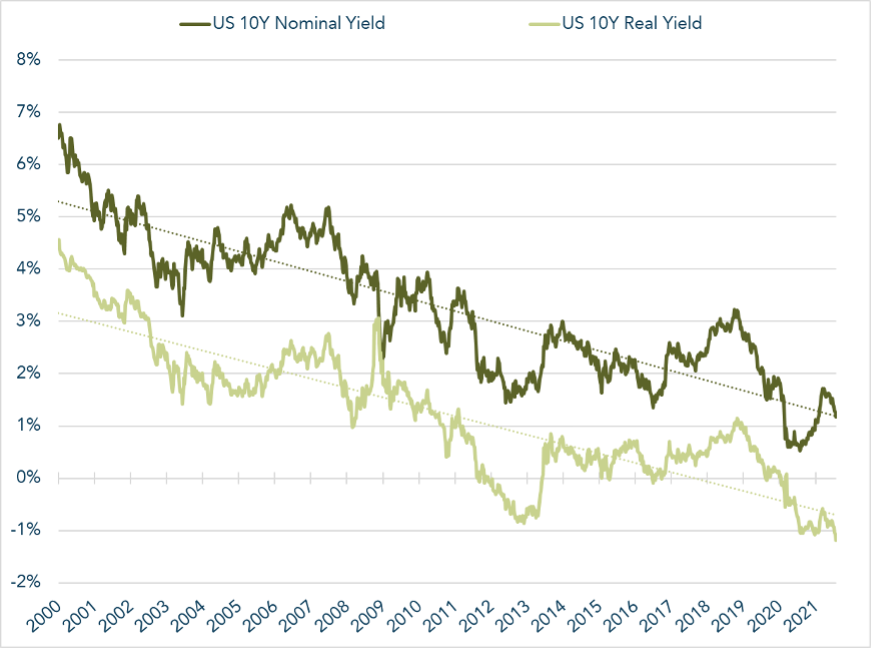

- Yields on government bonds dropped accordingly, with the 10-year US yield now back at its multi-year long-term downtrend.

- New lows in real yields should support the price of gold going forward.

- Policy uncertainty in China reached a new high, and debt woes in the real estate sector as well as new lockdown measures pose a risk of contagion.

- Given this backdrop, we deem it unlikely that the Fed will announce a tapering of its QE program in Jackson Hole this August, even if some members expressed inflation concerns.

- Our big picture remains attractive for equities, yet risks are rising. We prefer quality stocks, large caps, and developed markets.

Triggered by weaker macroeconomic data and by the spread of the delta variant, we witnessed an initial growth scare in mid-July. Although the S&P500 was only down 3.6% from its all-time high, sentiment among investors was dire. Sentiment indicators, such as the CNN Fear and Greed index, hit levels of extreme fear which were last seen during the COVID crash. The correction was, however, very short-lived as investors bought the dip. Large caps and quality/growth stocks outperformed small caps and value stocks.

World

- US second quarter GDP came in weaker than expected at 6.5% versus 8.4%, thereby supporting the argument that peak growth may be behind us.

- Globally, long-term interest rates declined substantially. 10-year US yields fell from 1.47% at the beginning of the month to their current level of 1.18%, and 10-year German yields from -0.22% to -0.48%. Real yields even hit new lows.

- Second quarter corporate earnings were robust, as most companies beat analysts’ expectations. Despite input cost inflation, margins proved surprisingly resilient.

- According to Goldman Sachs, households have globally accumulated $5tn in excess savings since the beginning of the pandemic, which are waiting to be invested or spent.

Europe

According to July’s PMI (purchasing manager index), the manufacturing sector continues to grow strongly. However, the cyclical peak may have passed. Except for Germany, momentum weakened in all eurozone countries. Persistent capacity constraints and transportation bottlenecks are leading to higher input costs which will impact companies for the foreseeable future.

Switzerland

Thanks to a substantial increase in production and an improvement in the order backlog, the manufacturing PMI reached its highest value since inception in 1995. The recovery in the service sector has lost some steam though. Overall, the Swiss economy is still growing at an above-average rate.

We think that global equity markets still have room to run. During July’s mini correction, positive sentiment was washed out, which is usually a good sign going forward, since markets do not peak on fear. Weaker economic data could be good for stocks as it makes it more unlikely that the Fed will trim its asset purchases soon. Currently, the Fed is still buying $80bn in treasuries and $40bn in mortgage-backed securities per month. Some FOMC members seem to be concerned about inflation and want to start tapering sooner rather than later, but announcing such a step when growth is slowing, and risks of the delta variant are rising, seems unlikely to us. We therefore do not believe that a taper announcement will be made at the Jackson Hole meeting in August.

Political gridlock in the US regarding the infrastructure package and the increase of the debt ceiling are short-term risks. We expect that both parties will eventually be ready to make compromises. Until an agreement is reached, the US Treasury cannot increase its net debt. Because of a shortage in new bonds, downward pressure on the 10-year yield should persist, potentially pushing the yield down to 1% or even lower.

Something we closely monitor are the latest developments in China. As China is one of the main global growth engines, unfavorable events can quickly spill over to other markets. The ongoing crackdown on big-tech companies over monopolistic practices and data security caused a sell-off in Chinese equities. Investors worry that Beijing is trying to block foreign capital flows. A recently leaked document reinforced this fear. It outlines that after-school tutoring companies (a large industry in China) might need to become non-profits and foreigners might be banned from investing. To appease authorities, many companies are taking actions. For example, it is rumored that the ride-hailing company Didi wishes to reverse its June IPO. Meanwhile, Evergrande, China’s largest real estate developer, and Huarong, the largest asset manager, are struggling to pay their debts, widening concerns over contagion risks in the country’s 862bn dollar bond market. All of this is happening at a time when forward-looking PMIs indicate softer conditions at the start of the third quarter, and millions of citizens are being placed under lockdown again because of rising infections.

- Our big picture for equities remains essentially unchanged and supportive of equities. Central banks will continue to be accommodative, real yields are negative, more fiscal stimulus can be expected, and households have large excess savings as well as pent-up demand. Strong corporate earnings and the resumption of stock buybacks are further positive factors.

- Risks continue to loom in the background: a monetary policy mistake, unexpected inflation, a significant resurgence of COVID or a Chinese spillover.

- We are maintaining our balanced allocation, with an emphasis on high-quality stocks, as these companies should perform better than cyclical value stocks in a period of slowing growth.

- Because of mounting risks in China, we have exited our remaining direct investments in Chinese equities and will remain on the sideline until there is more clarity for foreign investors.

- Strongly negative real yields, which just reached new lows, are favorable for the outlook of gold.

The graph shows how the recent downward move has put the yield on 10-year US government bonds right back at the long-term trend. Real yields on US government bonds have been negative since the COVID crash and are continuing to drift lower.

Quellen: Bloomberg, Financial Times, Nordea, Reuters, Goldman Sachs

FINAD CIO Team