- Markets have taken a breather due to rapidly rising yields and a stronger US dollar.

- The global reopening has become market consensus, which may now be called into question as the recovery from the pandemic becomes more and more uneven.

- Relative growth-sentiment favoring the United States over other developed markets is based on faster reopening, higher vaccination rates, and stronger fiscal support, but this divergence may not last much longer.

- The stock market in China is currently illustrating what happens when central banks and governments start to remove pandemic-era stimulus.

- Meanwhile, input costs are increasing broadly, further raising inflation concerns.

- Markets could transition to a period favoring quality stocks, but this will depend on receding interest rate volatility and stabilizing yields.

- While broad equity indices remain near their highs, there has been a lot of volatility and factor rotation under the surface as the market digests rising interest rates.

- In March, the Fed sent the message that it will not be proactively controlling nominal yields, as it expects the inflation bump to be short-lived.

- Markets are not so convinced, as U.S. 10-year and 30-year breakeven inflation rates both hit new highs.

- Meanwhile, the rising rates are hitting the speculative corners of the equity market (e.g. high-beta growth and SPACs) particularly hard.

World

- Just weeks after the latest USD 1.9 trillion stimulus was rolled out, President Biden will present a new spending program to the tune of USD 2–4 trillion this week.

- The Biden administration knows that this will likely be the last package it can send to Congress before the mid-terms and will move forward aggressively.

- China emerged victorious from the first wave of the pandemic crisis on a global scale. The vaccine launch, on the other hand, is lagging well behind that of the United States and even Europe.

- March saw record delivery delays for a third straight month, with delayed shipments from Asia flagged in particular.

Europe

The market brushed off the strongest ever Manufacturing PMI reading out of Germany, as the growth narrative continues to stretch in favor of the U.S. While Europe is clearly lagging behind at the moment, growth momentum is set to accelerate over the coming months as vaccine supply is expected to improve and recovery fund disbursements get under way.

Switzerland

Using leveraged equity bets, Archegos Capital, a sizable hedge fund/family office, blew up and failed to meet margin calls last week. Some of the world’s biggest banks now have a problem, including Credit Suisse (shares -15% when the news hit). The bank’s incurred loss has not yet been announced, but the firm’s estimated 2021 net income of approx. CHF 4bn could be in danger.

At this point, the bullish narrative of a fading pandemic, a reopening economy and plenty of stimulus has become market consensus. By some measures, the pro-cyclical rotation has already overshot compared to the increase in global PMIs and has left many portfolios underperforming compared to broader markets. The rise in long-term nominal and real interest rates has been the main driver behind these moves.

The U.S. is now the only major economy whose 10-year bond yield is still below its pre-Covid peak of 1.91%. Another push higher for yields to the range of 1.90–2.00%, before stabilization sets in, seems a reasonable expectation to us. Likewise, a March survey from Bank of America suggests that the 2% area for 10-year yields is the level to watch. Above that level, further rising yields would increasingly start to hurt equity markets. The Fed then may be forced to act.

So, what is next? It seems that this cycle (assuming we are in fact in a new market cycle) is evolving a lot faster than previous ones. A transition into a mid-cycle environment could therefore already be on the cards. This would correspond with performance leadership moving from small caps to large caps and to the quality factor in general.

Recent research by Morgan Stanley argues that operating margins may already have peaked. Supply shortages, missed sales, higher input costs and missing pricing power are all more likely to hurt smaller companies disproportionately more severely than global, quality large caps.

Furthermore, we are now entering a period, in which the most favorable year-over-year comparisons (in terms of Fed balance sheet growth, equity inflows, earnings revisions, …) are rolling over. This again should start to support the quality factor as it historically outperforms when general risk sentiment eases from peak conditions and the rate of change in growth-related indicators slows down.

Finally, after underperforming for several months now, quality would be ready for a rebound in performance terms. The lower quality but higher beta “junk” cohort in equities has outperformed for months. Consequently, quality is now vastly under-owned, with positioning now only in the 3rd percentile on a 10-year history, according to Morgan Stanley. On top of that, the factor is currently the second most crowded factor as a short.

For the first time in at least a decade, there is a plausible narrative for why inflation may rise sustainably. However, the market seems to have already fully discounted this in the short-term.

With risk appetite turning less exuberant overall (e.g. retail trading declining from January peaks) and equities chopping around, moving up the quality curve has become more relevant in our view. The upside trigger for the quality factor lies in receding interest rate volatility and stabilizing yields bouncing back. Likewise, a mean reversion of the cyclical rotation and a rebound in oversold long-duration bonds would catch many investors on the wrong foot.

One rate-sensitive sub-sector that has corrected significantly from earlier this year is Clean Energy. We still see a compelling secular growth trend and have initiated a first position through a highly liquid ETF in March.

That said, our conviction level for short-term market moves is currently low and our cash position higher than in past months. We remain convinced that a balanced portfolio approach remains key.

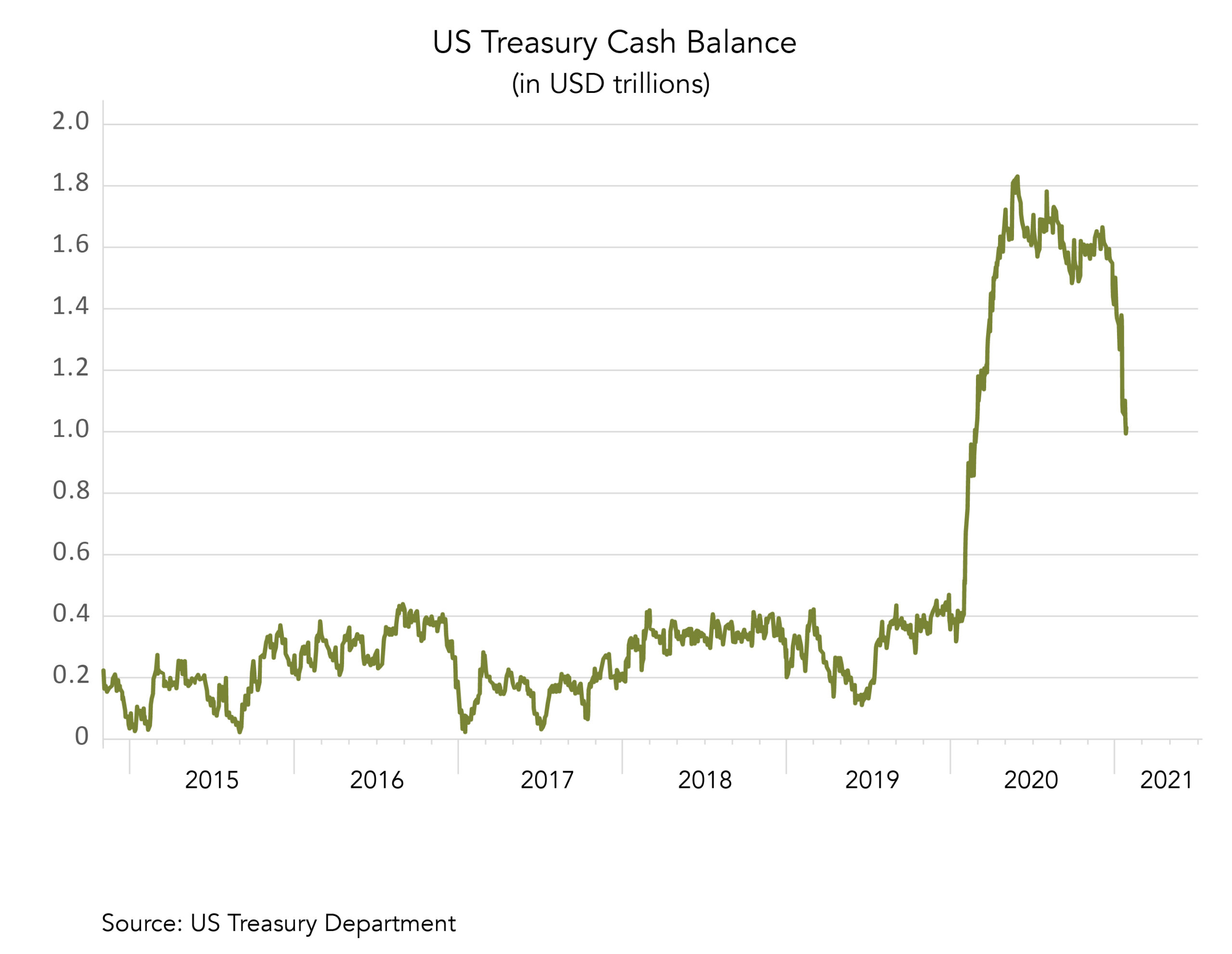

In March, the U.S. Treasury’s cash balance fell below USD 1 trillion, down from its peak at approx. USD 2 trillion last summer. The cash pile has been declining as the US government withdraws money for stimulus payments. Once it has been completely drawn down – which will likely be some time in Q3 – we expect US government bond issuance to pick up, in order to finance the next stimulus packages, potentially putting further pressure on yields.

Sources: Bloomberg, Goldman Sachs, Saxo Bank, The Market Ear, JP Morgan, Bank of America, Citi, Zürcher Kantonalbank, Scotiabank, Morgan Stanley, Kepler Cheuvreux

FINAD CIO Team