Another historic week of extreme market volatility is behind us. It truly felt surreal at times. The velocity of the plunge and of the VIX surge is the fastest on record. 10-year US yields fell to an all-time low during the week but have since risen sharply.

Uncertainty is incredibly high at the moment and market commentaries are prone to be outdated as soon as they are released. Nevertheless, here is our take on recent developments and a quick outlook. We will make sure to release updates on a frequent basis.

Executive Summary

Volatility will remain high as long as visibility of virus peak-growth is not there. However, monetary and fiscal stimulus measures are now ramping up and will reach critical mass in the coming weeks. This, coupled with aggressive action to prevent further spreading, can build a bottom in markets. In the meantime anything is possible given the thin market liquidity. That said, we do not recommend to sell positions here but rather look to average into our most preferred names over the coming weeks.

Last week’s developments (enough to fill years of financial market history)

- Monday was the worst day for stocks since the 2008 financial crisis. (Oil Shock)

- Thursday was the worst day for stocks since the 1987 crash. (Lagarde “[ECB] not here to close spreads”)

- Friday was the best day for stocks since 2008. (Trump declaring state of emergency)

- Sunday saw the Fed cutting rates to 0% and announcing USD 700bn QE 4

Given the extreme losses in risk assets on Monday that followed the oil dispute between the Saudis and Russia, the remaining days of last week where mainly driven by the need for liquidity of market participants. This also led to forced selling of traditional hedges like Gold and US Treasuries.

On Friday, President Trump finally stepped up his game and declared the state of emergency in the US. This has never been done before as a result of a virus outbreak and is an important step to fight the outbreak in the US.

The market situation remains extremely fluid. Even a closing of major exchanges for several days (similar to 9/11) is a possibility at this point and could in fact help to calm markets down.

How extreme are the recent moves in financial markets really?

The market has priced in an incredible amount of fear and has reached an historic level of oversold. Remember that markets are emotional and can swing to extremes. Right now we are at such an extreme to the downside. But sentiment is mean reverting.

- Only 1% of all the stocks in the S&P 500 are above their 50-day moving average, lowest since August 2011.

- Less than 6% of stocks in the S&P 500 are above their 200-day moving average, lowest since March 2009.

What is needed for a sustainable bottom?

- US needs to step up and act aggressively against the virus.

- Market needs to get visibility for peak viral growth numbers (this is still at the least 2-4 weeks away according to most analysts).

- This is primarily a health crisis / natural disaster and as such needs government bodies to act.

- The central banks can only provide liquidity to keep the markets functioning but they can’t dampen the virus curve which is at the core of the market panic.

- Cumulative policy responses (monetary and fiscal) need to reach a critical mass level.

- Monetary policy is not sufficient in the current environment. The biggest damage is at the Micro, SME level – monetary policy can’t reach that efficiently.

- Fiscal stimulus is much more potent in this case but needs democratic legalization in the western countries and as such is slower.

Note: This is what is needed for a sustainable bottom – the “real” bottom is likely to happen much earlier but we can only know ex post.

Outlook

We face a sizeable shock to global growth. Right now we are in the exponential growth phase of the virus in the west. This means the uncertainty/inability to see a peak is at the highest right now. However, this is transitory! This is not like 2008. The problem is known and the solution is also known and progress to that solution is being made.

Eventually, the virus will fade but the easy money and fiscal stimulus will stay. In fact, most of the stimulative measures (rate cuts, QE, fiscal stimulus) need a few quarters to have effect on the real economy anyway. Thus, risk assets could see a solid rebound in the second half of this year and perform very well in 2021.

That said, broad equity index valuations still have to fall further to present a true bargain buying opportunity. These levels are in fact 10% to 20% lower from current prices since last year’s equity rally was mostly based on multiple expansion.

For these reasons we will step-by-step rebalance / buy into our most preferred equity names. Overall, we have to remain mentally flexible to add risk and accept short term pain. The time to further increase exposure can come soon given the fast moving markets.

Implications / Portfolio Actions

We will start to rebalance/buy our most preferred equity names in the Technology, Health Care and Consumer space and will be spreading our purchasing activity over the coming weeks to account for the extreme volatility levels. We select these companies based on their high quality balance sheet, sustainable business model, relative better trend characteristics and recent insider buying activity (CEOs buying equity of their company for themselves).

We currently avoid Energy and Financials (Banks and Insurers) because of their possible exposure to credit market dislocations as a results of the recent oil price shock.

Your FINAD CIO Team

Appendix

What is happening in the Energy Sector?

- On the surface this is a price war between the Saudis and Russia, however it is also a war on US Shale. The US has become a net oil exporter and too big of a challenge to the old players. The entire US Shale industry is under threat now. US Energy should be avoided.

- There will definitely be defaults in the Energy Sector, especially in the US (estimates are for up to 30% default rates by some analysts).

- Many analysts expect to see Brent in the USD twenties.

- Cheap oil as a stimulus? The virus is a fear factor – for now, consumers are more likely to pocket the oil savings. Once the fear fades it will further support the policy stimulus measures.

Are we going into a recession?

- The short answer is very likely yes.

- However, there are different types of recessions. A technical recession (with 2 negative quarters) is very likely at this point.

- A growth recession (rising unemployment, severe and long-lasting downturn) will likely not happen. Companies will be reluctant to lay people off (especially high quality jobs) unless the picture for 2021 weakens significantly – which is not expected.

If China is the roadmap, can we trust the numbers?

- Even if the numbers are dressed up, you would see the virus impact through the health system. It is not possible to hide overwhelmed hospitals and deaths – even for China. So far, most indications are that it is actually fading and China has control over the situation.

- President Xi Jinping would likely not have visited Hubei if he would have had information of things getting worse.

How much pain is priced in / how close to a bottom are we?

- Most analysts believe that 70 – 80% of downside is priced in by now. The next weeks will definitely remain volatile. Most analysts do not recommend to reduce risk here. Keep in mind that a bottom can happen any time with a forceful move.

- However, the equity valuation floor is still far off. Goldman Sachs puts it to around 2000 in the S&P 500. This would imply further downside of 20%.

- Studies (of course with limited data sets) show that the virus thrives in 0–15 degrees Celsius. If true, this would strongly help virus mitigation in the west starting from mid to late April.

Biggest downside risk?

- The biggest downside risk (but not the most probable risk) right now is not the virus but this becoming a financial crisis through transfer mechanisms like credit and liquidity.

- However, here central banks can act decidedly and actually have an impact (for example USD 1,5 trillion in Fed Repos, rate cuts, 700bn in QE).

- How credit and liquidity metrics react to the newly announced Fed measures over the next weeks will be crucial. Analyst consensus right now is that this will not become a financial crisis.

What is happening to Gold?

- Short term Gold volatility can largely be explained by forced selling in order to meet margin calls and other liquidity needs.

- We expect Gold to soon be perceived as save haven of last resort as central banks debase their currencies and global rates are at the lower bound.

- Over the next few years gold will become much more prominent with institutional investors as an alternative to government bonds – it could become the preferred save haven.

Is there any historic template for what is happening?

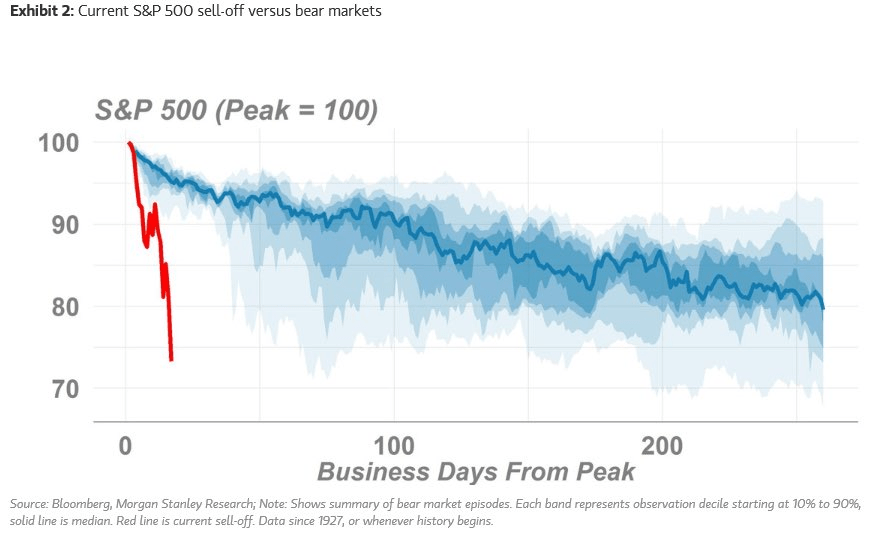

- This is not 2008, the situation is moving much faster. This time the Dow Jones only needed 19 days to fall into a bear market. In 2008 it was 184 days.

- Be careful not to extrapolate the recent moves. Sharp bear markets have resulted in quicker recoveries in the past.

Sources: Bloomberg, JP Morgan, Goldman Sachs, Nordea, PineBridge, ECR, Morning Brew, Hightower Advisors, Charlie Bello, Sentimentrader, Howard Marks, The Martket Ear