We are seeing the first back to back positive days for the S&P 500 and Dow Jones since early February and while still stressed, credit spreads and liquidity conditions have recovered from their disorderly levels of recent weeks.

It feels like last week did indeed mark at least an interim low in markets and that the systematic driven panic-selling-phase should be behind us. Central Bank liquidity injections and the emerging, massive US fiscal bill of USD 2 trillion appear to have established a credible backstop for financial markets. A market consensus is forming that a negative spill-over effect from the economy to a structural financial crisis can be avoided.

All these are positive signs but we are careful not to get overly excited at this point as there are obviously still a lot of uncertainties and unresolved issues in the markets – and a relief rally was overdue.

The US will soon be the (new) epicenter of the outbreak, global economic data and sentiment indicators will get worse before they get better, corporations will start to slash their forward guidance and – in consequence – a lot of them will face the risk of rating migration into junk status.

Another issue is the USD shortage in the financial system. While many liquidity indicators have improved over the recent days, it remains to be seen if the unlimited Fed QE and the established facilities can sustainably stabilize the USD funding markets.

Bottom line: For the first time in 2 months, global markets seem to stabilize, although on lower levels. Policy response has been swift and large which means that a vicious downward spiral should be avoided. That said, we remain convinced that a sustainable bottom cannot be declared until a peak in the US Coronavirus cases becomes visible.

Recent Developments

The US congress has been making good progress on an unprecedented USD 2 trillion spending bill to prop up the slumping economy. This triggered the best day (+11%) for the Dow Jones since 1933 on Tuesday.

- Goldman Sachs estimates that the package will be about three times the US’s lost economic output this year.

- Germany also introduced a 750 billion EUR crisis package.

- Meanwhile Europe’s finance ministers are looking to activate the European Stability Mechanism (ESM), a euro area fund established at the height of the sovereign debt crisis to help countries at risk of financial collapse. With the use of the ESM it would be possible to activate the ECB’s Outright Monetary Transaction (OMT) program. This would allow the ECB to purchase disproportionately large amounts of peripheral bonds. The spread of these countries to the core should then narrow considerably.

Global stimulus now runs around incredible 9% of world GDP. Down the road all this could result in a stronger inflationary environment based on rising input prices, rapidly increasing money-supply and supply chain inefficiencies – but this is a story for 2021 and onwards.

For now, the most important thing is to operationalize these packages and to deploy the money quickly to the real economy. The banking sector will play a decisive role here. This time the banks are part of the solution to the crisis, not its cause.

Assessment

We pointed out the extreme negative sentiment and extreme oversold conditions as the perfect setup for a bear market rally.

These moves can be very forceful (+20% and more) and drag-in money that sold at the lows and subsequently feels the pressure to chase the rebound.

While many market commentators are already declaring that a “bottom is in” we are more careful in our market assessment and will think about reducing broad market exposure should this rally continue.

That said, we remain confident in our strategy to gradually buy into high quality companies with strong balance sheets and convincing business models.

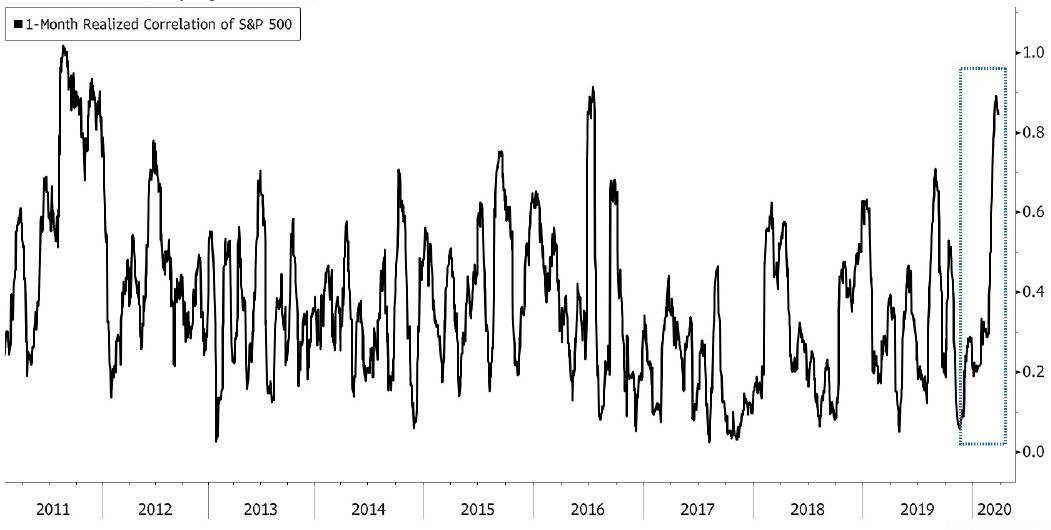

The chart shows how realized correlations have risen dramatically in the last month. This is typical for indiscriminate selling in a market crash.

As the volatility index peaks, the initial panic resides and “clearer” heads prevail, correlations tend to mean revert down and a more selective market regime will begin to take hold.

Simply put, we expect this will soon become a stock picker’s market where active management and a quality stock selection will be rewarded.

Your FINAD CIO Team

Source: Bloomberg, The Market Ear, Goldman Sachs, Alpine Macro, JP Morgan, Hightower Advisors, PineBridg

Appendix

US initial Jobless Claims

Today the market continued to rally despite very bad news.

- The much anticipated U.S. Initial Jobless claims turned out to be a breathtaking 3.283.000. This print confirms the most sudden, severe shock to ever hit the US labor market.

- There is an old market-wisdom that markets tend to bottom on bad news. However, unemployment numbers will probably get worse in the weeks to come.

Credit Market Developments (Source: Bloomberg)

Analyst consensus is that a credit crunch like in the Financial Crisis 2008/2009 can be avoided. Still, a lot of bonds are trading at levels that suggest that a big wave of rating downgrades is coming.

- The market value of corporate bonds at risk of falling to junk status has surged to almost USD 350 billion.

- That compares with about USD 100 billion in mid-February, and a roughly USD 1 trillion value for the U.S. high yield index.

- S&P has already made 565 downgrades this quarter, up from 351 in 4Q and 281 in 1Q last year. This far exceeds the prior quarterly peak of 390 in 1Q 2016 (with data going back to 2010).

- Moody’s has made 342 cuts, the most for a quarter since 2016.

- Fitch has done 192 downgrades this quarter, its most since 2012.