Market Highlights

- Bitcoin is close to USD 20,000 and retook its old highs from 2017. Its total market capitalization is USD 350 bn or approximately 4% of the current capitalization of Gold at USD 9,200bn. In contrast to 2017, however, there is no broad media hype.

- The acceptance of cryptocurrencies is rising. Similar to Square, PayPal’s US customers have been able to buy cryptos on the company’s platform since November. Demand for this new service has been high. In the foreseeable future, the company additionally plans to introduce a bitcoin paying option at merchants using the PayPal network. Institutional interest is also rising, as an improved market infrastructure in the form of custody and securitized investment vehicles are facilitating investing.

- Globally, central banks are working on the introduction of a digital currency based on the blockchain technology (CBDC). China, in particular, is at the forefront with its E-Yuan.

Cryptocurrencies in focus

Because of the positive market developments, more and more investors are starting to look into cryptocurrencies. The most frequently asked questions center around what cryptocurrencies actually are and what the differences are between the available coins. To enable a discussion, it is imperative to have a firm understanding of the basic terms. For that reason, we will provide a concise overview of the most important aspects below.

Bitcoin

Bitcoin is the oldest, best-known and largest cryptocurrency. It was first mentioned in 2008 in a white paper published by Satoshi Nakamoto, whose real identity is still unknown. The goal was to create a new digital payment system. First of all, two parties should be able to carry out a transaction with each other without the need of an intermediary. Secondly, the correctness of transactions should be verified by cryptographic proof, instead of trust in a central organization. For verifying transactions, members of the network (“miners”) receive bitcoins as a reward. All verified transactions are recorded in a transparent blockchain, a decentralized database. Thirdly, the currency should not be debased by central banks. The maximum supply of bitcoin is therefore capped at 21 million. Currently, there are 18.5 million and estimates indicate that it will take until 2140 before the last bitcoin is mined.

Arguments for bitcoin?

- A digital store of value: Similar to gold, the supply of bitcoin is limited and, in contrast to fiat currencies, cannot be increased at the will of central banks. As a result, bitcoin offers protection from ongoing monetary debasement resulting from ultra-loose monetary policy.

- New generation: As found in a study by JP Morgan, millennials prefer bitcoin over gold. Bitcoin is more portable, more easily divisible and easier to transfer. A long-term shift from gold to bitcoin could take place. The market capitalization of bitcoin is currently only 4% of that of gold.

- Network effect: The number of network participants is continuously growing, thereby increasing the utility and value of bitcoin. A higher price, in turn, lures more participants to the network.

- Safe-haven currency: Bitcoin is used in emerging markets in particular as a means of escaping the national monetary system. Examples include Venezuela’s economic crisis, the fall of the Turkish Lira or China’s capital controls.

Arguments against bitcoin?

- Regulation: Bitcoin is a threat to the national currency monopoly, which is why a ban may be enacted. Yet, the bigger the network, the more difficult it is to execute a ban that would also need to be coordinated on an international level.

- Scalability: The bitcoin blockchain is way too slow for a global payment network. Every second, only 5 transactions are processed, whereas the VISA network handles 1,700.

- Energy consumption: According to the University of Cambridge, bitcoin mining consumes 0.40% of global electricity. Were bitcoin a country, it would rank 35th in front of Finland, Belgium or Switzerland. It would need a fundamental technical upgrade to reduce the large consumption of resources.

- Concentration risks: The network’s decentralization is not guaranteed since large Chinese mining pools (collaborations of individual miners) account for up to 65%. Economic interests have prevailed so far, but this may not always be the case.

- Market volatility: The price of bitcoin fluctuates too much to qualify as a currency or store of value. Additionally, many trading venues are still loosely regulated and susceptible to market manipulation.

Alternatives to bitcoin?

Besides bitcoin, a large number of alternative coins, so-called altcoins, exist. There are about 100 coins worth more than USD 100mn. Like bitcoin, some are working towards the creation of a decentralized payment network, while others have completely different goals. There are decentralized and centralized approaches, there are limited and unlimited coins, as well as distinct verification methods. The only thing all of them have in common is the use of the blockchain technology.

The ethereum network, which started in 2015, is the number 2 in terms of market capitalization. Ethereum ist not only a payment system, but rather a blockchain-based software platform for smart contracts and decentralized applications (DApps). There is a proprietary programming language to develop these applications, which are fuelled by ether. Ether is the cryptocurrency that miners receive for verifiying transactions. Smart contracts are programmes that are automatically executed if a predefined amount of ether is paid in. DApps are based, in turn, on smart contracts. Examples of existing DApps are decentralized crypto exchanges and video games. In contrast to bitcoin, the supply of ether is not capped. To increase scalability and reduce electricity consumption, an upgrade process (ethereum 2.0) was initiated in November. For ethereum to be successful in the long-term, it is essential that attractive applications be developed.

With its coin known as XRP, the number 3 according to market cap, the Ripple company is seeking to build a faster and cheaper payment network in cooperation with the exisiting financial system. Standard Chartered, Santander or MUFG are partner firms. Ripple helps banks to process cross-border transactions in real-time. The blockchain used is special insofar as no mining needs to take place, and large-scale energy consumption is therefore avoided. All 100 million XRP coins were mined on inception in 2012. The majority is held by the company itself and can be sold in accordance with certain rules. Like Bitcoin, XRP has a limited supply, but a centralized approach. Its transaction speed of 1,500 per second is substantially faster. Ripple’s success will be determined by the ability to win as many banks as possible to incorporate its transaction system.

As highlighted by the differences between bitcoin, ethereum and ripple, no cryptocurrency is like any other. Each project has its unique characteristics.

How to invest?

- Cryptocurrencies can be purchased directly on specialized online exchanges, necessitating a more or less detailed KYC process. After purchase, many buyers store their coins at the exchange for convenience. Doing so exposes them to the security risks that exist at the exchange. In the past, IT hacks and theft took place every once in a while. To mitigate this risk, one can set up a wallet. Besides digital wallets, there are also cold wallets on specifically designed hardware that is not connected to the internet.

- Indirectly buying cryptocurrencies through securities is quicker, but obviously does not confer direct possession of the coins. Most securities are certificates, meaning that they are debt obligations of the issuer and are subject to a corresponding credit risk. The price of being able to buy more easily comes at the expense of yearly management fees between 1.5 to 2.5%. Depending on the jurisdiction, securities may enjoy tax advantages or disadvantages compared to direct purchases.

Chart

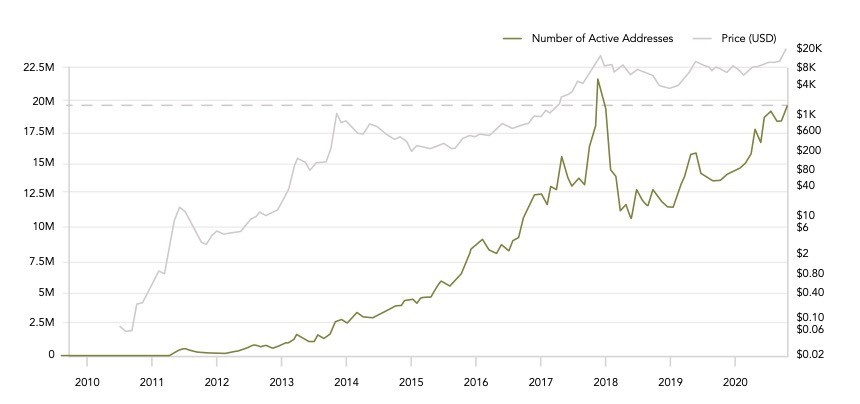

The long-term trend of active bitcoin addresses rises in tandem with the price, indicating broad participation. Close to 19.6 million addresses were active in November 2020, a level last seen in January 2018.

Sources: Bloomberg, JP Morgan, University of Cambridge, Glassnode, Coindesk.com, Coinmarketcap.com, Goldeneaglecoin.com, Ethereum.org, Ripple.com

FINAD CIO Team