Markets are showing a lot of optimism recently, fueled by data indicating that social distancing and lockdowns are working in the Western countries. While this is encouraging, we are just beginning to see the real size of the economic damage. March and April will likely be the worst months of this recession. The question remains how long it will take for activity to pick up again and whether we will be jumping back and forth between closing and opening our societies in the quarters leading up to a COVID-19 vaccine.

Recent Developments

- Larry Kudlow, economic advisor to the US president, signaled this week that the US administration may reopen the economy in the next four to eight weeks.

- Yesterday, Bernie Sanders dropped out of the 2020 presidential race, setting up a general election between Donald Trump and Joe Biden. Another good sign for markets, as both Biden and Trump are much more market-friendly than Sanders.

- In Europe, euro-area governments seem unwilling to create “Eurobond” like instruments, such as corona bonds, for now.

- Euro-area government debt issuance could almost double this year, posing huge challenges to the bond market and test the determination of the ECB.

- Germany has suggested repurposing the European Stability Mechanism (ESM) as an alternative to corona bonds. However, critics argue that the ESM is tied to a restrictive use of proceeds, rendering the tool less effective.

- Because of the already massive economic fallout in Italy, Spain and France, we expect that a more coordinated approach of burden sharing will be needed in the Eurozone before too long. Eurobonds would do the trick.

Health Crisis

As of writing, it seems that actual cases in New York are turning out lower than what had been projected one or two weeks ago. There is also good news out of China. Wuhan, the city where the coronavirus originated, is now officially out of lockdown. On the other hand, Japan and Singapore have re-tightened their measures as new cases spiked again.

- Case growth could likewise start re-accelerating in the West, if the economies are not opened very carefully.

- Testing and “smart containment” measures will be key (i.e. effectively quarantining new cases while letting the young and healthy workforce do their job).

- Even if everything goes according to plan, we will likely have to live with substantial travel restrictions in the West at the very least until the middle of Q3 (and potentially throughout 2020).

Equity Markets

The robustness of the Swiss equity market this year (SPI down -10% YTD) is close to rivaling that of mainland China’s (CSI 300 -7.4% YTD).

- Many analysts believe that earnings in Switzerland are more resilient than those of European peers. As the ability to maintain dividends has been called into question for many companies, Nestlé has already announced that it will not change its payout policy. Novartis and Roche are additional companies which rank high in “safe dividend” screenings according to Kepler Cheuvreux.

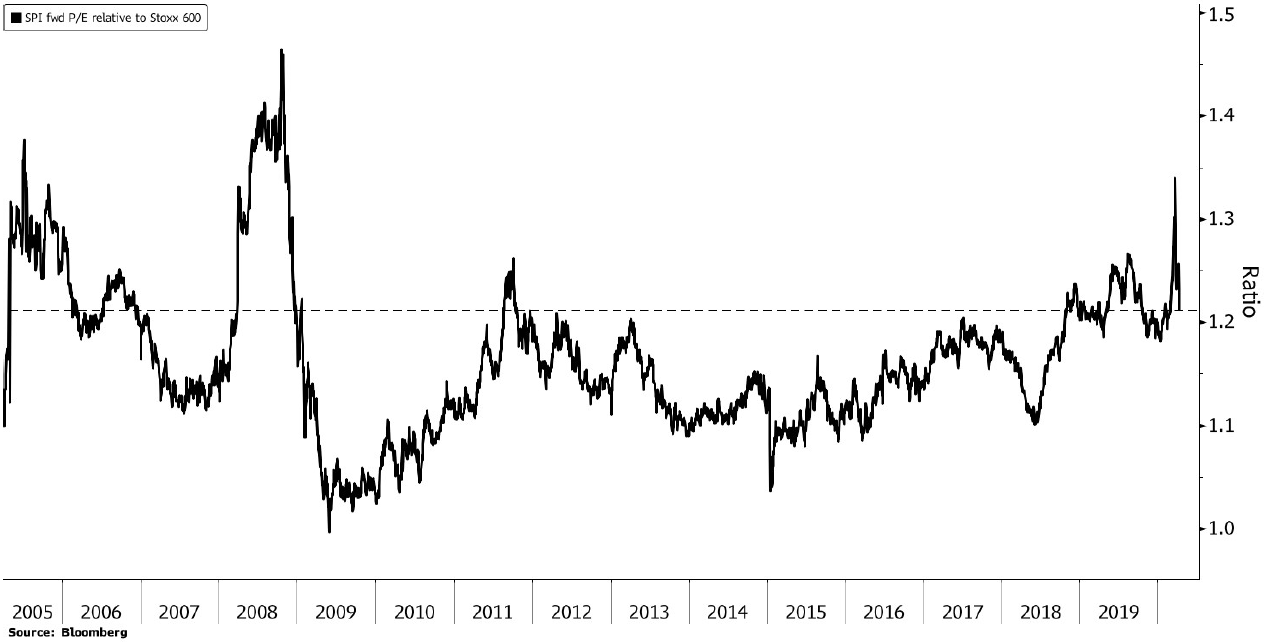

- The demand for haven assets puts a premium valuation on the Swiss equity market. The chart below shows that the SPI, at a forward P/E ratio of 17.6, is trading at about a 20% premium to the Europe Stoxx 600.

- This is still far from the highs of 2008, when it almost reached a premium of 50%.

Assessment

We are witnessing an impressive rally. The S&P 500 has now nearly retraced 50% of its drawdown and has risen more than 25% from the March 23rd lows.

Investors that de-risked aggressively in the late-March panic are now feeling tremendous pressure to jump back in. Thus, the pain trade in the short-term is higher as cash is forced back into the market at higher levels.

Over the mid-term, on the other hand, history still suggests something close to a retest of the lows before this crisis can be declared over. In fact, the recent market behavior is still much more indicative of a bear market environment than a “new” bull market.

- Bull markets are characterized by steady climbs higher amid low volatility.

- Bear markets see huge rallies with a lot of downside and upside volatility.

Therefore, we remain confident in our strategy and strongly prefer to be selective in high quality stocks, rather than to be long the broad equity market.

So, while we believe that markets are probably getting ahead of themselves in this rebound, we remain optimistic that the worst case in the form of a financial crisis has been averted – thanks to the vehemence of the monetary and fiscal policy response which dwarfs anything seen in the past.

As long as there won’t be too much second-round effect damage in the economy as a result of the lockdowns, we continue to expect a sizeable economic rebound beginning in the second half of this year and coming to full effect in 2021. Also, we believe that medical research will make a decisive breakthrough before too long since massive resources are put into action globally.

For now, however, further economic pain is still in the cards.

Your FINAD CIO Team

Source: Bloomberg, The Market Ear, Goldman Sachs, JP Morgan, Hightower Advisors, Morgan Stanley, The Morning Brew, Kepler Cheuvreux, Bank of America, Barclays, Citigroup, PineBridge

Appendix

Economic Impact

According to the latest estimate of the World Trade Organization (WTO), world trade is likely to collapse by 13% to 32% this year due to the Corona crisis.

- In a more optimistic scenario, the WTO outlines a rebound in which world trade would starts to recover significantly in the second half. The setback for the whole year of 2020 would then “only” reach -13%.

- Also, if the pandemic is brought under control in 2020, trade is expected to grow by more than 20% in most regions in 2021.

The UN’s International Labor Organization estimates that the coronavirus crisis will eliminate 6.7% of working hours globally this quarter. That’s equivalent to 195 million full-time workers.

- Working hour losses in upper-middle income countries will top the effects of the 2008 financial crisis.

- 81% of the global workforce is currently said to be affected one way or another by the crisis.

Top 5 committed COVID-19 stimulus packages in the G20 as share of GDP

(Source: statista.com)

- U.S.: 11% of GDP

- Australia: 9.7% of GDP

- Canada: 8.4% of GDP

- Germany: 4.9% of GDP

- Brazil: 3.5% of GDP

Earnings Outlook for S&P 500 and forward valuation

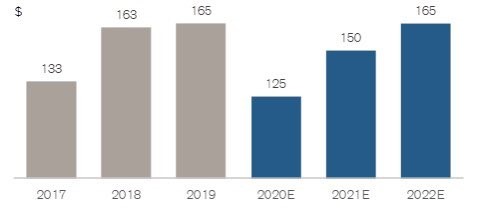

Below in the chart we show the current outlook for S&P 500 earnings per share by Credit Suisse.

Keep in mind that earnings projections are very uncertain at the moment and prone to revisions. The dispersion of analyst views is extremely high and the majority of research houses has not yet updated their forecasts (e.g. the Bloomberg consensus currently expects a -7% earnings decline for 2020).

This implies earnings declining -24% in 2020, followed by a recovery of +20% in 2021. In 2022 S&P 500 earnings are expected to regain the levels of 2019.

Using these earnings estimates as our baseline and considering historical valuation ranges, we can derive a (crude) estimate for an appropriate S&P 500 index level.

| S&P 500 forward P/E multiple over the last 5 years: | |||

| Average | Min (before March 2020) | Max | |

| Running Year | 17.8 | 14.9 | 20.0 |

| Running Year +1 | 15.9 | 13.3 | 18.3 |

| Running Year +2 | 14.4 | 12.2 | 16.5 |

| These imply the following S&P 500 levels: | |||

Average P/E | Min P/E | Max P/E | |

| Based on 2020 EPS estimates | 2221 | 1865 | 2499 |

| Based on 2021 EPS estimates | 2391 | 1994 | 2744 |

| Based on 2022 EPS estimates | 2369 | 2008 | 2721 |

If one were to assert that a severe economic crisis demands distressed equity valuations, the earnings estimates indicate S&P 500 index levels even below 2000.Source: Credit Suisse, Bloomberg, own calculations

On the other hand, one could easily argue that the ultra-low interest rates and the unprecedented central bank buying spree should set forward valuations at the upper end of the historical range. This would then imply “fair” S&P 500 index levels between 2.500 – 2.750.

Obviously, all the analysis is based on a lot of assumptions. Earnings estimates will likely change significantly during Q2.