The extreme market volatility continues while the western world is shutting down to combat the pandemic and the tug of war between worsening fundamentals and increasing policy responses continues.

We are several steps closer to the “critical mass level” of policy measures that we believe is needed for a bottom building process in equity markets. Most importantly, the US Congress is set to vote on a USD 1.3 trillion fiscal stimulus package potentially within a few days. This package corresponds to roughly 5% of US GDP. As of writing it seems to have reasonably good chances of passing.

Overall, there seems to be a much higher political willingness to act fast and to spend compared to the financial crisis (even helicopter money is now in the pipeline). This of course is a good thing and will help to soften the expected drop in consumer confidence. A few years from now this will be spun as the Main Street bailout of 2020 compared to the Wall Street bailout of 2008.

Regarding the outbreak, Europe is now the epicenter while the scale of the virus-spread in the US is not yet clear as testing needs more time. Many analysts assume that the US is only a couple of days behind Europe and a nationwide lock down is also soon to follow there. Visibility for peak viral numbers thus remains at least a few weeks out.

Financial Market Developments

- The Dow Jones Industrial Average has lost more than 30% of its value in just over a month, almost wiping out all of its gains since Donald Trump was inaugurated three years ago. This price action already matches a “typical” bear market which tends to take away 3 years of gains.

- Oil has continued its decline, falling below 2016 lows. Many analysts think prices will continue to drop as global travel grinds to a halt and Saudi Arabia floods the market with crude. Somewhere around USD 20 should be a cash-cost floor for Brent according to consensus estimates.

- Money- and Credit markets remain dislocated but central banks are acting with full force to prevent a systemic problem. The Fed is now directly buying Corporate Commercial Papers which should help the short-term funding needs of many companies.

- Euro investment-grade corporate bonds over safer sovereign debt has exceeded 200bps for the first time since 2012

- Rating downgrades for Boeing and Exxon are leading indicators of what is likely ahead for many companies facing revenue, spending and balance sheet hits. Keep a keen eye on BBB- companies. No doubt, there will be downgrades and bankruptcies.

- Energy sector bonds are down 34% this month alone, and have lost 40% year-to-date.

- The junk ex-energy spread is at the highest since 2011 with the next stop being the 2009 peaks at much wider levels.

- Even the usually highly liquid T-Bill and Treasury market is experiencing bid/ask spread widening.

- Periphery spreads in the Eurozone (Italy, Greece) were widening rapidly which triggered more QE from the ECB. For now this seems back under control.

- According to Citigroup global equities are already discounting a 30% fall in earnings this year which would be roughly in line with the expectation of a global recession.

- This has happened so fast that analysts consensus had no time to catch-up with their estimates. The consensus still expects +6% earnings growth in 2020.

- During past 5 global EPS recessions since 1970, global earnings fell 34% on average.

- During the Global Financial Crisis EPS collapsed 58%.

Assessment

Our market assessment has not changed. This is a market panic for the history books. The media is now full with predictions that this will be worse than even the financial crisis. However, the ultimate worst case is not and should not be our main assumption when making investment decisions for the long-term.

While broad indices have “only” fallen back to valuation levels comparable to the December 2018 lows, there are a lot of high quality single names that have been sold off indiscriminately as tends to happen when fear rises to an extreme and correlations spike.

Hence, we are looking to buy week by week into our most preferred cash rich companies with quality balance sheets and promising business models for the coming years.

Yesterday Investor legend Bill Miller called in on CNBC and voiced a similar mindset:

“I think this is an exceptional buying opportunity. I don’t mean to put all the money in at once but I do think layering it in right now is the way to go. […] There have been four great buying opportunities in my adult lifetime. The first was in 1973 and ’74, the second was in 1982, the third was in 1987 and the fourth was in 2008 and 2009. And this is the fifth one. Those are the sorts of events that you see when markets are making historic lows, the news is just bleak all around.”

(Bill Miller, 18.03.2020 on CNBC)

Mr. Miller has an impressive track record: He beat the S&P 500 15 years in a row while working at Legg Mason from 1991 to 2005. His 2019 return was +119%.

Your FINAD CIO Team

Appendix

Could warmer weather help against COVID-19?

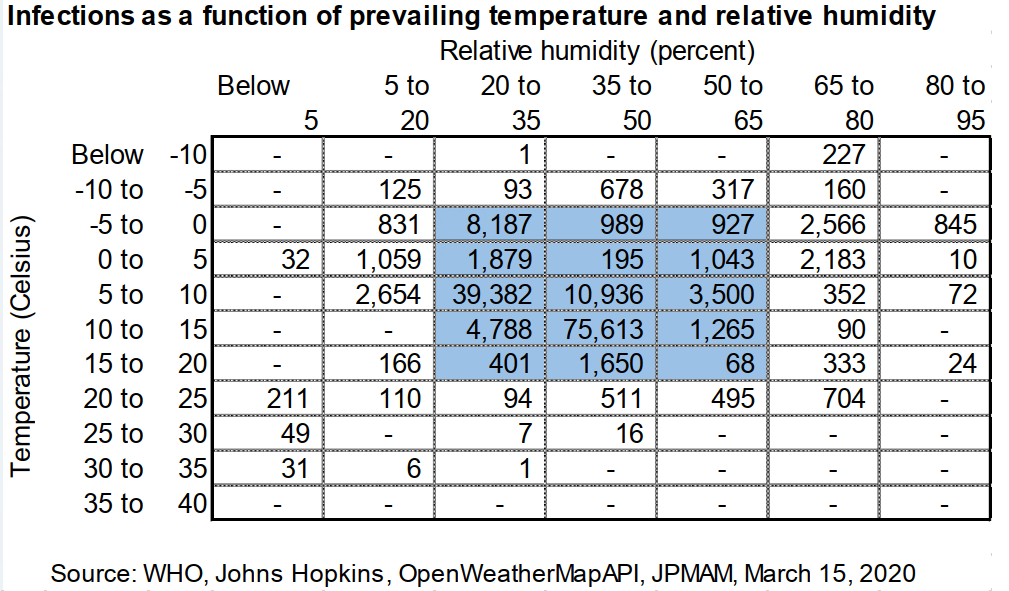

The short answer is maybe. There is some data that would support this but scientists have not yet come to a conclusion as numerous other factors also play a role (for example availability of test kits). Here is a matrix from JP Morgan that matches temperature and relative humidity with known cases as of March 15th. Note how most cases are clustered in the 0 to 15 degree Celsius range.

“The COVID-19 virus shares 86% genetic similarity with SARS. […] During the SARS epidemic in 2003, infection rates declined from March to May as temperatures rose. However, there were other factors changing at the same time (changes in hospitalization rates, greater provision of gear to medical personnel, higher quarantine rates and the natural erosion of epidemic severity over time) so results were not conclusive with respect to weather in isolation.” (Source: JP Morgan)

Sources: Bloomberg, JP Morgan, WisdomTree, ECR, Morning Brew, Hightower Advisors, Mohammed A. El-Erian, The Market Ear, Citigroup