While a lot has been happening, not much has changed. The next two to four weeks are crucial for this global health crisis as well as financial markets. Investors need to see credible information that social distancing and containment measures are flattening the infection curve and that fiscal and monetary policy measures are progressing as needed.

Recent Developments

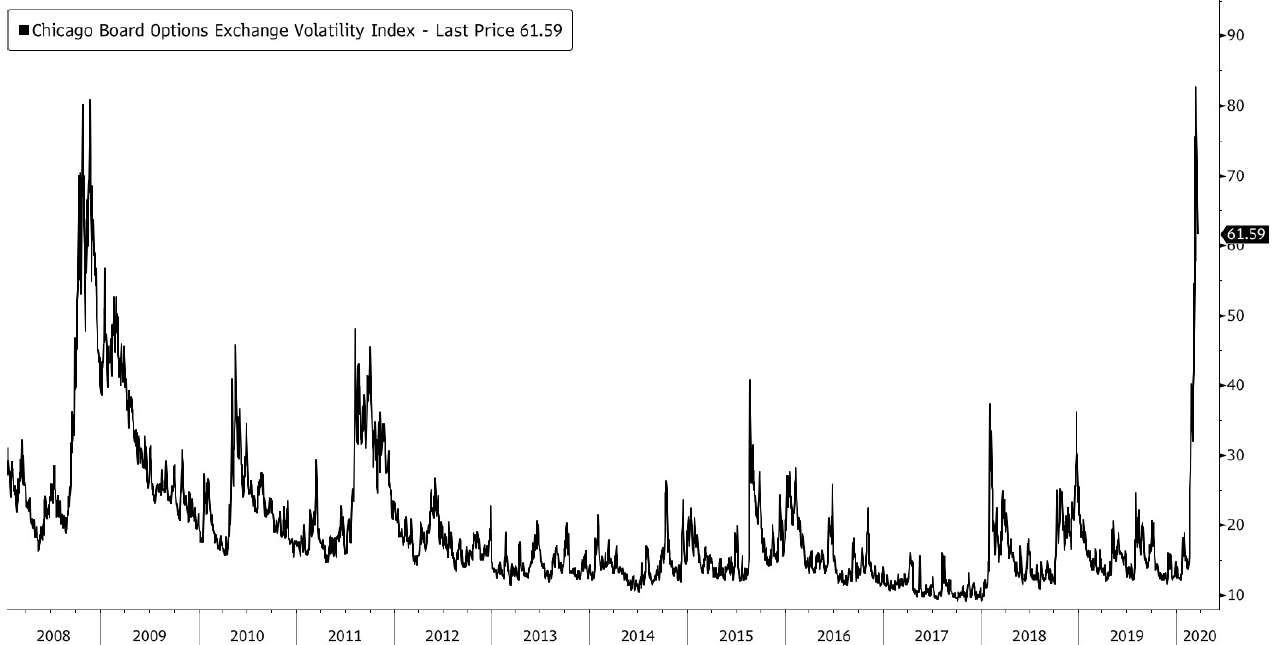

Another dismal week for global equity markets took place, in fact, the worst week since 2008. It is hard to believe, but the VIX Index (the “fear index”) actually dropped on Friday despite a declining S&P 500.

This could be a sign that the VIX has peaked and that the panic has somewhat exhausted itself.

This doesn’t necessarily mean that equity indices can’t fall further. In 2008 the VIX peaked 4 months prior to the market bottom.

However, it indicates that we may be one step further through this mess and that we have seen the climax of technical/systematic selling.

On the viral front, there is at least good news coming out of China since no new infections originating from within China have been reported for several days now.

In the meantime, cases are rising rapidly in the US as testing gets rolled out and analysts are slashing their economic outlook to sharp recessionary levels for the second quarter, followed by an expected rebound starting in Q3.

Estimates of different research houses on US GDP:

- Bank von America:

Q2 (annualized): -12%

Full Year 2020: -0,8% - JP Morgan:

Q2 (annualized): -14%

Full Year 2020: -1,8% - Goldman Sachs:

Q2 (annualized): -24%

Full Year 2020: -3,8%

- Bank von America:

Whatever the figure will turn out to be, it will be released well into the summer when a lot of the uncertainty that is currently plaguing the financial markets will already be behind us.

Historically, equity markets tend to bottom around 4 months prior to the end of a recession (but with wide dispersion around this average).

What are our greatest worries regarding financial markets?

Credit markets are still high on this list – this is where it will be decided if the recent turmoil turns into a financial crisis or not. The analyst consensus remains that a credit/liquidity crunch will be averted.

- While credit markets are stressed, they are not completely shut. Issuers in the U.S. and Europe borrowed a combined USD 23.2 billion on Friday, although at significantly higher costs.

- Goldman Sachs revised its junk default forecasts significantly higher, to 13% this year on a 12-month trailing default rate basis.

- The default rate would start to decline as the economy normalizes in 2021, predicated on “a sharp, but transitory, negative shock followed by a gradual rebound as we progress into the second half of the year”.

- The Energy sector remains the one with the highest expected default rates.

Your FINAD CIO-Team

Quellen: Bloomberg, JP Morgan, Hightower Advisors, The Market Ear, Citigroup, Bank of America, Makro-Charts, Morgan Stanley, PineBridge, Nordea, Goldman Sachs

Apendix

Where are we regarding policy?

It is hard to keep track on all the discussed/announced/introduced policy measures. The US relief package and the Fed response remain the two most important.

- Fiscal Policy: The US fiscal USD approx. 2 trillion aid package missed its first and second run in the Senate as it was blocked by the democrats. At the time of writing it appears that another attempt will be made this week.

- There still seems to be a bipartisan agreement that a huge fiscal bill has to be put out fast. The problem is that the consumer relief which both parties mostly agree on is coupled with a bailout package for corporate America. It might have been wiser to separate these two.

- Nevertheless, we remain optimistic that the bill, in one form or another, can pass soon. There is simply too much at stake.

- PineBridge estimates that ultimately around 50% of a quarter’s worth of GDP will be necessary from the fiscal side. This would amount to cumulated packages of USD approx. 2.5 trillion in the US.

- Monetary Policy: The Federal Reserve announced a massive second wave of initiatives to support financial markets, including buying an unlimited amount of bonds to keep borrowing costs low and setting up programs to ensure credit flows to corporations and state and local governments.Here are some of the steps the Fed has already taken (Source: Bloomberg):

- Fiscal Policy: The US fiscal USD approx. 2 trillion aid package missed its first and second run in the Senate as it was blocked by the democrats. At the time of writing it appears that another attempt will be made this week.

Our assumption is that the Fed will start buying corporate bonds, similar to the ECB, down the road. Also, keep in mind that the Bank of Japan has been buying Equity ETFs for years now. The Fed would need congressional approval to make these instruments eligible for purchase.

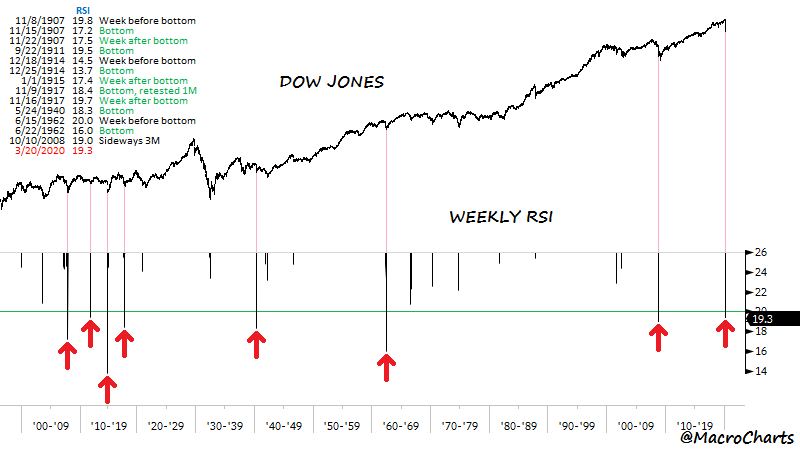

The Dow Jones is historically oversold

- Last week the Dow Jones hit one of its most oversold conditions in its 125-year history

- Its weekly Relative Strength Index (RSI) fell to its 10th lowest value of all time.

- In the past, every weekly RSI below <20 produced a tradeable bottoms within 1 week. 2008 was the exception, when the Dow Jones traded sideways for 3 months following this signal.