Executive Summary

- Equities had a rough start in the new year as the S&P 500 dropped by 5% in January.

- The Fed has turned very aggressive as it is being spooked by high inflation numbers (7% CPI YoY in Dec 2021).

- The risk of over-tightening into a growth slowdown is higher than at any time since the financial crisis.

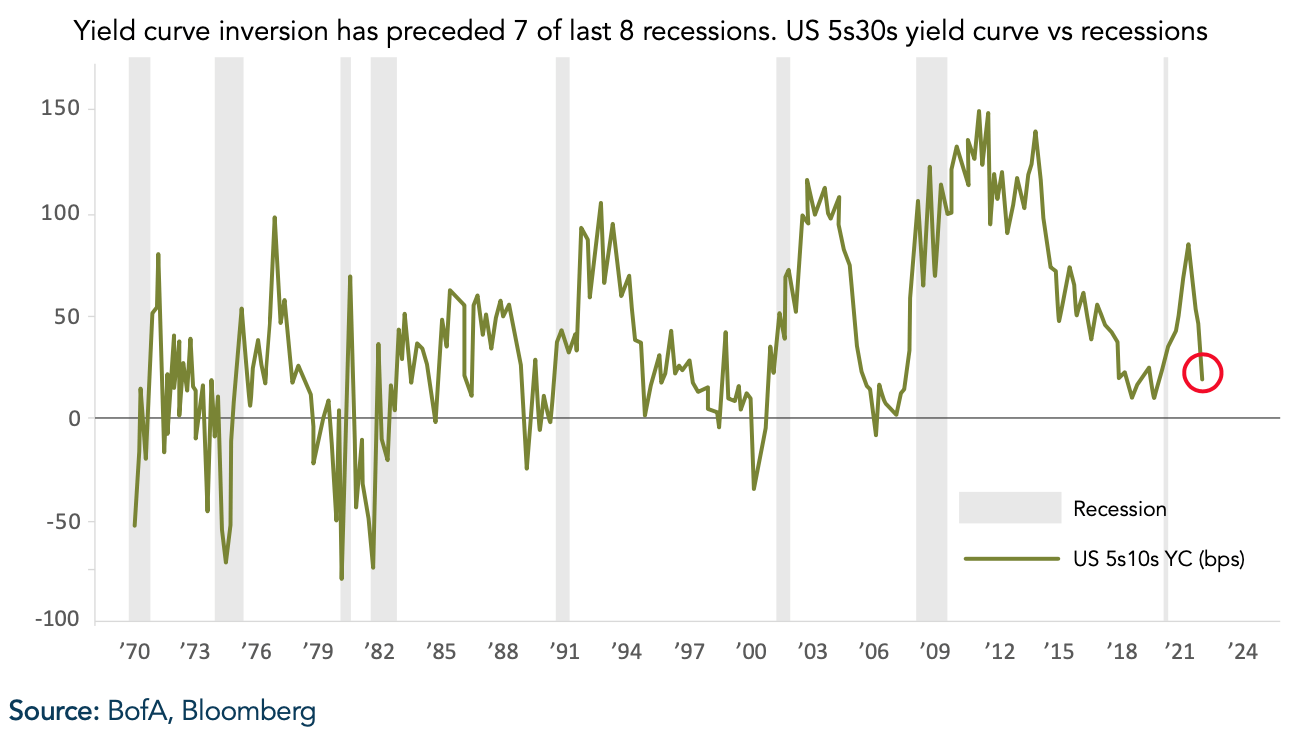

- Bond markets are increasingly pricing in a hard landing, as evidenced by the steadily flattening yield curve.

- Once the focus shifts from inflation to growth fears, the Fed will likely dial back its hawkishness.

- Due to high political pressure to curb inflation, such a pivot is probably at least a few months away.

- The strike of the Fed Put therefore remains decidedly lower than in previous years.

- Weak sentiment indicates a short-term rebound, but our base case is for another leg down in the first half of 2022.

The Fed turns hawkish

- Markets have been declining since the release of the hawkish FOMC minutes on January 5th. The hawkish stance was stepped up even further at the last press conference.

- Fed Chair Powell repeatedly emphasized the differences between now and the start of the last tightening cycle, highlighting the current strength of the economy, a tight labor market and soaring inflation.

- He did not push back against the idea of a 50-bp rate hike (twice as large as normal) nor did he rule out tightening at every meeting.

- Although we do not expect such moves, everything is on the table.

Market Development

World

- US 10-year real yields spiked rapidly by 35bps, tightening financial conditions, compressing equity multiples and underpinning a rotation from growth to value.

- Only 16% of Nasdaq Composite stocks are above their 200-day moving averages, the lowest level since April 2020.

- Inflation is now a high priority topic for this year’s midterm election. The Fed cannot solve supply bottlenecks; it can only kill demand.

- China is gradually increasing stimulus, yet the zero-Covid policy remains a danger to supply chains.

- Surprisingly, company profits within the S&P 500 are around 5% this reporting season, which is in line with the historical norm but lower than the preceding 6 quarters.

Europe

The eurozone economy grew 0.3% in the final quarter of 2021, returning the bloc to its pre-pandemic level of output. Despite a slowdown due to the Omicron wave, overall economic activity has been less disrupted than in previous waves. While Spain, France and Italy showed resilience, the German economy contracted by 0.7%.

Switzerland

After several declining months, the leading economic indicator, KOF, stabilized in January. According to the barometer, Switzerland’s growth prospects for 2022 have weakened but are still above average. Credit Suisse’s manufacturing PMI confirms this assessment, as it is well in expansionary territory but trending down.

Volatility is here to stay

From the end of October onwards, we expected that the first half of 2022 would be volatile because of a confluence of worsening macro impulses – monetary tightening, a fiscal cliff and a weakening earnings outlook. This scenario is playing out now.

The Fed is moving fast as it plans to end QE, start raising interest rates and reduce the balance sheet (QT) within the next six months. In comparison, the period of time between QE and QT during the last tightening cycle was four years. Since everything is happening faster than in previous cycles, we could possibly also see a very short (and steep) tightening cycle. We think that moving this aggressively is a policy mistake. Equity markets could sell off strongly even before QT starts. Lagging economic data has been decent so far and inflation is on everyone’s mind, making it nearly impossible to soften the rhetoric. However, leading indicators, such as retail sales, consumer sentiment, industrial production or PMIs have been turning lower. In particular, the US consumer is facing tough months ahead. Child tax credits, which boosted household income by $15bn a month, were not extended, because the Build Back Better program did not pass. In addition, no stimulus checks or supplemental unemployment insurance benefits will be paid. In a year-over-year comparison, income and spending will therefore be weak.

In our view, 2022 GDP growth targets of around 4% for the US and 4.4% globally are too high and will be revised down in the coming months. In the five years prior to the pandemic, annual GDP growth was about 2.4%. Exceptionally strong economic growth seems implausible when both monetary and fiscal support turn into a headwind.

What could cause the Fed to change its current path? Significantly widening credit spreads, as they would aggravate financial conditions and indicate an acceleration of the growth slowdown. So far, credit spreads have been resilient thanks to healthier balance sheets post-COVID, but when they react, the Fed will take notice.

In the short term, we are expecting a rebound, as market sentiment turned too negative. Yet, because equity fund flows have not shown signs of capitulation, we think that we have only seen a local low and that it will likely go lower in the coming months.

Positioning

After being overweight in equities since Q2 2020, we started to trim our position in Q3 2021. In Q4 2021, we moved to a neutral allocation. Our scoring model has now turned defensive, meaning that we will further decrease equities and increase cash. Based on sentiment and technicals, the set-up for a short-term February rally is reasonably good and we can use this to adjust our allocation.

We are expecting another move lower in global markets in late Q1 or early Q2, when the slowdown in growth accelerates. At the same time, we assume that we have either already seen, or will see, a peak in Fed hawkishness in the next two months. Financial conditions have already tightened significantly from their ultra-easy levels, but they would need to become significantly worse before the Fed might pivot dovish again. When we get closer to that pivot, we expect to see attractive entry points.

We continue to prefer high-quality names, such as Big Tech, based on their relatively macro-resilient business models. However, recognizing the recent rise in real yields, we have nudged our portfolio a tilt more towards the value in January.

Chart

An inverted yield curve preceded seven of the last eight recessions. We are quickly approaching the point of inversion, which could induce the Fed to pause, likely pushing real yields lower and sparking a rally in quality/growth stocks. An inverted yield curve not only predicts, but also contributes to economic slowdowns through rising short-term refinancing costs.