The month of May saw a risk-on environment in financial markets, marked by the catch-up of lagging regions (Europe and Emerging Markets), sectors (cyclicals), styles (small caps) and asset classes (commodities). These developments show how investors are stepping-up the risk ladder in the hope of a re-opening economy.

The negative outlier was Hong Kong which suffered from political uncertainty around a new security law, giving the Chinese government a much tighter grip on the city. The Hang Seng lost -6.3% (total return in HKD) in May.

- In response, US President Trump announced that he will end preferential treatment for Hong Kong in trade and travel. This was followed by China halting purchases of some American farm goods, including soybeans. The phase-one trade deal is coming more and more under pressure.

- Given the upcoming US election, weak economy, COVID-19 worries, riots in the streets and the need for the stock market to keep rising in order to help his re-election, China may view Trump as being in a weak spot right now.

Meanwhile, the divergence between equity markets and the real economy is becoming more and more evident by the week. The most severe civil unrests in the US since the 1960’s that erupted last week are merely the latest manifestation of this increasing disconnect.

- The US is now counting around 40 million jobless people, most of which are from lower income jobs, and the Bloomberg consensus is predicting -34% in annualized real GDP terms for the second quarter.

- Record-large fiscal deficits meet equally record-large central bank balance sheet expansions. Last week, Federal Reserve Chairman Jerome Powell defended aggressive action to shield the economy as the coronavirus pandemic took hold:

“We crossed a lot of red lines that had not been crossed before … I’m very confident that this is the situation where you do that and then you figure it out.”

(Jerome Powell during an online event hosted by Princeton University’s Griswold Center for Economic Policy Studies on 29.05.2020)

The near-term economic outlook remains weak:

- The Atlanta Fed’s new estimate for US Q2 GDP even crashed to -51% (annualized).

- A new Becker-Friedman institute study shows that up to 42% of furloughed workers may not be able to return to work at all. This would imply that consumption would take a prolonged hit and leave margins under pressure for a long time.

- Bankruptcies in the US recently reached a high not seen since May 2009.

However, some green shoots are emerging:

- A private gauge of China’s service sector activity rebounded sharply to a nearly ten-year high in May as domestic demand recovered amid government measures to buoy economic growth.

- There seems to be some progress in the search for a vaccine.

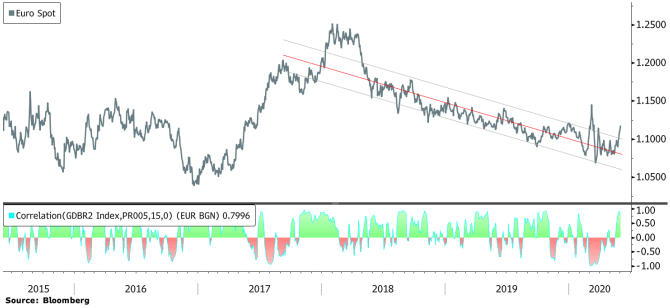

Chart: The euro’s rally may gain momentum as the currency is re-establishing its positive correlation with German yields. The currency, which displayed a negative correlation with two-year German yields through the recent turmoil, has seen that link turn positive in recent weeks.

In Europe, large grants are on the table should the current European Commission proposal come into fruition. Italy, Spain, France and Poland would be mostly on the receiving end. This could turn out to be a game changer for the prospects of the common currency. However, there will likely be tough negotiations among the countries in the weeks and months ahead.

Market Commentary:

The combination of the steepest recession on record, together with unprecedented monetary and fiscal support, is challenging most conventional market wisdoms. It seems that as long as investors are willing to focus on the Fed and its liquidity provision this rally can continue despite the harsh economic reality. “Do not fight the Fed” and fear of missing out are now the main market drivers.

However, should investors shift to a more defensive posture, digesting the economic data, social unrest, higher than justified valuations and potential election risk the summer could see a stronger equity correction.