Private debt (PD) is an attractive asset class. This term is generally understood to include all forms of private lending. In the existing low-interest environment, private debt offers investors an interesting supplement to fixed-interest investments.

Basel III and Basel IV make it more difficult for banks to grant loans to SMEs. The stricter regulatory environment has led banks to withdraw from lending commitments, thus shrinking their balance sheets. This has created a market of its own, which operates outside the so-called «liquid» markets and is seen as an alternative to bank loans.

Private debt financing is mainly used for acquisitions of other companies, for refinancing and as growth capital.

Private investors assume the risk of financing at higher returns. The advantage for the borrowing company is a faster decision-making process and a more flexible structuring breadth.

In the area of «investment-grade bonds», which were launched privately, there has recently been an average 1.45% higher yield compared with comparable tradable bond investments.

Outside the investment class, the return was even 2.31% higher. According to a Blackrock survey, this has led to a good half of all institutional investors now pushing into this market.

The high number of different private debt targets usually found in funds leads to a diversification and balance of risk desired by private investors.

Private debt in figures

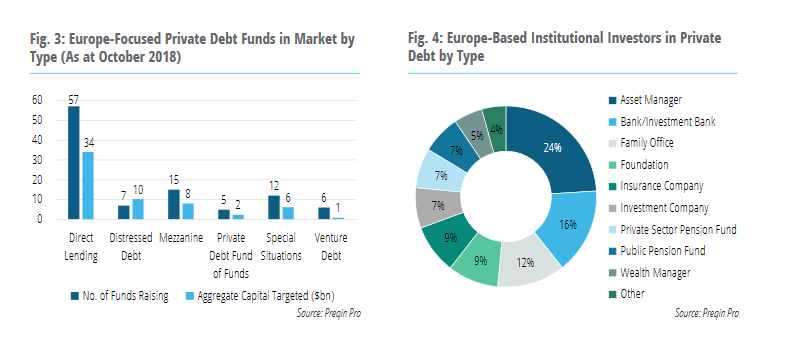

The private debt funds market is steadily growing in importance. With fund assets of around USD 700 billion in 2017 and projected growth to more than double by 2023, private debt represents an important asset class.

Asset managers account for 24% of total capital, followed by investment banks (16%), family offices and foundations (12%/9%). Insurance companies contribute up to 9% of investments. FINAD offers know-how and support throughout the entire process.

How to invest

Access to private debt is provided through direct investments, closed individual and fund of funds, mandates and co-investments.

Funds of funds are particularly suitable for investors who want to invest smaller amounts in this asset class without having to forego diversification in terms of managers, regions and strategies.

Individual funds are used for higher investment commitments, which are then spread over several funds over a longer period of time.

Direct investments are for investors who also want to incorporate entrepreneurial momentum into their investment decisions and have sufficient capital. FINAD supports its clients in all types of access to private debt and in particular accompanies direct investments with its specialists

It should be noted that private debt is an investment form with limited upside potential and that particular attention is paid to the management of risk. FINAD takes this into account by sufficiently diversifying its strategies, prudent selection of managers and continuous monitoring.

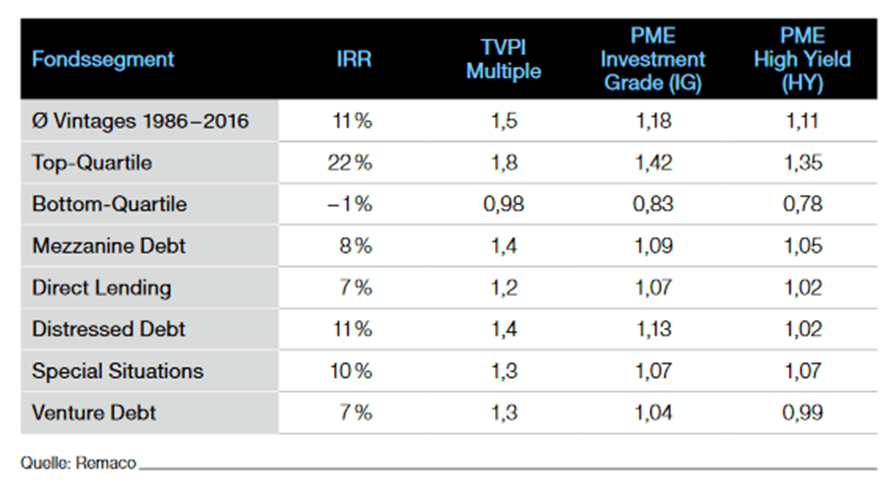

The strategies have different risk parameters and return figures over a longer period of time, which makes the selection of funds that FINAD has been monitoring for many years all the more important:

The Public Market Equivalent (PME) is an indicator that compares a private equity investment with an investment in a liquid market, with the same incoming and outgoing payments or cash in- and outflows. If the key figure is higher than 1, this means that the private equity investment has achieved a higher return than the liquid reference market. Only the funds in the «bottom quartile» (funds whose returns are worse than 75% of all comparable funds) show a PME below 1.

Total Value to Paid In (TVPI) is a key performance indicator based on the reporting date, which determines the return on capital employed on the basis of the net asset value of the fund, the available liquidity and the payments already made. If the TVPI is above 1, then the investment has (historically) generated a return.

The most important strategies can be invested through individual funds with a dedicated investment focus:

mezzanine debt:

Hybrid debt for equity financing, consisting of stock options (e.g. warrants) and subordinated debt. The investor is thus given the opportunity to convert into shares in the event of default on repayment.

direct lending:

Direct lending is a form of providing debt capital to companies where lenders other than banks extend loans to companies without intermediaries such as an investment bank, broker or private equity firm.

Distressed Debt:

Investment in distressed loans from companies with the prospect of successful restructuring. This is considered to be a high-risk security with high yield potential, as the protection depends on the success of a corporate restructuring. FINAD does not offer this strategy.

Special situation:

A special situation refers to special circumstances affecting a security that are not based on the economic fundamentals of a company.

Venture Debt:

Risk loans can complement risk capital and provide added value to fast-growing companies and their investors. Unlike traditional bank loans, venture debt is available to start-ups and growth companies that do not have positive cash flows or significant assets as collateral.

What does the exit look like

The investments are usually held for the entire predefined term. For most funds, this varies between 5 and 10 years. A sale to third parties is practically impossible during this period. In rare cases, the fund offers investors the opportunity to offer fund units to other investors. One therefore speaks of an illiquid asset. This illiquidity is compensated by higher returns.

How to start a private debt investment

However, depending on the type of bond and the investment platform, you can control how far you want to go as an investor. There are many opportunities for entrepreneurs to contribute their own know-how and assess risks.

At Finad, we work very closely with entrepreneurs and are familiar with the economic options, not only from the investor’s perspective. We work successfully on both sides of the debt capital procurement process and provide clients with orientation and know-how.