- Equity markets retraced in August, erasing exuberant sentiment that had prevailed in July.

- Latest macroeconomic data increased the probability of a soft landing in the US.

- Yields on US government bonds rose further, supported by a potential soft landing and large issuance of new debt to fund the deficit.

- Historically reliable indicators, such as the US Leading Index or the inverted yield curve, still warn about a US recession in 2024.

- Weakness in China and Europe is worrisome.

- In the short-term, the stock market could continue this year’s rise as sentiment has moderated and stocks used to rise in the past when the Fed stopped hiking interest rates.

Overdue correction

- After five months of strong equity performance, sentiment had become extremely greedy going into August, so the first negative monthly return in the S&P 500 since February can be considered healthy.

- To finance a projected deficit of $2 trillion in 2023, the US Government has begun to substantially increase the issuance of new debt, thereby exerting upward pressure on the 10-year government bond yield which has climbed up to 4.3%, a level last seen in 2007.

- Supported by OPEC+ output cuts and resilient economic growth in the US, Brent trades again at approximately $90 a barrel, higher than in all of 2023.

Market Development

World

- The tight US labour market is softening, a welcome sign for the Fed. The August update showed higher supply of workers (more people returning to the workforce) and softer demand for workers (fewer job openings) – the unemployment rate rose to 3.8% from 3.5%

- Summing up the second quarter earnings season, EPS came in at -2.9% yoy for the S&P 500 and -5.6% yoy for the Stoxx 600, better than previously thought at the end of June when -7% and -8% were expected by analysts. Growth for the third quarter is expected to be +2% and -10%, according to Refinitiv data.

- The Chinese economy is still suffering from the ongoing real estate crisis and could miss the 5% GDP growth target without major fiscal or monetary stimulus.

Europe

- Headline inflation in the Eurozone held steady at 5.3% in August, as the drag from energy prices that helped reduce inflation in the previous months disappeared. The core inflation rate eased a little from 5.5% to 5.3% but is still substantially above the inflation target.

- The composite PMI, which is below the growth threshold of 50 for the third month in a row, points to falling GDP in the third quarter (2Q grew surprisingly +0.3% qoq).

Switzerland

- The Swiss economy stagnated in the second quarter of 2023 with 0% GDP growth qoq. The manufacturing sector fared poorly, which had been indicated by the PMIs for several months, while the services sector held up and should continue doing so according to the aforementioned PMIs.

The debate about a soft landing continues.

The probability that a soft landing in the US is achievable has risen. The labour market and inflation seem to be gradually cooling, all while economic growth stays resilient. The quits rate, measuring the percentage of workers who resign from their jobs, has fallen to approximately its pre-COVID level (2.3% in August; high in April 2022 at 3%). Also, the ratio of job openings to unemployed has come down to a more normal level (1.5 jobs per unemployed in August; high in March 2022 at 2 jobs per unemployed; pre-COVID 1.25). This cooling in the labour market is a promising sign that inflation, and in particular services inflation where wages are a main input cost, can further recede. Surprisingly, estimates for 3Q GDP growth have risen over the last two months, indicating solid growth. The consensus now stands at 2.1% qoq after 0% at the end of June. Consumer and government spending are the main drivers. Given this data, the Fed will likely hold interest rates stable at the next meeting.

We acknowledge the latest economic developments in the US, but still do not think that a hard landing is off the table.

First, the worrying economic situations in China and Europe could spill over. China continues to suffer from a real estate crisis. So far, targeted monetary measures have been inadequate to lift demand and it is questionable whether big fiscal or monetary stimulus will be enacted, because debt levels are way higher than during the global financial crisis. In Europe, some countries are on the verge of a recession and leading economic indicators point to further weakness ahead. The ECB is in the delicate situation to weigh still high inflation against recession risks.

Second, inflation could be stickier because energy prices are rising again. Petrol prices are back where they were last autumn. As a result, the Fed might need to tighten more, causing the labour market not to soften but to break.

Third, higher interest rates may take longer to have an impact on the economy but eventually will do so. Households and corporates have financed largely at lower fixed rates which need to be refinanced at higher rates over time.

Fourth, historically reliable indicators, such as the clearly negative Conference Board Leading Economic Index or the inverted yield curve, suggest that a recession could start at the beginning of next year.

Positioning

Despite some improvements in macroeconomic data from the US, we keep a close to neutral allocation to equities. Other important economic regions are leaning towards a recession, and we think it is premature to dismiss a hard landing in the US. Furthermore, the equity risk premium, calculated as the earnings yield of the S&P 500 minus the 10-year government bond yield, has been trending down to almost zero. Medium to long-term, the low relative attractiveness of equities argues against overweighting and adding much risk to the portfolio. Short-term, however, this year’s rally could continue as the setback in August moderated sentiment and markets usually performed well when the Fed stopped raising interest rates, at least until it changed course and started cutting again.

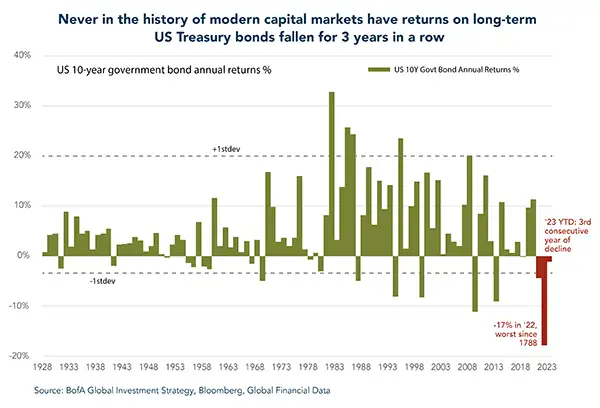

Regarding the bond market, we closely monitor the ongoing upwards trend in yields. We think it is currently too soon, but over the coming months the moment could come where we increase our fixed income exposure at then comparatively even higher yields.

Chart

Never have US government bond returns fallen for three consecutive years. There is a high chance that 2023 could be the first such instance, unless a recession materialises quickly and investors look for a safe haven.