- We continue to observe a Goldilocks market environment with only a moderate slowdown in US growth, supported by debt-financed fiscal spending, ongoing disinflation and a resilient consumer.

- US financial conditions are now the most accommodative in two years, based on the Bloomberg Financial Conditions Index, and in our view supportive of our quality-focused investment approach.

- We believe that if the Goldilocks environment can ride out the current earnings season and flood of critical macro data, the market rally can persist into spring.

- This is not to say that we have been given the all-clear. While the yield curve continues to signal a heightened probability of a beginning recession in the first half of 2024, risks also lurk in the credit market. A policy mistake could still occur if the US Federal Reserve (Fed) waits too long to follow through with the recently signaled rate adjustments.

- Overall, we remain in a late-cycle environment where market fluctuations between positive and negative outcomes for the economy are expected.

- However, for the first time in two years, the risks to growth appear to be more controllable by policymakers –which shifts our bias towards risk assets to a slight overweight.

The Fed’s dovish pivot sparks market confidence

- Liquidity conditions received a positive impulse in Q4 2023, starting with the US Treasury’s dovish Quarterly Refinancing Announcement (QRA) at the end of October. This was followed by the widely unexpected dovish pivot by Fed Chair Jerome Powell in mid-December. Many thought the Fed would be displeased with the market reaction and push back (as it did several times over the past two years), but speeches by Federal Open Market Committee (FOMC) members throughout the month of January confirmed the pivot.

- Recent releases of hard data (the latest being strong January US jobs report) and the massive easing in financial conditions have further lowered the perceived probability of a medium-term recession to ~40%. This is still significantly higher than in a typical year but down from the historical odds of ~80%, which were based on previous tightening cycles.

- With the Q1 2024 QRA, US Treasury Secretary Janet Yellen reinforced the prevailing favorable liquidity conditions by reducing the anticipated bond issuance target and maintaining a short maturity profile.

- While US “Big Tech” quality stocks are leading the market – those are in our view, the main beneficiaries of improving liquidity conditions – China stocks tumbled to a five-year low in January.

- A regional US bank, New York Community Bancorp (NYCB), fell by a record 45% after reporting a Q4 loss and dividend cut, and raising renewed concerns about the commercial real estate (CRE) credit market.

Market Development

World

- Further support of the Goldilocks market environment came with the release of the December US Personal Consumption Expenditures (PCE) Price Index, along with more stimulus signals out of China, in response to the local stock market slump.

- US real income growth is expected to remain robust, with wage growth at ~4% and core PCE at 2%, sustaining a ~2% rise in real income per capita through at least Q1.

- Beijing signaled more targeted stimulus via low-cost central bank funding to specific sectors of the economy. As it seems that restoring confidence among investors is a core part of the party‘s agenda, investors should continue to expect a front-loading of stimulus early in 2024, according to 42 Macro.

- The Q4 2023 earnings season has been solid so far. A few high-profile tech names fell following the release of their earnings reports but others like Meta and Amazon delivered impressive results.

Europe

Goldman Sachs analysts believe that a Donald Trump victory in the US presidential elections would pose significant risks not only to German stock benchmarks, but also to European cyclical sectors with a high correlation to world trade (e.g. industrial, chemical, automotive). This is due to a higher risk of both an increase in tariffs on Europe and a reduction in US funding support for Ukraine. The areas least exposed to this outcome would include the Swiss Market Index and the UK’s FTSE 100. Defensive sectors, such as health care and consumer staples, also tend to outperform in the face of rising uncertainty around policy.

Switzerland

The KOF Economic Barometer rose to 101.5 points in the first month of the year, an impressive 3.5 points higher than in December 2023. This is the first time since March 2023 that it has climbed above its medium-term average value. As a result, the signs of an imminent recovery in the Swiss economy are intensifying.

Powell puts focus on economic growth with no short-term rate cuts foreseen

In the January Market View, we suggested that the Fed could be inclined to maintain higher interest rates for an extended period, contrary to consensus expectations. Powell’s statement in the January press conference appeared to confirm this outlook, as he explicitly stated that a rate cut in March was not his base case.

Despite the initial negative market reaction, subsequent remarks by Powell point to a general market-friendly shift in the Fed’s policy. The central bank no longer appears to be solely concerned with inflation and is now prepared to act swiftly if there is a deterioration in growth data, providing a backstop for markets.

Powell: “If we saw an unexpected weakening in the labor market, that would certainly call for cutting sooner. If inflation was stickier or higher than anticipated, that would argue for moving later.”

Our view is that the Fed should cut rates sooner rather than later to avoid a deviation from the current favorable Goldilocks trajectory.

Key takeaways:

- Based on Powell’s remarks, we believe there is less than a 25% probability of a March rate cut. We think this favors continued US dollar strength for the time being.

- The good news is that the Fed considers the current inflation data as sufficient for a cut, with no immediate need for further improvement. In short, they just like to see more of the same before taking action.

- Powell acknowledged a marginal pickup in economic activity, hinting at a potential re-acceleration in cyclical growth.

- He also left the door open for tapering quantitative tightening (QT) in March. We agree with Steno Research that the Fed is likely to taper QT when the overnight reverse repurchase (ON RRP) facility approaches depletion – sometime in the first half of this year – which speaks to a benign USD liquidity outlook.

At the same time, the Fed meeting was in many ways overshadowed by a US regional bank, New York Community Bancorp (NYCB), reporting large losses in Q4. The bank took significant net charge-offs and increased provisions for losses in its loan book.

As a first reaction, reminiscent of last year’s banking crisis, the SPDR S&P Regional Banking ETF experienced its biggest decline since May 2023, dropping by up to 5.6% in a day.

- Our initial assessment – that this is mostly a bank specific issue – aligns with that of Steno Research.

- NYCB’s balance sheet surged after the bank acquired the deposits of Signature Bank, which failed in March 2023. This pushed NYCB into heightened regulatory scrutiny and increased capital requirements, necessitating a balance sheet/accounting adjustment in the Q4 report.

- Much of this appears to be a one-off correction due to the higher regulatory tier, and not necessarily indicative of larger problems in the loan book (which is focused mostly on commercial real estate, CRE).

That said, there is a systemic element to this as it is another signal that CRE remains the key area of concern in the credit markets. According to the National Bureau of Economic Research (NBER), 14% of all commercial real estate loans and 44% of office building loans seem to be in negative equity, where debt surpasses property value.

We will be watching the situation closely to see if the NYCB affair remains an isolated event or concerns about the regional banking sector widen. Yield-curve steepness could be a good indicator. Back in March 2023, the US Treasury curve (10-year minus 2-year yield) responded to the banking crisis with a steepening of more than 80 basis points (bps).

Positioning

Looking at the broad data, we are in the late stage of the economic cycle, and the Fed is expected to implement easing measures this year. In such an environment, quality growth stocks and gold have historically outperformed – which we believe supports our preferred investment strategy.

Though not extreme, stretched sentiment and the historically weaker first half of a US election year make a 5-10% equity correction likely in the coming months. What has changed our previous neutral stance is that we now see such a correction as an attractive dip-buying opportunity. This can be explained by the fact that the “Fed put” – the potential for market supportive policy intervention – is back, or at least on its way.

- We now have greater conviction that the liquidity cycle has sustainably turned higher for the medium and longer term.

- With each month that inflation continues to fall without a simultaneous collapse in growth data, the Fed is accruing additional capacity for rate cuts. This positions it to act decisively in the event of an intensified slowdown in growth, for example through a credit event (which would be the more classic conclusion in the cycle).

- In essence, this gradually cuts off the “left tail”e. very bad outcomes in our scenario distribution. Our concern about a Fed unable and unwilling to act in the face of a slowdown, mainly due to the fight against inflation (a lagging indicator), has notably diminished.

The key risk to this outlook would be a sudden revival of inflation, forcing the Fed to prolong tightening or even tighten further. What could lead us down that road is a supply shock induced by a sizeable geopolitical escalation, especially with no signs of tensions easing in the Middle East, in particular around global trade in the Red Sea. However, it is still too early to have a clear view on this.

Lower-quality cyclicals did demonstrate better performance in the last two months of 2023. We attribute this to both short covering (buying to cover) and year-end performance chasing rather than a sustainable shift in leadership resulting from a comprehensive cycle reset.

Due to the weakness of the European economy, we feel that the ECB needs to catch up in their easing path relative to the Fed. For now, this is favorable for the dollar.

Chart

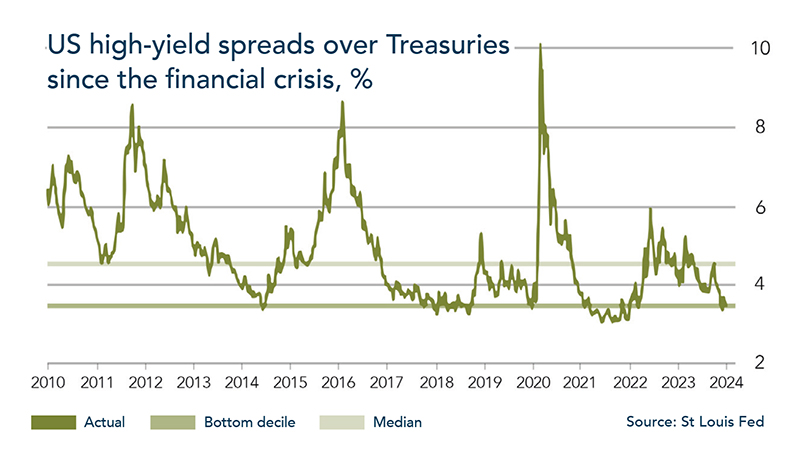

The NYCB incident comes at a time when liquid credit markets are highly complacent. The spread between junk and treasury bonds is at or near historic lows. High-yield markets are clearly expecting a perfect landing for the US economy and a benign credit cycle. We will watch credit spreads closely in the coming weeks.