- Equities have been declining across the board since the start of August as bond yields are surging to new highs in a vicious bear steepening.

- Uncertainties are manifold: a weakening consumer, US fiscal policy in limbo, energy prices and geopolitical risks rising and fixed income mark-to-market losses mounting on institutional balance sheets.

- While we have long been arguing for an unfinished bear market and hard landing still to come, we don’t think that this is it just yet.

- We see a chance for a temporary goldilocks revival in Q4 before the final leg of this cycle (credit cycle weakness) sets in. This outlook for a tactical equity rebound depends on the dollar and yields consolidating their overbought conditions.

- Next important events are the upcoming Q3 earnings season and the ongoing US budget showdown.

The deepest equity correction since autumn 2022

- The US 10-year note yield has surged by approximately 440 basis points since its low point in March 2020. Throughout history, nearly every move of this magnitude, and often smaller ones, has been associated with some form of crisis, tracing back to the 1980s.

- As of writing, the USD is in its 12th consecutive week of gains, something not seen since 2014. It’s safe to say that the dollar and yields have been a major headwind for liquidity conditions and risk assets.

- The S&P 500 has fallen back to the 4,200 mark (also the 200 day moving average) that marked the break-out level for the AI-driven summer rally.

- While the broad S&P 500 Index is still up solidly (+11% in USD price return) this year due to the “magnificent 7” stocks (tech mega caps) the equal-weight version is now down on the year.

- Similarly, the Dow Jones Industrial has turned negative YTD and the SPI is back to merely +2.7 YTD% (in CHF).

Market Development

World

- Gone are the complacent days of the summer ”immaculate disinflation” market narrative. In hindsight, the market peak right at the 1st August US rating down grade by Fitch seems noteworthy. As worries about fiscal discipline and debt sustainability amid sticky inflation have more and more taken centre stage since then accompanied by a forceful move higher in real rates. That said, we think the bond selling could have reached a climax, at least for the short-term.

- Currently, the removal of Kevin McCarthy from his role as Speaker of the US House adds more complexity to the matters of determining prices in the Treasury market.

- It’s worth noting that Moody’s, the sole remaining ratings agency to grant the highest rating to the US, expressed doubts about its confidence in the country last month, citing concerns related to governance.

- The House is scheduled to vote on McCarthy’s replacement in the upcoming week, and Congress has until 17th November to vote on a budget that would prevent a government shutdown.

Europe

In September, there was a significant decline in inflation within the Eurozone. This decline can be attributed to two factors: base effects in the energy and transportation sectors, as well as tangible efforts to restore price stability. Out of the 20 countries in the currency union, 15 experienced a decrease in their annual inflation rates. The range of these changes spanned from -0.3% in the Netherlands to 8.9% in Slovakia.

Switzerland

Towards the end of September, Swiss purchasing managers exhibited a somewhat less negative outlook compared to the preceding months. The Industrial Purchasing Managers’ Index (PMI) for the month reported at 44.9 points, surpassing both expectations (40.5) and the August figure (39.9). Nevertheless, with an index reading below 50 points, this crucial leading indicator still indicates a shrinking Swiss industrial sector.

Bad news may be good news at first.

Undoubtedly, the bond market has experienced an extremely harsh sell-off. The current rate-hiking cycle is among the swiftest and most aggressive in history, and the Fed is concurrently reducing the size of its balance sheet.

- The Vanguard Extended Duration (20-30 years) Treasury ETF has seen a decline of 58% from its peak, which is actually greater than the peak-to-trough decline in stocks (-56%) observed during the Global Financial Crisis.

When we look at historical data, we find that even milder rate-hiking cycles have previously led to recessions, and during those times, the Fed initiated rate cuts early on. In contrast, this time the Fed is inclined to maintain a steady stance and possibly raise rates further due to concerns about inflation. Nevertheless, the prevailing consensus among most market participants is either a soft landing or no landing at all, and analysts are expecting a 12% increase in 2024 earnings according to Refinitiv.

Our perspective, which diverges from the consensus, remains that a hard landing is the most likely outcome. It does not appear imminent, however.

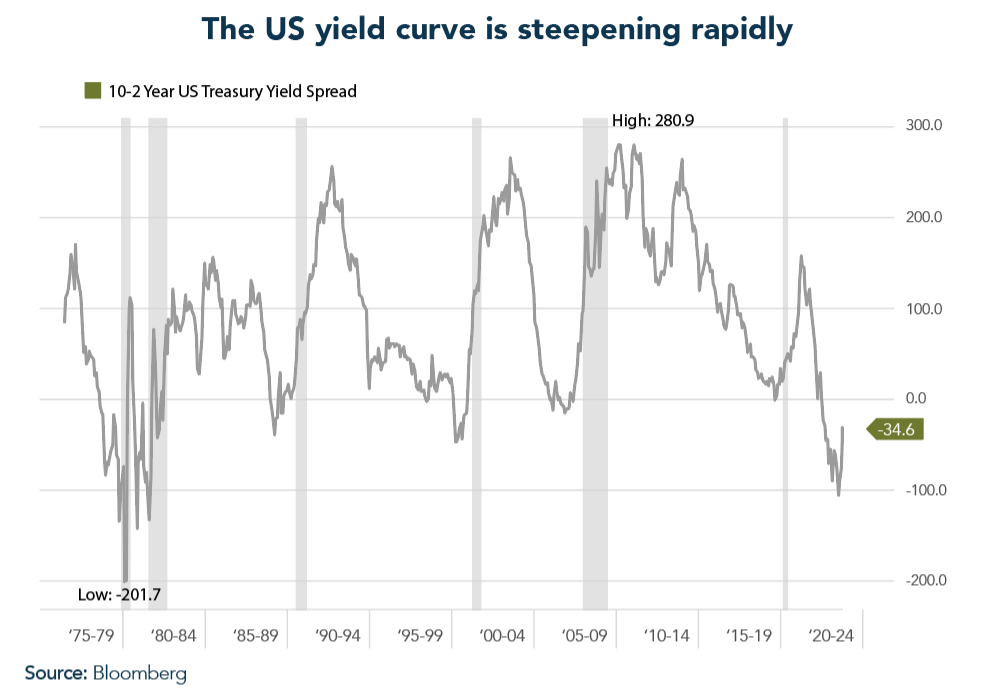

- Incoming macro data continues to show that the US economy has been resilient at least until early September. This notion will only change with sustained weakness in the labour markets. According to the Macro Compass, labour market weakness tends to occur 12-24 months after a persistent yield curve inversion. We are now at month 15.

In this context, bad economic news may be interpreted as “good news” for markets at first as a cooling-off in employment may prevent further Fed tightening, the story goes. The transition from resilient to weaker economic data may translate into a consolidation of the dollar and yields. A potentially good set-up for a “goldilocks” rebound in Q4.

This assumes of course that we are not on the brink of an imminent credit event. From our perspective, the current macro trajectory appears to resemble a “policy error over time”, meaning a situation where monetary policy remains too restrictive for an extended period in the face of weakening economic indicators, eventually leading to a downturn in the credit cycle and a recession. This contrasts with a sudden and dramatic crash in economic momentum.

We want to emphasise again that for a Goldilocks-like respite to materialise, it’s essential for interest rates to stabilise. If the current trend of rising rates continues unchecked, it’s likely that some aspect of the financial system will become disorderly. The stakes are undeniably high.

Positioning

Tactically, we observe market conditions that allow for a rebound in equity markets.

- Equity markets are very oversold with only 12% of S&P 500 members trading above their 50-day moving average, the lowest since October 2022.

- Sentiment has been purged off the summer complacency – the CNN Fear and Greed index is below the levels seen during theregional banking crisisin March.

- Seasonality turning more positive from Mid-October onwards into year end

- Most importantly: Dollar and yields are very stretched and ready for a period of consolidation.

The problem with this outlook is that risk-return is still not that great given the non-linearity to the downside that lurks around the corner.

- Breaking the critical 4,200 level would worsen the technical picture significantly for the S&P.

- Should yields keep pushing higher this forcefully without pause, chances are rising that we will see some form of market dislocation.

To us this means that we do not add much risk here but also don’t cut risk.

Our medium-term outlook remains unchanged. We expect a beginning US hard landing towards Q1 next year. This would imply that the real pain for stocks is still months away. In this context, we currently see an attractive entry opportunity for long gold positions as a good medium-term recession hedge. It is strongly oversold too (at levels last seen in August 2018, which marked the start for a 70%+ gold rally until mid-2020).

We leave you with this quote from Strategas on the question if October 2022 was the ultimate bear market low:

- “We took a look at every S&P bottom going back to the early1930s… this would mark the first time in roughly 100 years that the Banks are lower one year off the market low (in this instance by -20%)”

Chart

The US Treasury yield curve is rapidly re-steepening. End of June, the 10/2yr inversion was at -108 basis points and has now steepened to -35 basis points. We interpret this as another sign that a potential hard landing is moving closer. As the graphic shows yield curve steepening from prior inversion has been a clear recession warning in the past.