- We continue to view equities as priced for policy and growth outcomes that are too optimistic, namely rate cuts in 2023 without any downsides to growth — which we see as unlikely.

- Market leadership has narrowed further and turned more defensive. The Big Tech companies have broadly kept indices afloat and saved the Q1 earnings season.

- In the May Fed meeting, Powell signaled that the Fed is likely done with raising rates but will keep them at a restrictive level of 5% until it gets inflation closer to the target of 2%. This remains at odds with the market pricing for -75 bps of rate cuts in the second half of the financial year.

- The latest failures make it clear that the US banking crisis is not over and will have a lasting impact on credit conditions.

- Wrangling over the US debt ceiling may rumble on to the eleventh hour, which should keep growing pressure on equity volatility.

- Equities rarely start new bull markets before a recession is advanced and central banks have turned accommodative (not just less restrictive). We remain defensively positioned.

Fed delivers a “hawkish pause” while Big Tech saves the earnings season

- Big Tech earnings, stabilizing rates and cautious positioning have recently been supportive for equity markets.

- We have observed large inflows into global quality ETFs since the banking crisis started in March.

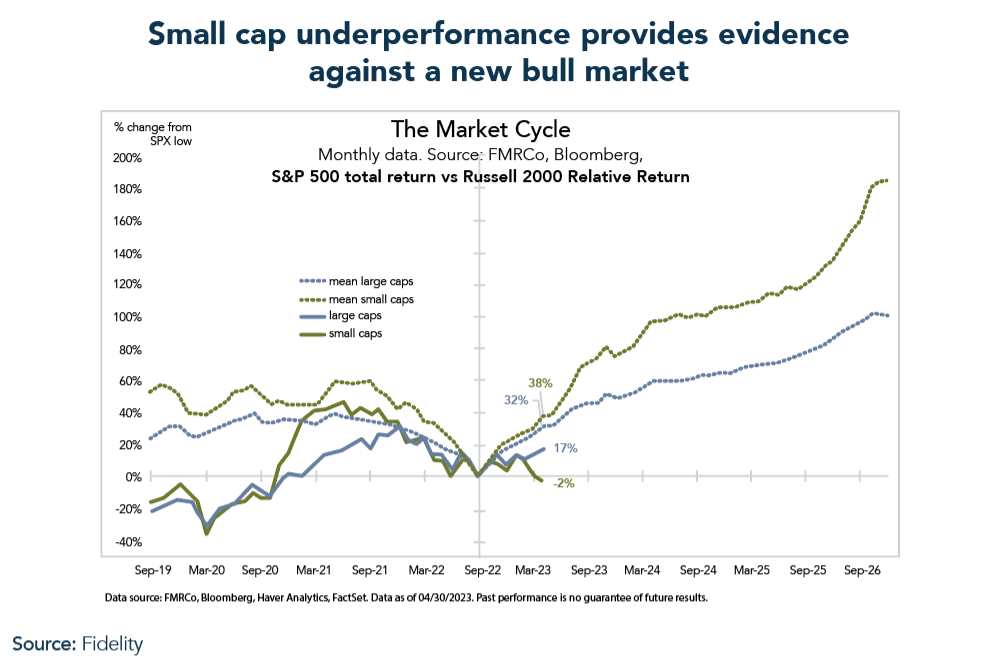

- The small cap Russell 2000 Index (-1% YTD) has significantly underperformed the large cap S&P 500 (+8% YTD). The problem is that, typically, the market needs to see small cap leadership for a new bull market.

- The current S&P 500 Q1 earnings season has shown some notable successes among large cap tech and banks but the earnings recession that started in Q4 2022 looks set to continue on a nominal and real basis.

Market Development

World

- The noise-to-signal ratio in monthly macro data is unusually high at the moment. Coincident growth data and core inflation are both proving rather resilient whereas leading data (e.g. Leading Index or cyclical commodity weakness) points towards a sharp economic slowdown in the next 2–3 quarters.

- The squeeze in tech is driven by demand for quality and the AI narrative. Some analysts expect huge AI-induced productivity gains. (e.g. IBM CEO “up to 30 percent of IBM’s back-office jobs—around 7800 roles—could be replaced by AI”).

- Based on Powell’s press conference, monetary policy conditions are set to remain tight for a while. History tells us that the longer this goes on, the higher the chances something breaks for good.

Europe

- Eurozone April CPI data revealed that headline inflation rose slightly in April (to 7% YoY, up from 6.9%). This was largely driven by rising fuel costs, while the core inflation figure fell for the first time in 10 months (from 5.7% YoY to 5.6%).

- In the first week of May, the ECB released Euro area bank lending survey showing tightening lending standards but also falling demand for loans.

Switzerland

- The Swiss PMI Manufacturing Index declined further in April and remains below the growth threshold for the fourth time in a row. At 45.3 points, the index is significantly lower than the consensus estimate of economists.

- The last time we saw similarly low values was in summer of 2020 — in the midst of the pandemic.

US banking crisis flares up again

Only three days after the emergency takeover of First Republic Bank (FRC) by JP Morgan (the 4th US bank collapse this year), Jerome Powell opened his FOMC press conference by emphasizing that the “US banking system is sound and resilient.” Only a few hours later, a handful of regional US banks continued their sell-off (PacWest, Western Alliance, etc.).

- The S&P Regional Banks Index has hit new lows and is now down -40% YTD, back at mid-2020 levels.

At this point “a few” more failures may create a momentum of their own, puncturing the narrative that CS, SVB and First Republic were all idiosyncratic and containable. In any case, we are seeing signs emerging that the US regional banking turmoil may be morphing into a balance-sheet-driven crisis, and it is no longer purely a deposit-flight issue. - The mere fact that JPM wanted an 80/20 risk split over 7 years in the FRC deal is a testimony to the fragility in the regional banking system and the underlying loan books. (We talked about the US regional banks commercial real estate [CRE] credit exposure in the April Market View).

- Also, why would a large bank now opt to buy a smaller bank before the FDIC seizes it? (As we have seen, FDIC receivership status allows the acquiring [big] bank to get a much better deal afterwards).

Overall, we feel equity markets are increasingly complacent about macroeconomic risks, such as:

- a potentially ugly debt ceiling battle,

- a significant tightening of bank credit,

- disappointingly hawkish central banks.

On this last point, in our view the Fed remains focused on the current inflation and activity data. Therefore their plan is likely to retain rates in the now restrictive sector until inflation is back on target. In addition to that, the previous tightening steps still have to flow through the economy and will result in demand destruction and higher credit losses (with consumer credit, CRE etc.).

Our conclusion is that the Fed will not start to cut rates until it becomes evident from (backward-looking) activity and inflation data that the economy is clearly headed in the right direction or until something finally, demonstrably breaks in the financial markets. Therefore, we continue to perceive a heightened risk of keeping policy too tight for too long into this slowdown.

Positioning

The latest FOMC statement was very similar to the one used in June 2006 when the Fed paused its cycle of rising interest rates for 13 months.

- Bulls will point out that on average, equities continued to rise after the last Fed pause, but fell after the first cut.

- The median Fed pause at the peak of the cycle of rising interest rates only lasts for about 5 months (with large dispersion around the median).

- In the 80s, a pause of only a month was observed, while in 2000 or 2018 the Fed paused for 7–8 months before a cycle of cutting interest rates began.

However, a policy pause does not necessarily mean a positive environment for equity markets. In fact, as history shows, S&P 500 returns following a pause have tended to be negative when the economic cycle has been slowing (using the ISM Manufacturing gauge as a proxy). In this context, it is worth mentioning that this will be the first time we have seen a policy pause at a moment when the ISM manufacturing activity gauge is already in contraction territory.

We consider our portfolio well positioned for the current environment: no bank exposure, high quality equities with a long-put overlay, a substantial gold position and we still have a lot of AAA short-term government bonds which we will use to buy equities and/or credit when the market finally has set prices in the eventual hard landing. We have added stop losses for parts of our MSCI World ETF position recently.

Chart

A great chart from Fidelity’s Jurrien Timmer: Historically speaking, small caps not only participate in a new bull market, but lead the upward trend. That’s not happening right now, as small caps have been significantly underperforming since the lows in October. To us, this is another data point that makes us question the stability of the currently calm market environment.