- Recent hot macro data in developed markets has put a dent in the “immaculate disinflation” narrative.

- It seems to us that investors turned too optimistic about an improving economic outlook and an imminent Fed pivot at the beginning of the year. This complacency is now being challenged by re-emerging inflation fears and the prospect of further rising interest rates amid an earnings recession.

- We are now getting data that shows how the January rally was largely driven by mechanical buying of volatility-driven, valuation-insensitive participants triggered by excess liquidity (i.e. the US Treasury’s TGA drawdown, and liquidity injections by the PBoC and BoJ)

- In this context, the rise in valuations, with the S&P 500 forward P/E ratio now around 18x, makes little sense to us, particularly given the fragile earnings picture.

- The outlook for equities is, therefore, becoming increasingly risky and risk management remains crucial in our view.

It seems that only a hard landing will eventually stop “higher-for-longer”

- January and preliminary February inflation numbers from the US and Europe show that price pressures are still very much present, while jobs data and retail sales have come in stronger than expected.

- The Fed’s preferred measure of underlying inflation, PCE services ex-housing, is running at more than twice their 2% target. Even goods inflation, which had been falling for over a year, is showing signs of turning upwards again.

- We also note a strong divergence between hard data (resilient but more lagging) and soft data (weakening and forward-looking) in developed markets.

- Meanwhile China’s reopening seems to be moving along, as the manufacturing PMI for February recorded the highest reading since April 2012 and the property market is showing early signs of improvement.

Market Development

World

- The Fed has signaled that it plans to continue its tightening cycle, with Fed fund futures now pricing in a peak rate close to 5.5% by Q3 2023. Despite this, equity markets have not priced in the prospects of a tighter policy according to Barclays, with the options-implied probability of a soft landing now higher than a month ago (as of mid-February).

- This suggests that equity markets are out of sync with what the rates markets are signaling, and a convergence of views is likely to bring about pain for equities.

- Interestingly, retail participation is currently at 11.7% of the total market volume and at the 96th percentile relative to the last 5 years, according to Morgan Stanley.

Europe

- Inflation in France and Spain accelerated unexpectedly in February, increasing pressure on the ECB to implement further interest rate hikes (futures markets pricing up to 4% now).

- In France, the CPI rose by a record 7.2% YoY as the cost of food and services increased. Spain saw a 6.1% increase. Analysts had expected inflation to remain flat in France and weaken in Spain.

- It appears that inflation in the euro zone is lagging behind developments in the U.S. by about 6 months.

Switzerland

The Swiss manufacturing PMI unexpectedly fell for a second month to 48.9 in February, down from 49.3 in January. The reading defies economists’ estimates of a return above 50 — the threshold which separates expansion from contraction. This marks another weak macro print for Switzerland last month, following the Q4 GDP data which showed that the economy failed to grow at the end of last year.

Will the Fed feel forced to surprise markets with a hawkish update in March?

We believe that the currently prevailing conclusions that a US recession is off the table are premature, given the Federal Reserve’s aggressive rate hike campaign and the fact that the impact of monetary policy on the economy comes with a lag of one to two years. Remember, the implied yield curve estimate for the onset of a U.S. recession is the second half of the year, not now.

- A sustained inversion of the US 2/10 yield curve always anticipated a recession – no false signals during the past 40+ years.

- The 2/10 first inverted in March 2022 and has been sustainably inverted (with a threshold of -25bps) since July 2022. Historically, a recession starts around 12 months after.

The problem for the Fed is that markets have shown a tendency to price in a softer stance well in advance, thereby reigniting economic momentum and inflation pressures, which works diametrically against the goals of the FED to rebalance the labor market, destroy demand and ultimately reduce inflation.

To succeed, the Fed may need to demonstrate that they will tighten policy even more and keep it tight, while simultaneously expecting a weaker macro environment. The market must believe this (and, in our opinion, price risk assets lower) for the Fed to be successful, even if they ultimately pivot. The Fed may therefore have to “shock” with a hawkish dot plot update on March 22nd.

We agree with the conclusions of BofA’s Mike Gapen: “A big slowdown in consumer demand might be needed for inflation to return to 2%. This could require several more Fed hikes… This will likely lead to a recession, because the non-consumer sectors of the economy already look soft”

Finally, we would like to devote a few words to systematic strategies, as we are seeing evidence that these players are currently playing a key role in equity markets:

- The equity rally until early February was led by high beta unprofitable tech and the losers of the past year.

- Volatility is frequently used as a buying or selling signal by CTAs, risk parity, and volatility-targeting funds. As implied and realized volatility decrease, these players mechanically increase leverage and make purchases.

- Their approach is insensitive to equity valuation and has a significant impact on two types of stocks: the most disliked and shorted stocks, as well as the least liquid and most flow-prone market sectors.

Positioning

Recent economic data suggest that the US growth slowdown may be delayed but not avoided. Our best estimate for the beginning of a US recession remains Q4 2023.

While our base case clearly makes a strong case for remaining defensive, a potential bull case for a soft landing could be argued if consumption in developed markets is truly rebounding (we have seen signs of recovery in real wages across the West recently), coupled with further stimulus out of China. If positive real growth then drove the shift higher in yields, risk assets should be able to absorb the pressure. However, the probability of this scenario (while up from 6 months ago) is still only 25% in our view.

The reality is that the equity risk premium is at its lowest level in 15 years, making the risk-reward for stocks very poor. We expect margin pressure to drive further downside in 2023 earnings, as companies struggle to cut costs as quickly as pricing power/demand erodes. We think that S&P 500 3.900-3.800 will be the real test for the equity market.

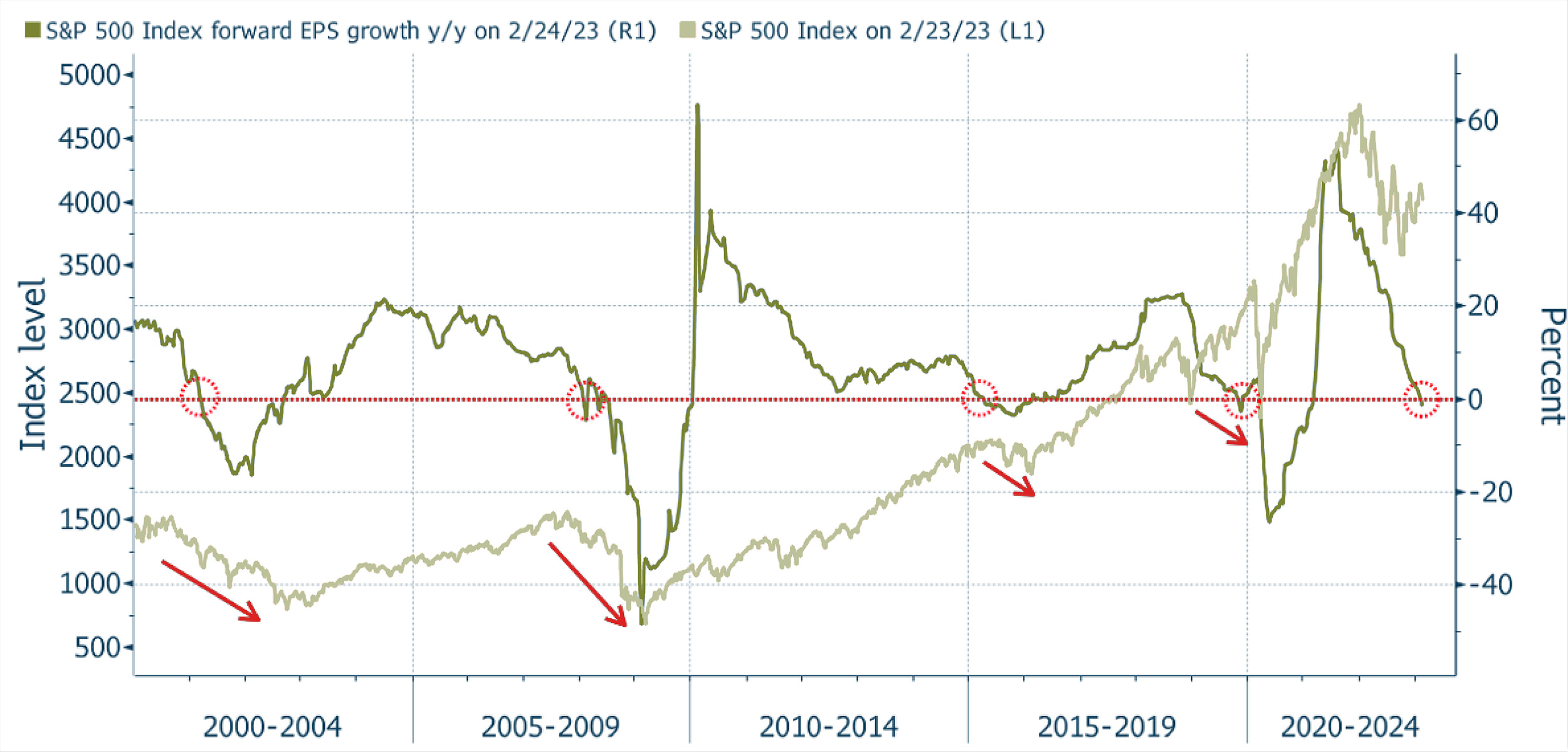

Chart

For only the fifth time since 2000, 12-month earnings expectations have turned negative, which historically has been a sell signal for investors, according to Morgan Stanley. Historically, the majority of stock price declines have occurred when expected EPS growth turns negative.