- AI-related stocks have contributed virtually all of the S&P 500’s YTD return and have evoked a “recession is canceled” market sentiment, with the Fear and Greed index now reaching “extreme greed” and the VIX Index crashing to 2021 lows.

- Investors have been actively hedging melt-up scenarios via massive call-option volumes and are increasingly ignoring downside risks that are still looming over the mid-term in our view.

- Raising the debt ceiling in the USA will lead to significantly higher issuance of US government bonds in the coming months. This could temporarily put upward pressure on long-term interest rates and the USD, hence tightening financial conditions amid an ongoing credit crunch in the background.

- Inflation is falling globally, but only slowly. From the middle of the year, base effects will disappear, making a further decline more difficult.

- Leading indicators keep falling and point toward a US hard landing within the next 2–3 quarters.

- Bank of America reported the largest monthly inflow into tech stocks since Feb 2021 and most recently the largest weekly inflow ever in their data series.

- The contrarian approach here is to fade this trend as it is becoming very extended. We are considering doing so via a rotation within equities but also asset classes.

The US avoided a default, but what are the consequences of the deal?

- Days before the US could have faced a potential default, a deal was struck. It sets the course for federal spending for the next two years and suspends the debt ceiling until January 2025.

- The current impact of the deal on the economy is small, since most of the projected savings will depend on decisions made after the next election.

- The impact on the market could be substantial, however, if the US Treasury quickly refills its coffers by issuing government debt and thereby removes liquidity from financial markets — Morgan Stanley estimates an additional bill issuance of USD 730bn over the next three months.

Market Development

World

- Thanks to an outstanding Nvidia earnings report that further intensified the hype around artificial intelligence, equity leadership is ever more concentrated in the largest technology stocks — the Nasdaq 100 is up around 8% in May, the S&P 500 is flat, and the Dow Jones and EuroStoxx 50 are down.

- Just when the narrative about de-dollarization had reached its peak, the US dollar turned and proved those predicting a quick demise wrong.

- Chinese manufacturing activity contracted, raising fears about the growth outlook and prompting calls for more central bank support (potentially coming as early as June.)

- The poor performance of copper and oil are a warning sign for the global economy.

Europe

- Germany fell into a shallow technical recession, defined as two consecutive quarters of declining output, as consumer spending was dampened by high inflation.

- In Greece, the liberal-conservative Nea Dimokratia party has scored a strong result in the elections. The Greek economy continues to perform relatively well and orthodox policies are helping to reduce public debt. Further credit rating upgrades are likely and Greece’s credit spread is now lower than Italy’s.

Switzerland

- 1Q GDP grew surprisingly by 0.3% compared to last quarter. Contrary to Germany, private consumption was one of the mainstays of growth due to a low inflation rate and strong franc.

- Yet some important leading indicators are pointing steeply downward, indicating a cooling economy in the coming quarters.

AI Hype: New bull market or a glitch in the Matrix?

A rising number of financial media outlets are declaring a new equity bull market, which is often defined as a 20% or more increase from a recent low — a definition that is of course arbitrary and seldom actually helpful. That said, the S&P 500 is nearing this milestone and has recently broken out of a multi-month trading range, albeit with the narrowest market breadth since the heights of the dot-com bubble — all driven by chasing the AI narrative.

The 6 big tech stocks have gained over USD 3 tn in market cap YTD. This gain alone:

- exceeds US industrials and consumer staples sectors

- surpasses all 2000 constituents of the Russell 2000 index

- is close to the market cap of the EuroStoxx50 index

Lisa Shalett, Chief Investment Officer at Morgan Stanley Wealth Management, put it this way: “Exuberance around artificial intelligence, along with a resurgent US dollar, has produced extreme divergence and concentration risk in the main stock indexes. Such narrowness is not what new bull markets are built on.”

History has shown that tech stocks can still have strong rallies even in bear markets, as seen during the 2000–2002 tech bubble. During the 2000–2002 tech bubble bear market, the Nasdaq had 11 rallies of more than 10%. Four of those rallies were between 28% and 49%.

The bullish sentiment is fueled by expectations of earnings growth accelerating, positive and analyst revisions, and optimism around AI’s impact on growth and productivity.

That said, chasing the rally here seems increasingly risky to us with the NYSE FANG index very overbought, the CNN Fear and Greed index now in “extreme greed” territory and the CBOE index put/call ratio recently hitting its lowest level since March 2020.

In fact, market breadth indicators have deteriorated further in May, as more stocks made new 52-week lows in the S&P 500 than 52-week highs in May. In bull markets, optimism prevails and tends to raise all boats. That’s not happening at the moment — at least not yet.

Historically, the stock market usually waits for the Fed to cut rates when a recession is either imminent or has already started. If this really is a new bull market, it’s the first to start when the Fed had still been hiking.

Positioning

Assuming a recession has only been delayed relative to consensus expectations, given excess Covid-savings (recall that we have been expecting a US recession to begin in Q4 2023 this year — whereas the analyst consensus began this year expecting a recession in H1), it would be atypical if the lows for the stock market are not retested.

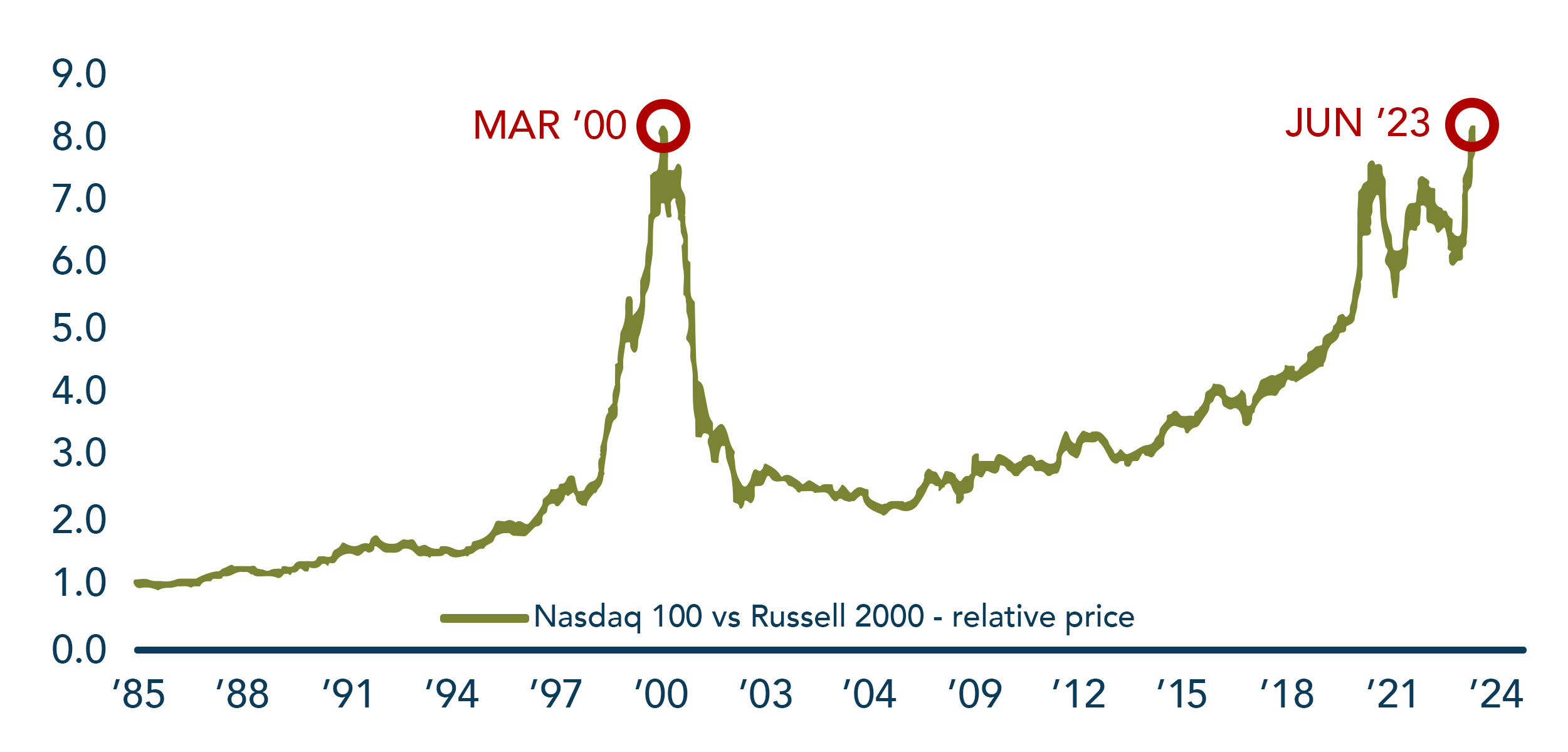

For the past months, Fidelity’s Jurrien Timmer has been showing how early-cycle bull markets are typically led by small caps — something that is clearly not happening at the moment, with small caps at new relative lows and large caps breaking out. However, there are exceptions to this rule, like the 1998 low. This could mean the market is treating the March banking crisis similarly to 1998’s LTCM collapse and subsequent Fed easing resulting in two more years of rising equities — this is possible, but not probable in our view.

Looking at tactical trade ideas for the summer, the prevailing soft-landing narrative could lead to a rebound in small caps, cyclical sectors and emerging market equity relative to US mega-caps. A possible strategy here could be to start taking profits from high-performing big tech stocks and shift some of the proceeds towards lagging small caps. Given the extreme performance dispersion, this trade may also exhibit better risk/return characteristics in unfavorable market scenarios. If we were to implement such a trade, we would likely keep the overall equity exposure unchanged at neutral levels.

Chart

The chart provided by Bank of America impressively depicts how the relative price of the Nasdaq 100 (Big Tech) vs. the Russell 2000 (Small Caps) has reached the peak of the dot.com bubble of March 2000. Similarly, JPM reports that systematic CTA positioning of Nasdaq vs Russell 2000 is now at historical extremes.