- 2023 got off to a much better start than most (including us) expected, and sentiment has flipped drastically to expectations of a soft landing.

- While the fundamental data is deteriorating (leading economic indicators keep worsening and corporate earnings have likely entered earnings recession), markets are pricing in a Goldilocks environment.

- Powell was inconsistent in his February press conference and did little to push back against the easing of financial conditions.

- Historically speaking, a transitory Goldilocks period is not uncommon prior to recessions. Today, disinflation, China’s reopening and US Debt Ceiling liquidity mechanics are the main drivers.

- That said, it remains our view that a hard landing is not priced into earnings expectations, credit spreads or equity index levels.

- Signs of excessive optimism and FOMO are plentiful. The transitory Goldilocks drivers seem fully discounted by now. A VIX Index of around 18 is a sign of complacency.

- Stocks, bonds and gold can all rally together as long as there is no Fed pushback or extreme (hot/cold) macro data – but the hard landing risk implies that eventually, only gold and bonds will keep going.

Goldilocks climax – Markets do not believe Powell anymore

- This rally has been fueled by repositioning after heavy tax-loss selling in December, systematic flows and massive short covering.

- It is being led by last year’s laggards such as Big Tech, but even more so by high-beta, unprofitable tech – the infamous ARK Innovation ETF is up +42% in USD YTD as at 02.02.2023.

- Financial conditions have eased significantly. The Bloomberg US Financial Conditions Index is back at levels prior to the invasion of Ukraine.

- More than 80% of stocks in the NYSE composite are above their 50-day moving average. The last time this happened was in August 2022. Back then, what followed for the Index was a16% leg lower into October.

Market Development

World

- We are observing weak forward-looking growth data from the US (ISM, Retail Sales, Leading Index) and UK and more mixed numbers in Europe.

- As expected, the Fed hiked by 25 bps, raising the target range for the Fed Funds rate to 4.50-4.75%. This slowed the pace of tightening, compared to the 50-bps rate hike in December and the 75-bps rate hike earlier in 2022.

- When asked about the easing in financial conditions – which could make it hard for the central bank to curb high inflation – Powell didn’t sound particularly alarmed.

- That said, he repeated that Fed members’ expectations are still that rate cuts in 2023 will not be appropriate – the markets clearly don’t believe him and are already pricing ~50bps cuts for H2 this year from an expected peak rate of ~5% in June.

Europe

- The ECB hiked by 50bps, committed itself to another 50-bps increase in March and will then review the policy path.

- The plunge in gas prices has taken the risk of an imminent energy crisis in Europe off the table and has reduced headline inflation. However, core inflation remains stuck at record highs.

- Contrary to consensus expectations, the Eurozone economy expanded by 0.1% in Q4 of 2022, even though Germany’s GDP contracted.

Switzerland

The Manufacturing PMI fell sharply in January, dropping below the growth threshold of 50 points for the first time since July 2020. In comparison to the previous month, the index dropped from 54.5 to 49.3 points. Consensus expectations, which had even assumed an increase to 54.8 points, were therefore massively undercut. All subcomponents declined compared with the previous month.

A hard landing usually looks like a soft landing at first

Fed Chair Powell had an opportunity to aggressively push back against the stock market rally, investor overconfidence and the easing of financial conditions. Instead, he only delivered a nuanced, hawkish message.

As a consequence the risk rally is once again forcing investors to abandon their fundamental discipline in fear of missing out. They are pinning their hopes on an easing cycle that should start later this year, coupled with a simultaneous soft landing. Meanwhile European and Asian policymakers as well as investors are convincing themselves they can “decouple” from whatever happens in the US.

As we have been saying, the transition from an inflation scare to a recession scare usually takes a few quarters and is often accompanied by Goldilocks rallies lasting several months.

The problem is that virtually every recession starts as a soft landing, but not all soft landings end in a recession.

The first innings of a recession usually looks like a soft landing:

- The labor market weakens, but not yet enough to generate job losses

- Earnings decline, but not yet into deeply negative YoY territory

- Inflation drops, but not yet in a recessionary manner

When we look at the current earning season, we are already seeing clear evidence of weakness. According to Morgan Stanley, cost growth is rising faster than sales growth in ~80% of S&P 500 industry groups. As a result, margin pressure is worsening and could lead to negative EPS growth this quarter for the first time since the COVID-19 recession. EBIT margins for 2023 have fallen 1.2% for the S&P 500 since the end of last year.

We are also seeing some big reversals in the FX space post the latest central bank meetings, with the USD gaining strength. Should this continue (right now, it is too early to tell), it could signal the end of the easing period for financial conditions which started in October last year.

In a recent note, BNP Paribas also reminds us that the last time, the NASDAQ was up more than 10% in January was in 2001 (after a significant multiple contraction in the previous year). The NASDAQ then continued to go down by more than 50% for the rest of 2001. While we certainly do not have such a negative view, our base case remains that a hard landing in the US is probable and has not been accounted for in risk market pricing – at current levels, risk compensation for equities is poor.

Positioning

We recognize real positives for risk assets (disinflation; European energy crisis avoided; China reopening, a Fed pause likely in Q2, which we had been expecting for some time now, as well as temporary liquidity support resulting from US debt ceiling dynamics). So, there is a path to get inflation under control without causing a sharp contraction in economic activity, however, in our view, that path remains very narrow. Right now, markets instead are fully pricing in this narrow path, which makes the market vulnerable to another leg lower, potentially already in Q1.

The reality is that the Fed is still doing USD 95bn a month in quantitative tightening and will likely not cut rates without a hard landing. The other reality is that growth is not just slowing modestly but is re-accelerating to the downside. Risks are clearly evolving, based on the possibility that inflation could flare up again during the next few months, and that the US economy may face a deeper recession in the second half of 2023 when consensus is fully committed to the soft landing narrative.

While in hindsight we would have liked to enter 2023 with a tactically higher equity quota, we are happy that our sizeable gold position is partly compensating for this. It seems to us that gold has entered a bullish regime (albeit short-term overbought), with the business cycle turning lower and a peak in real yields and the dollar.

A VIX Index at a level of 18 shows that a lot of optimism is priced in – for us this seems like an opportune time to think about implementing long put hedges.

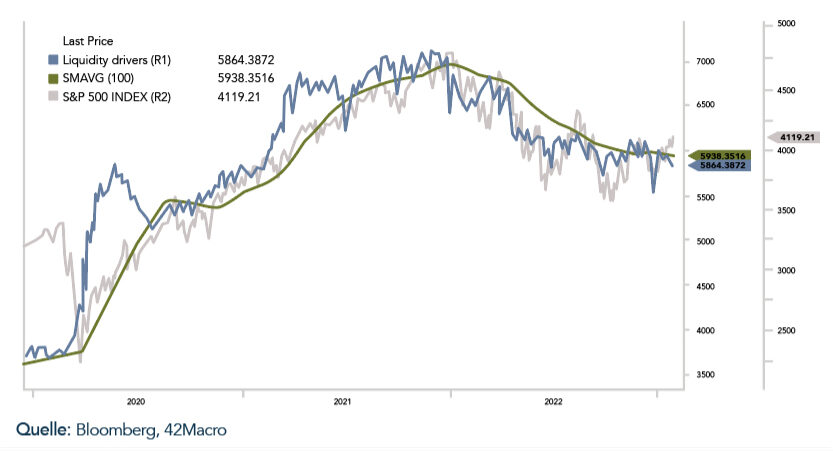

Chart

We are following macro42’s liquidity drivers index to gauge where we are in the liquidity cycle. To our surprise, liquidity conditions have stabilized in the past 2 months (note how the green line is no longer falling sharply) – a huge boost for a Goldilocks environment. The main driver behind this is the drawdown in the US Treasury General Account, since the US Treasury cannot issue net-new debt at the moment. This drawdown is increasing liquidity in the banking system and is currently neutralizing the Fed’s QT. Once a new debt ceiling limit is decided upon, this will flip into reverse and drain liquidity from markets.