- A steep drop in yields on the back of slowing growth and inflation sparked one of the strongest November S&P 500 rallies in the past 90 years, amid a renewed Goldilocks market environment.

- Global bonds had one of their best months since the 2008 financial crisis.

- The CBOE Volatility Index – better known as the VIX or Wall Street’s “fear gauge”– dropped to its lowest close since January 2020.

- While the financial media speaks about a soft landing, we are not yet convinced and think changing liquidity conditions better explain the recent performance.

- The Conference Board Leading Economic Index continues to fall, declining in October for the 19th consecutive month – a streak only surpassed during the 2008 and 1974 recessions.

Strong equity rebound in November

- The dollar is down by nearly 3% in November, heading for its worst month in a year as the developing narrative of the Federal Reserve cutting interest rates in 2024 sets the tone.

- After three months of rising yields and declining equities, systematic strategies entered the month heavily short equities and bonds. The rapid yield reversal has since forced them to cover their short positions. This cohort of market participants is now fully invested and can no longer be expected to be a tailwind for equities.

- In hindsight, the trigger for this development can arguably be found in the US Treasury’s quarterly refinancing announcement, made in early November.

Market Development

World

- Based on the technical picture, the November rally looks almost like panic-buying marked by the fear-of-missing out, with many chart-gaps left to be filled.

- The “Magnificent 7” tech giants now account for 29% of the S&P 500, an all-time high in terms of market concentration, according to Goldman Sachs.

- US households still have an estimated USD 433 billion in excess savings remaining from the 2020-21 stimulus programs.

- The latest Mastercard SpendingPulse report found that US retail sales on Black Friday were up 2.5% year on year (YoY), with e-commerce sales rising 8.5% YoY. Adobe Analytics also shows that online sales were up 7.5% YoY. (Note that none of these figures have been adjusted for inflation.)

Europe

- In the last week of November, new German data showed cooling inflation, supporting bets that the ECB will not be raising interest rates again.

- In recent months, several real-time indicators (e.g. purchasing managers indices, industrial production figures) underscored the probability that the Eurozone could already be in a real recession. Interestingly, survey-based “soft data” has stopped deteriorating – suggesting the possibility that the Eurozone could be stabilizing in Q1.

Switzerland

- Swiss banks will be subject to updated capital adequacy requirements from January 2025, when the final Basel III standards of the international Basel Committee on Banking Supervision will be transposed into Swiss law.

- The Basel III reforms centers on the premise that risky areas of the banking business must be backed with more capital (and less risky areas with less capital). According to an awp press release, the Swiss banking sector should not expect any significant change in the total capital requirements. However, capital requirements for UBS – now the only major Swiss bank since the takeover of Credit Suisse – are expected to increase.

It’s all about liquidity – at least in the short term

November’s strong equity performance has shifted the consensus-based probability of a “soft landing or no landing” to 74%, according to the November 2023 Bank of America (BofA) Global Fund Manager Survey. While we have always kept an open mind about such a benign outcome, we still see a significantly lower probability of it materializing.

We would argue that historically, the transition from a “higher-for-longer” regime to an eventual recession first appeared as a soft landing, as inflation and growth slow simultaneously.

We would agree, with the view of BofA’s chief investment strategist, Michael Hartnett, that the 10-year US yield could be a good indicator to gauge where we are in this transition:

“While a [10yr] yield of 4% to 5% means easier financial conditions and ‘risk on’ for markets, one that drops to the 3% to 4% range would bring on recession talk and a bearish risk for markets.”

The world above 5%, 10-year US Government bond yields would also be problematic as it would likely be derived from reaccelerating inflation.

The Fed has been on hold since July, and the market is pricing in rate cuts for next year. However, the Fed won’t likely cut rates unless at least one of the following happens:

- Inflation falls to its target of 2%

- The US economy enters a recession, markets are volatile and the Fed has to come to the rescue

In the past, the following sequence of events was the norm in nearly every instance: the Fed raises rates and pauses; a recession starts; the Fed cuts rates several times; only then markets go higher.

Looking beyond the seemingly endless discussion of a soft versus hard landing, we do want to highlight that much of the recent equity moves can be explained by changes in the often obscure liquidity factor.

- The time when the market began to rally coincided with the Treasury’s decision to fund much of the huge current fiscal deficit by using treasury bills.

- Funding large amounts of the deficit with bills as opposed to longer-term debt has allowed money market funds to absorb the new supply of government debt, providing a liquidity boost to the banking system. You can think of it as bringing “idle cash” from Fed accounts back into the banking system via the issuance of these short-term bills.

- With the Treasury’s most recent quarterly refunding announcement, the government implied it would continue skewing issuance towards bills. Coupled with ~USD 870 billion of “idle cash” remaining, the current market development can continue for the time being.

Positioning

You may recall that in our last market view, we highlighted a weaker dollar and declining bond yields as necessary conditions for a risk rally. While both of these have played out, we are surprised by the magnitude of it. Without the pro-cyclical liquidity injections mentioned before, risk assets would likely be in a much more precarious spot.

The question of a recession will be what is ultimately important for stocks. In the interim, favorable liquidity conditions could continue to provide tailwinds once the current overbought conditions are worked out. We have been pointing towards the time window of November 2023 to April 2024 as for when the yield curve points to a beginning recession in the US.

The current market complacency thus seems like an opportune time to look for cheap hedges for the next 6-9 months. Indeed, one has to wonder how much lower the VIX (currently at 12.9) can go. In the ultra-low-volatility year of 2017, it struggled to stay below 10.

The return of volatility may indeed be one of the features of 2024, not least due to high political uncertainty.

2024 will be a major election year in countries that account for:

- 80% of the world’s market capitalization

- 60% of the world’s gross domestic product

- 40% of the world’s population, including Taiwan, Indonesia, Russia, Korea, India, South Africa, the EU, Mexico, the US and the UK

We will leave you with a quote of the late great Charlie Munger of Berkshire Hathaway:

“The world is full of foolish gamblers and they will not do as well as the patient investors.”

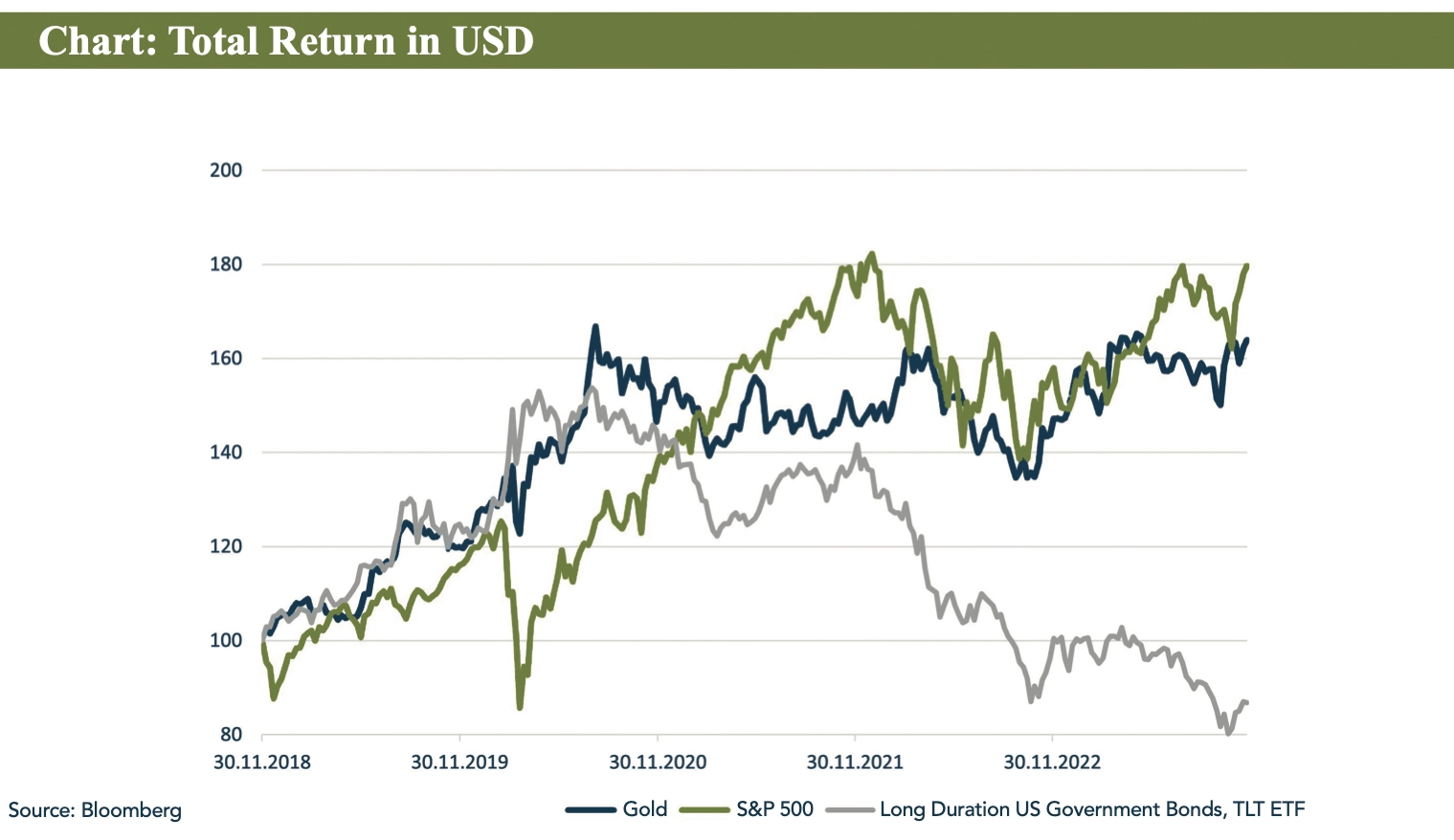

Chart

This chart sums up why we prefer gold as our primary portfolio diversifier and have allocated significant portions of our portfolios to the precious metal in recent years. Note the equity-like returns but non-correlation to equities. Gold has even taken the rising-rates environment in stride (unlike long-duration bonds “TLT”) and is now holding just below all-time highs.