- US equity markets performed better than most experts (including us) expected.

- The S&P 500 is now boasting a 5-month winning streak. In hindsight, the Fed’s reaction to the SVB collapse in March was the time to take on a higher than neutral equity weighting as the “Fed Put” got reinstated.

- We observe an overall risk-on sentiment shift, driven by optimism around a potential peak in interest rates as inflation cools faster than expected and as US economic growth remains upbeat compared to Europe and China.

- For example, Fed Chair Powell is now visibly more confident in a soft landing and the Fed staff is no longer projecting a US recession.

- At the same time, the US leading economic indicators are down for the 15th consecutive month – the longest decline since 2008. Additionally, the US was just stripped of its AAA rating by Fitch as budget deficits swell and the Fed’s recent loan officer survey is showing further credit tightening.

- The bottom line is that we acknowledge the recent “green shoots” in macro and market data but also note that it is too soon to dismiss the risk of a hard landing when putting the current cycle into historic context. We therefore remain mindful not to fall prey to easy market narratives.

All-time highs next for the S&P 500?)

- The equity market realised very little volatility in July, which in turn makes hedging via options attractive.

- Money has been flowing aggressively to US Tech, driven by the AI story and Goldilocks data.

- Goldman Sachs notes that we have just seen the largest 6-month increase in margin leverage on record, according to data from FINRA (the US Financial Industry Regulatory Authority).

- This alone shows the strong bullish momentum and could potentially lead the way to test prior all-time highs in Q3.

Market Development

World

- Positive US economic surprises are running high vs. Europe and China. The Q2 US GDP grew +2.4% QoQ vs. +1.8% BBG consensus expectations. While US consumption and income slowed, government spending ramped up further – as of Q2, the 12 months US budget deficit is running at -8.5% of GDP (the largest outside of the GFC and Covid, with Bloomberg data going back to 1970). These deficits will become increasingly costlier to finance and are not a recipe to tame inflation in the long term.

- In this context, we note that Fitch Ratings downgraded the US to AA+ from AAA (echoing a move by S&P Global Ratings in 2011), citing fiscal deterioration, high and growing govt debt burden, and erosion of governance relative to AA & AAA rated peers. Our first take is that this will have limited impact, since AA+ and AAA are treated very similarly in terms of collateralisation by institutional players.

- The recent decision by the Bank of Japan to relax its yield curve control policy (under which it maintains a cap on interest rates across the curve) is more significant for global bond markets. This is an important pivot in our view, as it is incrementally hawkish for global bond markets and liquidity conditions.

Europe

The Eurozone’s economy outperformed expectations in Q2, with GDP increasing by 0.3% quarter over quarter (annualized 1.2%). Economists had predicted a smaller rise. However, the figures should be interpreted cautiously as Irish GDP heavily skewed the data once again, with a growth of 3.3%. Excluding this, the Eurozone’s growth would have been half the rate, falling below its potential. Germany’s GDP stagnated, Italy’s shrank by (-0.3%), while France (+0.5%) and Spain (+0.4%) experienced higher growth rates.

Switzerland

The Swiss industry experienced a significant decline in sentiment during July, with the corresponding indicator reaching its lowest point since April 2009. The service sector also faced a more challenging situation. In July, the Purchasing Managers’ Index (PMI) for the industrial sector dropped sharply by 6.4 points, falling to 38.5, according to a report from Credit Suisse. Economists surveyed by the news agency AWP had predicted higher values in the range of 42.0 to 44.5 points.

The summer of disinflation – is a soft-landing now a foregone conclusion?

The resilience of the US economy this year, despite the most aggressive Fed tightening cycle in decades, has forced many market commentators to repeatedly delay their recession calls. Now, with recent data showing persistent strength in hiring alongside moderating inflation, Wall Street firms are rethinking their economic-downturn calls altogether.

The soft-landing thinking goes:

- Inflation quickly and sustainably falls back to central bank targets

- Central banks therefore will take it easy on further tightening and can ease on-time to prevent meaningful deterioration of the credit cycle and prior to the nearing corporate maturity wall

- In the meantime, fiscal policy will remain expansive and keep the economy afloat

- Therefore, equity markets can look through a soft earnings patch and valuation multiples can keep rising

We think a lot has to keep going right to produce such an outcome. Admittedly, most things have gone right for markets since the regional banking crisis in March. In turn, a benign outcome has now become consensus. However, how reasonable is it to expect 2024 will have +12.5% S&P 500 earnings growth and 4-5 Fed rate cuts? (This is currently the Refinitiv analyst earnings consensus and Fed Futures market pricing).

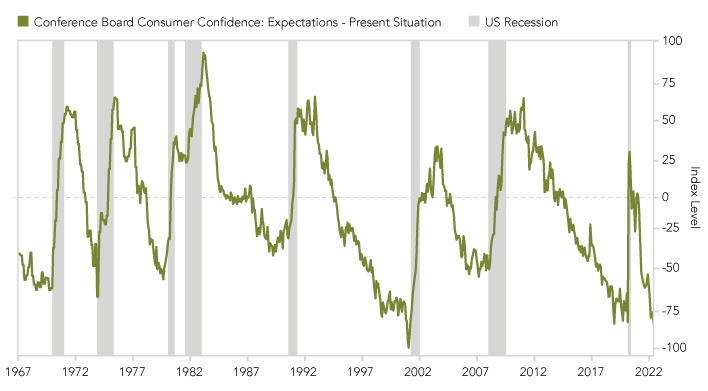

For a long time now we have had the view that a hard landing is the most probable outcome and should begin around year end 2023 to Q1 2024 based on forward looking indicators.

For now, it seems likely that US growth holds up through Q3. That in turn may also lead to upside inflation surprises and a disappointingly hawkish Fed in the autumn. Adding to this potential yield pressure is a likely increase in duration supply through the end of the year as the US Treasury shifts from issuing mostly short-term bills to more long-term bonds. Note the US Treasury projects another USD 1.8 trillion additional borrowing until year end.

The crucial question is how long the US consumer can remain resilient (our most favoured macro research houses estimate the consumer will run out of excess savings around November).

Hightower Naples shared these very interesting observations:

- The average interest rate on a new car loan just hit a record 7.2%.

- The average new car payment in the US is now USD 750 and the average new mortgage payment is USD 2,850.

- This means that an American who wants a new car and house is paying USD 3.600/month after a 20% downpayment.

- That is 62% of the median household income in the US.

Positioning

Given the Goldilocks environment of late (meaning downside surprises in inflation and a potential recession is being pushed out relative to consensus expectation), equities can continue to grind higher until late cycle dynamics finally catch up to the markets. There is even an upside scenario where we are in a new cyclical upturn and growth is about to reaccelerate for both the economy and earnings (so far, 2023 has only been a story of higher valuations).

That said, we find it premature to exclude a possible hard landing (the historically most probable outcome) at this point, given that we are just now entering the time window when the hard landing would historically have started. Based on history, this time window for a beginning recession starts approximately 13 months after the US yield curve has sustainably inverted and stretches for 8 months. Therefore history would deem it “normal” for a recession to begin at some point from now until late Q1 2024.

Given this macro uncertainty around the economic and central bank policy outcome, we keep an overall close to neutral risk allocation and look to continue our rotation into lagging sectors and single stocks with less demanding valuations for a possible relative performance catch-up.

Interestingly in this respect is that over the past month the worst performing YTD sectors (Energy, Utilities, Health Care) have started to exhibit overall improvements – according to Morgan Stanley.

Chart

The Fed’s Q2 Senior Loan Officer Opinion Survey on Bank Lending, released in late July, indicates a continued tightening of bank lending standards for loans during the second quarter. Historically, such tighter standards have been linked to negative loan growth, declining GDP, increased defaults and wider credit spreads. Surprisingly, in this cycle so far, there is a striking contrast as high-yield credit spreads have even decreased despite the significant tightening observed in the survey.