Markets have been rallying on the promise of more central bank asset purchases and hopes of lockdown relaxations while the real economy is still fighting for survival. At its peak the S&P 500 gained +30% from the lows in March.

The first set of Q1 earnings has been coming in weak. For example, Q1 earnings of JPMorgan have fallen to the lowest levels in more than six years.

While we are not inclined to “fight the Fed”, we advise caution regarding broad equity markets as historically bear-market rallies tend to fail around here and there is still plenty of uncertainty surrounding the severity and duration of the economic shock.

Recent Developments

- The Fed has entered new spheres of market support with its announcement to buy junk bonds via High Yield ETFs.

- Companies will qualify if they had an investment-grade rating on March 22 and have since been downgraded to BB+, BB or BB-. Obviously an attempt to cushion the big wave of coming “fallen angels”.

- Buying sub-investment grade credit goes far beyond simply providing market liquidity. Down the road this will lead to divergences between the market, sentiment, and fundamentals. Moral hazard could become a problem. (In economics, moral hazard occurs when an actor has an incentive to take more risk because they do not bear the full costs of that risk.)

- That said, the Fed had enough reasons to do it as the weak oil market remains a big headwind for the energy sector and the credit market in general.

- The Rating agency Fitch sees overall 2020 high yield default rates between 5%-6% and then rising to 7%-8% in 2021.

- Energy default rates are expected to reach 17% in 2020, near the record 19.7% of January 2017.

- US President Donald Trump wants to reopen parts of the US economy beginning on May 1st, a suggestion that Jamie Dimon quickly dismissed. The CEO of JP Morgan reckons that such an opening would come too soon. There should first be plans how to «carefully» return people to work when the time is right.

- President Trump has frozen funds for the World Health Organization (WHO), which he sharply criticizes as being to “China-centric”. Not the best lay-up for the coming G7 call on a coordinated international response to the pandemic.

- OPEC+ countries have agreed to cut oil output by 9.7 million barrel per day in May and June. Despite the deal, oil prices have not yet stabilized. The lack of demand simply outweighs the projected supply cuts at the moment and storage capacity is shrinking week by week.

- The Fed has entered new spheres of market support with its announcement to buy junk bonds via High Yield ETFs.

Economic Data

Unsurprisingly economic data and corporate earnings are coming in weak.

- In its April economic outlook, the IMF expects the global economy is to shrink by 3.0% during 2020 which would mark the steepest downturn since the Great Depression of the 1930s. The big difference is of course that this time it was an active political decision to shut down the economy.

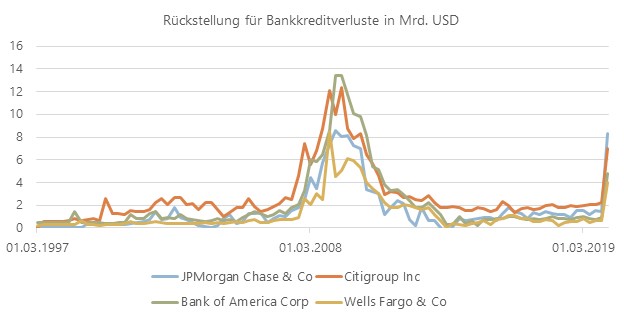

- The big US Banks all disclosed a sizable decline in Q1 earnings (-40 % YoY and more). This is partly due to loss provisions for their loan exposure.

- While JPMorgan was fairly aggressive in their loan provision, taking a hit nearly as large as in 2008, other banks (Bank of America, Citigroup, Wells Fargo) were (so far) more modest in their actions.

- The magnitude of the provisions may be an indication of rising loan defaults and corporate bankruptcies in the months to come.

Source: Bloomberg

- While the Q1 earnings season is just starting, we already note that many S&P 500 companies are suspending their forward guidance for this year. This means uncertainty around forward earnings will remain high for the foreseeable future.

- US retail sales for March plunged 8.7 % – a record.

- At least the latest Chinese data was encouraging: PMI indices surged in March albeit from very low levels and external trade figures were better than feared (-6% YoY for exports, -1% YoY for imports). More on the Chinese activity pick-up in the Appendix.

Assessment

Markets are at a pivotal point. The rally has worked off the oversold conditions from late March and turned Wall Street analysts bullish on the margin.

- Goldman Sachs: “Unlikely to make new lows”

- Morgan Stanley: “Pullbacks should be bought”

- JP Morgan: “All-time highs next year”

- Piper Sandler: “Bear market has concluded”

The S&P 500 is now at the 50% retracement of the March crash, a level where bear market rallies tend to get into trouble. Furthermore, the oil price has not participated in the recent up-move in equities, something one would like to see if the markets were to price a fundamental economic recovery.

In consequence, the risk-return profile of broad equity markets, to us, seems a less attractive than it was a few weeks ago.

That said, the commitment of the Federal Reserve must not be underestimated. The market can still push higher from here, however counter-intuitive it may seem given the human and economic hardship we are seeing in the news day by day.

No bear market in history has ever seen central banks this aggressive and this pro-active. The powerful Federal Reserve has made clear that it is willing to do whatever it takes to support the markets and prop up inflation expectations. Frankly, they are already in too deep to step back now and inflation seems like the only way out of the massive debt load.

So-called Yield Curve control and even equity purchases via ETFs (as the Bank of Japan is doing for many years now) are potential next steps for the Fed if we were to see another sizable shock to markets.

The large-caps (and mega caps especially) will likely remain the main beneficiaries of these kind of policies. This becomes evident when we look at the Russell 2000 Index (small caps) which is still down YTD -28% compared to -13% in the S&P 500 (large caps).

If the “easy money” and “no alternative” narratives take hold, there is potential for a strong push into equities no matter the fundamental outlook of the underlying companies, given that many market participants are underinvested (see Bank of America’s Survey of April in the Appendix).

However, before that, there is probably still a lot of volatility (up and down) to trade through. We are still far from returning to a normal social and economic life.

Amid all this uncertainty we have been deploying cash mostly by adding and buying into quality balance sheets and strong business models. We continue to feel confident about this strategy and will keep an open mind on market developments.

Your FINAD CIO Team

Source: Bloomberg, The Market Ear, JP Morgan, Hightower Advisors, Morgan Stanley, The Morning Brew, Kepler Cheuvreux, Bank of America, PineBridge Investments, Sanford Bernstein, Fitch Ratings

Appendix

Market Sentiment

A total of 183 participants, who oversee USD 545 billion in assets, took part in the April Bank of America global fund manager survey. Their pessimism over the pandemic’s economic damage is at extreme levels with cash positions the highest since the 9/11 terrorist attacks and equity allocation the lowest since March 2009. Most participants (93%) expect a global recession in 2020.

- The survey shows cash levels jumping to 5.9% in April from 5.1% in March.

- When predicting the pace of the recovery, 52% of those polled expect it to be U-shaped, compared with just 15% who see a more rapid, V-shaped rebound. 22% expect it to be W-shaped.

- The majority believes GDP down revisions are over, but global earnings downgrades are just starting.

- On balance sheets, 79% want companies to improve their financial strength, the highest level in 20 years. Just 5% want corporate buybacks, which is the lowest in 20 years.

- For biggest tail risk, 57% see second wave of the virus as top risk, followed by 30% fearing a systemic credit event.

China activity

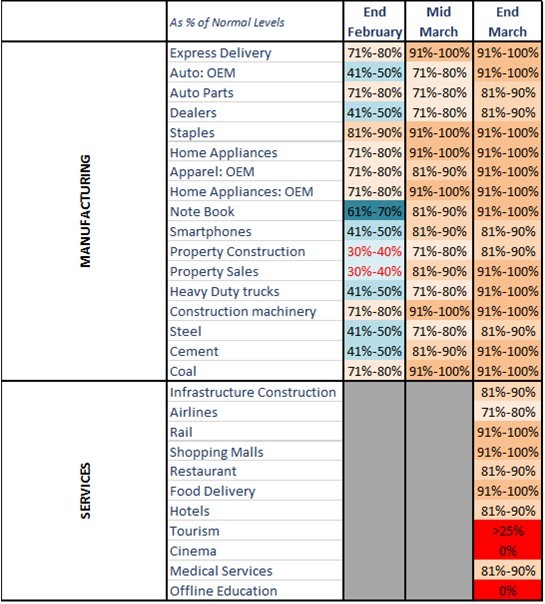

According to analysts at PineBridge Investments production activities in the Chinese manufacturing sector have already reached 85-95% of pre-coronavirus levels.

Services sector providers have ramped up their operational capacity to 75-85%.

- The transition phase in the manufacturing sector seems to have been 2 months from complete shutdown to close to pre-crisis levels.

- Overall activity in the services sector is increasing as well but with a lag.

- Certain sub sectors are still in a near complete shutdown (tourism, cinemas, offline education). A sign that social life is only coming back slowly as social distancing measures will remain in place for the foreseeable future.