Low interest rates, high stock prices and uncertain outlook are the factors which lead many investors to look for alternatives to stocks or bonds. Some are discovering private equity as an investment alternative. What are the reasons? Below, we explain, in an uncomplicated way, what you should know before making an investment.

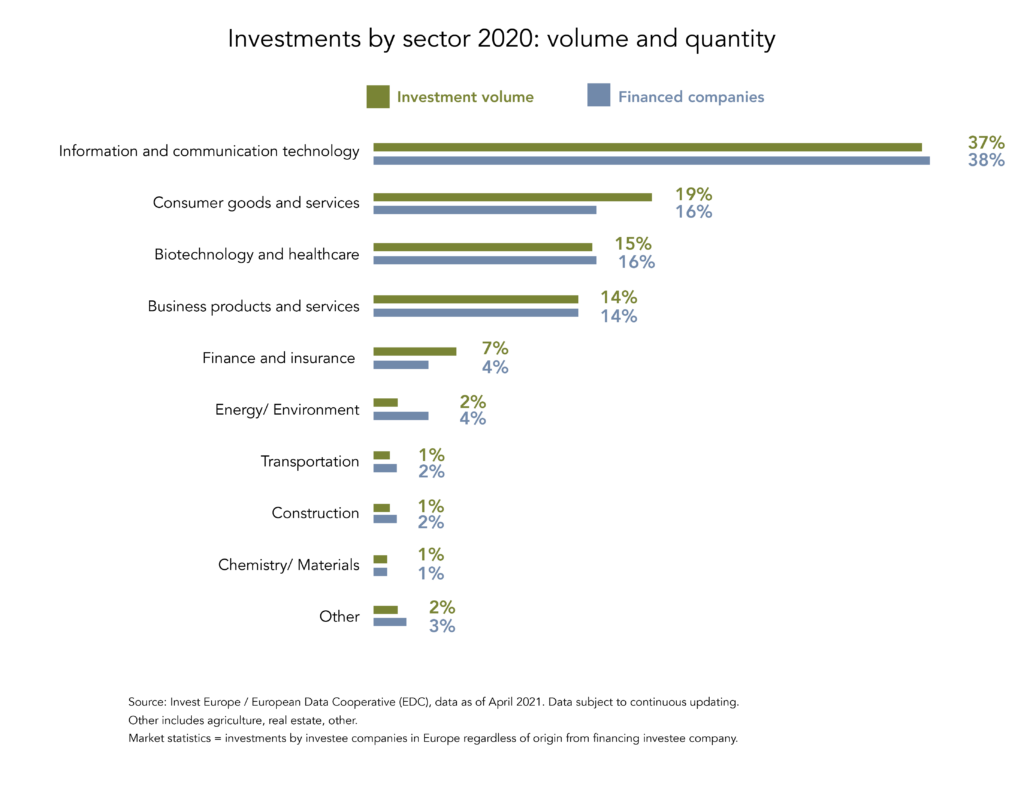

Private equity refers to over-the-counter equity or private equity capital. Investors acquire an interest directly in a company or indirectly (by means of a Fund or a Private equity company) in several companies – from its foundation to bridging financing, to an IPO or management buyout. Generally, the shares are not listed and are traded over-the-counter. This takes place with most companies in Europe: from promising startups looking for seed money or growth capital to market-leading SMEs which need funds for research and development or an acquisition. In 2020, private equity investors financed more than 8000 companies in Europe, for an amount of around 88 billion euros (source: Invest Europe und European Data Cooperative).

The Benefits of Private Equity

Thanks to its low correlation with traditional asset classes, private equity makes sense as a complementary investment for high net worth investors. As the investment value depends less on the short-term ups and downs of the stock markets and develops independently of prices or returns, your portfolio is diversified through company investments and the risk-return ratio is optimized. Primarily, direct private equity investments allow for additional returns in the long term, because in many companies the majority of value creation takes place before the IPO. Furthermore, as an investor, you can have more influence on decisions, you can support your company with your know-how and expertise or provide new business opportunities thanks to your network. With respect to indirect investments, in general, the fund company or private equity company handles these tasks for you, representing your interests.

Downsides of Private Equity

Private equity investments require staying power. An investment horizon of around ten years is to be taken into account, as well as low or negative return in the first few years. Regardless of whether your investment in venture capital is in a startup or in growth capital for an SME. As the secondary market is less liquid, it is unlikely to find yourself in the situation of suddenly having to withdraw the capital. Moreover, private companies are subject to less strict regulations and are required to report less frequently and less transparently on their business compared to publicly traded companies.

Choosing a Partner Carefully

When compared with other types of investment, private equity is riskier and requires more perseverance. Thus, informed due diligence is crucial for your investment decisions. Regardless of whether you invest in a company, in a private equity company or in a private equity fund. These financial, legal, tax and economic assessments require months, as well as industry knowledge, experience, technical expertise and a good network. That is why professionals should assess the company or fund in all the details before investing. Indeed, due diligence separates the wheat from the chaff.

Private Equity for Private Investors

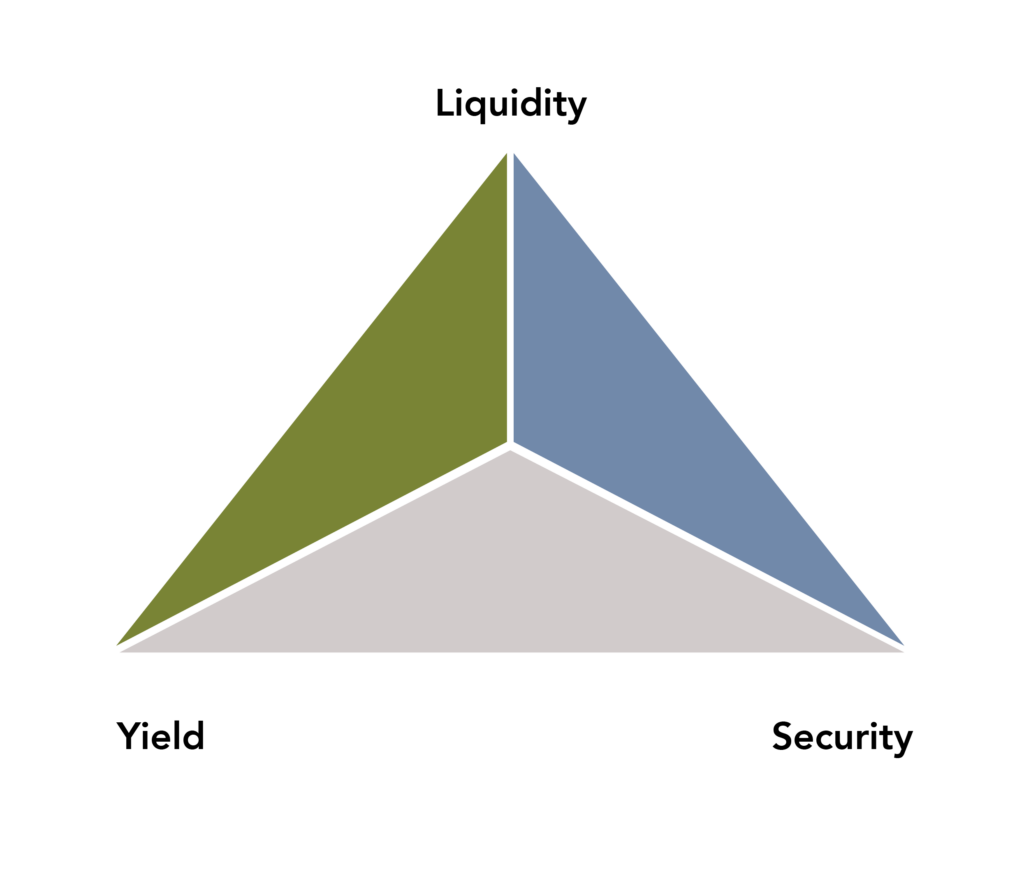

Private equity allows for a better balance of return, liquidity and security, thus optimizing the magic triangle of financial investments and sensibly complementing traditional investments. For a long time, private market investments were the prerogative of institutional investors and wealthy private investors. In Switzerland, the Swiss Financial Market Supervisory Authority only allows qualified investors to invest in private equity. Among other criteria, in order to qualify, investors must have at least CHF 500,000 in bankable assets. That is why there are dedicated investment funds or FinTech startups for private investors, who can, or prefer to, invest less. The recommendation of many asset managers is that a 5 percent investment in private equity requires assets of at least CHF 1 million, corresponding to an investment of CHF 50,000.

Is Private Equity Suitable for You?

Private equity does not suit everyone. We recommend investing in companies, whether directly or indirectly if, as a private investor, you have assets of CHF 5 million or more, based on a long-term investment horizon and an above-average risk appetite. You should consider private equity if your desire is to optimize the diversification of your portfolio, spread the risk and take advantage of attractive return opportunities. If you lack time, motivation and/or the know-how, an independent consultant can advise you. As well as reviewing and recommending investment opportunities, they will bring the right professionals on board, manage your projects from due diligence to the signing of the contract and fine-tune all private equity investments.

“Private equity is a matter of trust and is suitable for the portfolio diversification purposes of high net worth investors, with assets starting from five million Francs or Euros.”