- It is no secret that 2022 was an historically bad year for global stocks and bonds, with unprecedented market-value losses and the worst total returns in more than a decade.

- The technology and growth focused Nasdaq 100 led on the way down, closing the year at -32.4% in USD.

- In 2023, we are expecting a shift in narrative from inflation and rates shock to recession and credit worries, amid a still unfinished bear market. That said, we also see the potential for multi-month goldilocks rallies in the transition period.

- The Fed’s priority is controlling inflation and weakening the labor market to reach a supply-demand balance. Deliberately slowing aggregate demand into a potential recession is its chosen way to achieve these goals.

- China’s reopening will be one of the banner stories of the first half of 2023. Global rates markets may show concern about its inflationary impact.

Another hawkish shift by the Fed and ECB

The December FOMC meeting was surprisingly restrictive, relative to consensus expectations, suggesting a willingness to keep monetary policy tighter for longer rather than proactively easing as in previous cycles. Likewise, the December projections of the federal funds rate (dot-plot) underscored the fact that the FOMC had turned even more hawkish, with seven of its members signaling that they see the target rate higher than 5.25%.

In the Eurozone, Lagarde said that rate-hike increments of 50bps looked about right for a period of time and that the ECB was “in for a long game” and a steady pace. This implies that if the ECB had to draw its own dot-plot chart today, it would probably show the deposit rate at 3.5% by the end of 2023, i.e. another 150bp of rate hikes.

Market Development

World

- 2022 was the worst year in the history of the Bloomberg US Aggregate Bond Index at -13%, and 2021 and 2022 were the first consecutive years of negative total return (since data first began in 1976).

- Last year, European stocks steadily gained ground versus US stocks amid a longer-term downtrend. Cheaper valuations provided a cushion and the stronger dollar and a relative lack of tech (6% weighting in the Stoxx 600 versus 26% in the S&P 500) helped too.

- The global IPO market suffered as liquidity dried up, with global IPO proceeds down 61% from 2021, according to EY.

Europe

While a cold spell punished North America in December, the weather in Europe turned much milder. This led to reduced demand for heating and a surprise rise in natural gas inventories. The continent’s gas reservoirs are now approx. 30 ppts fuller than they were a year ago. It would now take an extraordinary turn of events to see the somewhat catastrophic zero-gas outcome that some had feared in the summer of 2022.

Switzerland

The PMI continues to signal sustained growth in the manufacturing sector. The value published in December was 54.1 points (vs. consensus expectations of 53), an increase of 0.2 points compared to November. The industrial PMI therefore remained above the growth threshold of 50 points throughout 2022.

Watch out for a re-steepening of the US yield curve in 2023

Given the delayed effects of the unprecedented tightening that started in 2022, we think a recession is likely in the US, Eurozone and the UK in 2023 – with the US potentially avoiding it until late in the second half of the year in our view. In contrast, growth in EMs should hold up better, especially in Asia, where the inflationary pressures have been more benign, and China is reopening.

The former President of the Federal Reserve Bank of New York, William Dudley, who was spot on when predicting the unprecedented tightening last year, said the following in an interview with Bloomberg on January 3rd 2023: “A recession is pretty likely just because of what the Fed has to do [tightening for longer to control inflation]. But what’s different this time I think is that if we have a recession, it’s going to be a Fed-induced recession and the Fed can end the recession by subsequently easing monetary policy.”

Yield curve flattening was arguably one of the big stories of 2022, but over recent weeks the curve has started to steepen once again and that might be the true harbinger of a recession. In past cycle ends, Fed rate hikes slowed the economy to the point that markets eventually predicted future rate cuts, thereby inverting the curve. Once the Fed recognized a recession was coming, they stopped the rate hike cycle and the market started to anticipate immediate cuts. The resulting re-steepening of the curve is historically a timelier signal of a recession than the initial inversion.

So as a potential recession approaches, will we finally see the credit cycle turning lower as is often associated with hard landings? High-yield spreads remain elevated compared to cycle lows and are comparable to levels reached in the correction in late 2018, but they’re still nowhere near the levels typically reached in recessions associated with extreme financial market stress. To us, this makes sense as the massive stimulus that followed the pandemic has left businesses and consumers with a liquidity cushion. While we are expecting credit spreads to widen and default rates to rise from low levels, we do not expect a credit crisis associated with the need for broad, forced deleveraging. The result should be a “mild” recession in the end.

Positioning

One of our favored Wall Street strategists, Mike Wilson from Morgan Stanley, who has been far ahead of the pack in predicting the beginning and various turns of this bear market, still holds a negative view on equities based on fundamental risks that have yet to be priced in. Mr. Wilson sees the S&P 500 pricing in the 2023 earnings risk sometime in the first quarter and reaching a trough at 3,000 to 3,300. While we are not expecting a drawdown that severe (our remaining buy limit is around 3,385), we agree that consensus earnings expectations are too high, given our macro outlook. In this context, we would also refer to a recent Bank of America note that the stock market typically bottoms six months before the end of a recession.

We believe that a tradeable multi-month bottom could become evident in the first half of 2023 as the liquidity cycle bottoms and turns upwards. In this context, the USD may already have peaked. In the meantime, we will continue to shift away from beta exposure to single names that we see as best positioned for this outlook.

Chart

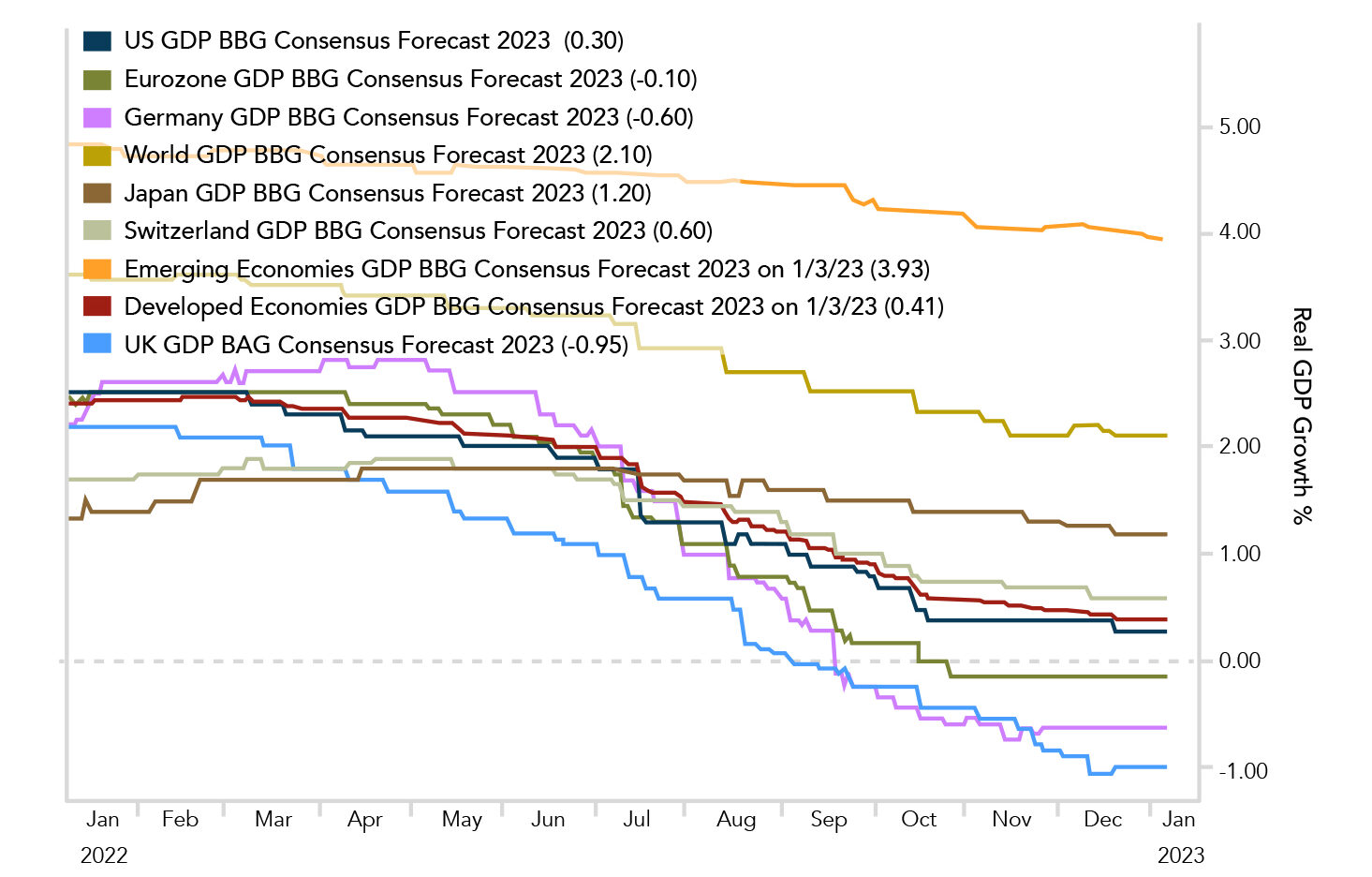

While 2022 started out with consensus GDP growth expectations above the long-term trend (which turned out to be far too optimistic), the reverse is true at the start of 2023. The chart depicts the declining real GDP growth forecasts for 2023 over time. Clearly, developed economies are expected to have much weaker growth than emerging economies.