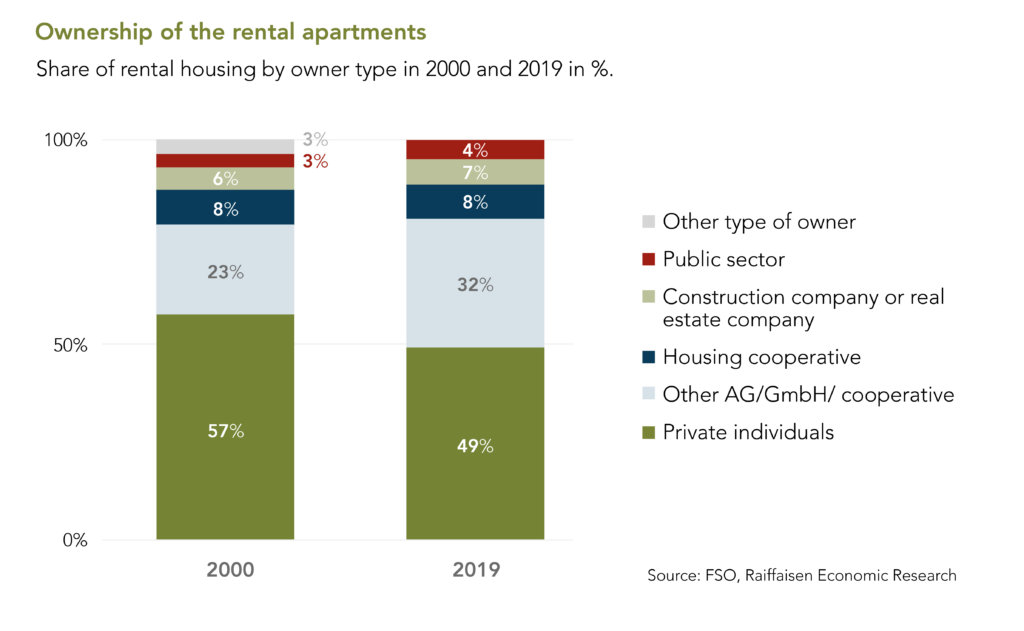

Almost half of all rental apartments in Switzerland belong to private individuals. The ratio has fallen from 57 to 49 percent between 2000 and 2019, because investment and pension funds have been looking for alternative investments and are investing in multi-family homes. However, real estate is still very popular with private investors. What are the investment opportunities available, and what are the differences?

There are at least three good reasons for investing in real estate at the moment: Real estate …

- … is more profitable than other asset classes such as bonds in times of low interest rates,

- … protects you against inflation as a real value thanks to rising real estate prices and

- … correlates less with asset classes such as shares, reducing the overall risk.

That is why every broadly diversified portfolio includes real estate investments. Also, and especially, in the context of the current tense geopolitical situation. You can invest in real estate directly, indirectly or along with others.

Direct real estate investing

Private individuals not only own and rent multi-family houses with apartments, but increasingly also condominiums and single-family houses. One in six homes financed by a mortgage is rented. And the trend is growing. A direct investment in real estate promises regular returns thanks to the rental income and increases in value thanks to high demand. However, properties must be managed, rented and well maintained. As a result, your return forecasts must also take into account the administrative and restructuring costs. Before you buy and rent a property, you should seek information on regional vacancy risks and returns and talk to a trusted real estate partner with specific knowledge of the market and the area. Potentially, apartments have a higher return than houses, while commercial properties are the most profitable.

Indirect real estate investing

If you prefer to spread the risk over many properties or you don’t want to worry about your properties, private investors can take advantage of some alternatives:

- Units of real estate funds or shares of real estate companies allow you to invest indirectly in a basket of real estate. These can include developed or undeveloped land, office buildings, commercial properties or residential buildings, whether in the country or abroad. Although real estate investments are intended for the long-term, you should make sure that the shares are traded on a stock exchange and that the market is liquid.

- Real estate ETFs are designed to track the performance of an index. Thus, ETFs invest according to a specific ratio in real estate funds or real estate companies. Unlike funds, ETFs are passively managed and if the real estate share is high, they correlate more strongly with the equity market. In Switzerland, only a few real estate ETFs are traded. Abroad, as well as to the exchange rate risk, you are also subject to currency risk.

- A Real Estate Investment Trust owns, finances and manages real estate. REITs can offer higher returns compared to other indirect real estate investments due to the fact that they are subject to lower regulations. They are also less diversified than funds. In Switzerland, no REIT is traded. If, for example, you invest in REITs in the US or Germany, you need to consider the volatility of stock prices and currencies.

Investing in real estate with others

A Club Deal combines the benefits of direct and indirect real estate investments. An independent consultant looks for private individuals with the aim of acquiring attractive real estate together or to develop and rent or sell attractive real estate projects. For example, co-investors may buy land together, build a block of apartments and sell or rent the apartments in the condominium. The investment horizon is determined at the beginning and risk is calculable. The goal is a return on equity of up to 15-20 percent per year, depending on the Club Deal structure and the property. The same co-investors may also buy several properties or develop projects at the same time without having to worry about dealing with operational duties. Thus, risk is minimised and returns optimised.

Crowd investing is a new form of co-ownership. On online platforms, private investors can buy shares in apartment buildings, commercial properties or building land (from CHF 100,000, including land register entry) and share the purchase price and the monthly payments.

Conclusion

Choosing the right real estate investment depends on many factors. If you prefer to remain in control and make every decision on your own, you should invest directly. If you don’t have the time, you should invest indirectly, so that part of the work and responsibility is delegated. However, this means that you are only partially in control. That is why an independent consultant can become an important resource: they can thoroughly examine all real estate investments, they are well connected in the real estate field and, as well as being familiar with real estate issues, they are also used to deal with tax and succession matters. This way, you are sure that your real estate investment will pay off.

“Wealthy investors who are already invested in real estate and would like to increase the diversification of their portfolio should consider a Club Deal.”