Land is a non-renewable and therefore valuable commodity per se. Furthermore, standing on one’s own land has a special emotional meaning for many people. Land is a very direct form of property. In this respect, people have always sought to acquire and increase ownership of real estate.

At FINAD, we have been advising our clients for many years to invest a high proportion of their assets in tangible assets. In addition to shares, gold or classic car collections, these should naturally include above all real estate in all possible forms, from residential to commercial property to agricultural and forestry land, and this worldwide. At FINAD we have partners who have an extended expertise in real estate investments and even run agricultural and forestry operations themselves. Due to the large number of investments made by our clients in recent years, we have acquired extensive knowledge of international real estate. In addition, FINAD has established a large network of real estate specialists for individual markets and sectors.

Residential and commercial real estate

A growing population combined with increasing prosperity has triggered a high demand for residential property over the last 10-15 years, especially in the residential sector. A property in the world’s major conurbations has almost always been a good investment in recent decades. Many cities suffer from a shortage of housing; therefore, property prices have risen sharply in recent years. However, the increasing decoupling of property prices and income is increasing the risk of falling prices. It is precisely because of the exploding housing costs in many cities that restrictions on the power of disposal over real estate are increasingly enshrined in law, often above all for foreigners. Switzerland has a long tradition of restricting the movement of property on the real estate market, and Austria is also rather restrictive, especially in tourist areas or in the case of agricultural and forestry land. Denmark has long since restricted the opportunities for foreigners to buy property, New Zealand recently moved on to such restrictions.

In some countries like Germany, to some part due to the reunification, larger packages of rental properties came on the market, which were easy to finance due to the low interest rates. As a result, the price of residential property has been developing at an ever faster rate, which in our opinion, exacerbated by the current situation of the coronavirus, could last even longer, provided that the legal restrictions mentioned above are not applied excessively. However, one must not forget that such price spirals always find an end, as in Spain 2011.

Commercial properties are more complex as an investment, because there are many other factors besides the location, such as reusability for new tenants, quality of tenants, changes in the economic environment and consumer behaviour can have a direct influence on the value of a property. Such effects can currently be observed in hotels and restaurants due to the COVID-related restrictions. In many countries, the pandemic leads to the closure of hotels, which are no longer able to pay their rent, and tenant waivers for restaurants, which in some countries even have a legal basis.

In order to be protected against such unexpected risk scenarios, we work with our clients to determine their risk appetite and investment objectives very precisely. On this basis, we have been able to evaluate and acquire residential and commercial real estate in Germany, Spain, England, Scandinavia and the USA for our customers in recent years.

One of the most important aspects of real estate acquisition is the often underestimated management, which is an important component of a high-yield property. This is not only true for the administration-intensive agriculture, but for all types of real estate. Trustworthy professional administrations are rare and often very busy. Thanks to our long-standing network of partners, we have already been able to offer support to many customers.

Another important point is the analysis of the tax and inheritance aspects of a real estate acquisition abroad. FINAD’s work includes not only the evaluation (due diligence) of the property and support in legal and tax issues after the acquisition, but also the supervision of the third-party partners then entrusted with the management of the property.

Agriculture and forestry

Investments in agriculture and forestry are investments in real estate as well as in raw materials, namely wood and/or food. This is what makes these objects so interesting from our point of view. In addition, there is the relatively new possibility of storing CO2 in forests, which has also been discovered as a business model.

In recent years, our clients have invested in agricultural and forestry land in Germany and Austria, the Czech Republic and Slovakia, Sweden and Norway, Eastern Canada and the USA, Uruguay and Argentina. In addition, areas in Latvia, Scotland, France and Italy have been offered on a sporadic basis, which we have looked at.

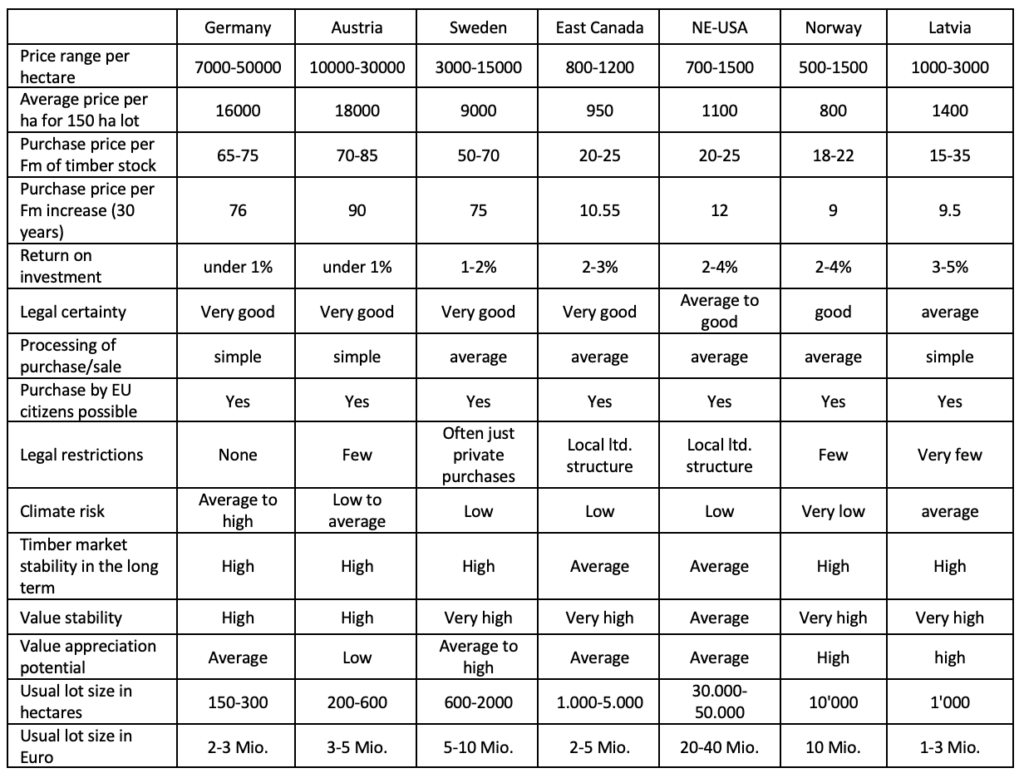

The first question is usually about the price. In our experience, however, a comparison of the prices per hectare is not very useful, as both the timber stock and the increase in timber must be taken into account when comparing prices. The following table should nevertheless try to give an overview. Countries where land acquisition has become difficult for foreigners, such as New Zealand, or which are politically unstable, such as Africa or South America, are not included.

In Europe, particularly in Germany, Austria and Sweden, but also in Italy and France, the price per hectare runs through a curve, depending on the size of the area. Example Germany:

Very small areas up to 10 or max. 20 hectares are about twice as expensive as areas between 20 and 75 hectares (own hunting territory). Small hunts between 75 and 200 hectares are in turn more expensive in relation to the price per hectare than very large hunts.

Very small forest areas and smaller own hunts are acquired in regard to a hobby and less due to economic reasons. The combination of a secure “piggy bank” and recreational value drives up the bids. From a certain size onwards, the “small investors” fall out and mainly buyers with economic interests remain. These then drop out again from their own hunting size, as the price jump is not representable for them. From a size of more than 500 hectares the profitability plays a role again and the hobbyist surcharge falls off. An investment in agriculture and forestry is therefore rarely without emotion. A classic case for an independent, objective consultant…

Conclusions

After dealing with lessons learnt from the Corona crisis in our series, we would like to conclude by picking out two crucial, current aspects of a real estate investment:

In the discussion about property taxes, real estate is often considered “easy prey”, as it is immovable according to its name, i.e. it cannot escape taxation as easily as movable assets. This risk can only be minimised by an appropriate geographical spread of real estate assets. This is why the international orientation of our services is so important to us.

For many investors, the need for a good investment is complemented by the desire to own an asset in a part of the world that offers security, stability and refuge in times of crisis. The Corona crisis has taught us how the shutdown, especially on a national level, not only led to economic restrictions, but above all, within just a few days, to a massive restriction of personal freedom and the freedom to travel. A “flight” to New Zealand, for example, would probably have been almost impossible to organise. Even crossing EU borders became almost impossible without the right passport or family members in the specific country. Especially if you are planning real estate for a personal or family crisis scenario, you should also consider which countries would be accessible in such a case, how and in what time frame.

by Dr. Clemens Gregor and Dr. Dominik Lamezan-Salins