- The bigger picture remains one of a slowing global recovery. However, given a possible peak of the Delta variant in the US in August, high-frequency data is now showing signs of a re-acceleration of economic activity, at least in the short term.

- Inflation pressure has been stabilizing but it will take 3-6 months to get a clearer picture of inflation “stickiness”. The current spike in energy prices is raising uncertainty with regard to that particular outlook.

- The US is nearing the fiscal cliff (debt ceiling, stimulus delay, possible government shutdown) in October.

- The Fed has made clear that it really wants to start tapering this year.

- Meanwhile, the China credit impulse is expected to switch from negative to positive in Q4 which means that China could therefore become the only major region turning more accommodative.

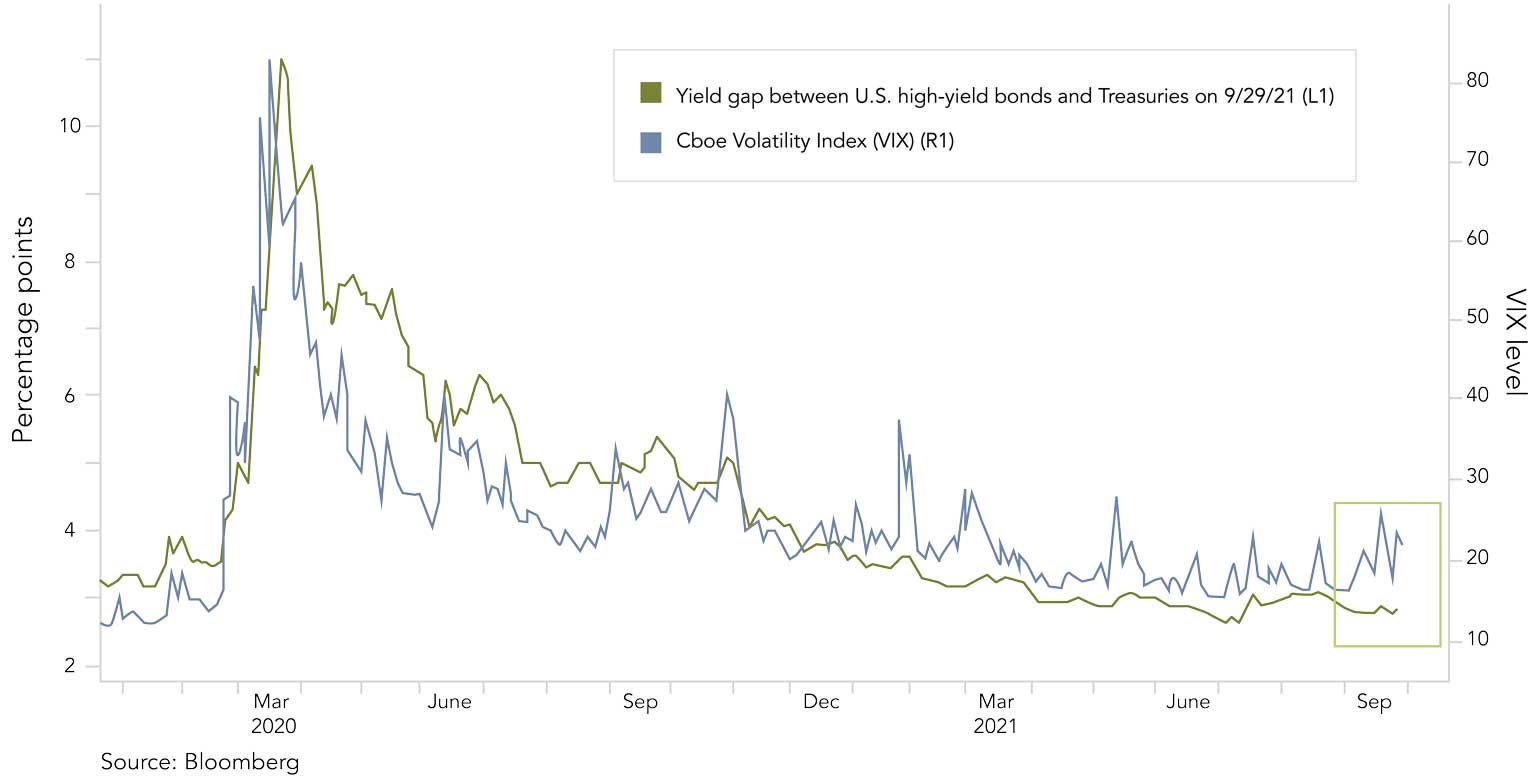

- The low-volatility regime of the past 6 months seems to be over. That said, a year ago investors would have shrugged at a 5% equity pullback.

- The US 10-year yield has risen rapidly by 20 bps to 1.5% within a week.

- After the Evergrande scare, markets now need to digest the fast-paced taper timeline indicated by Jerome Powell during the September FOMC conference. In addition, uncertainty in Washington is increasing with regard to the debt ceiling extension and the size of further fiscal stimulus.

World

- Market sentiment has become very bearish, but credit markets (CDS and TED spreads) don’t support the “China contagion fears”, neither do Chinese consumers or the banking leverage situation.

- The most likely outcome to the Evergrande situation is an organized restructuring, underpinned by state-owned enterprises and local governments.

- In the US, the Q3 earnings season is approaching. The hurdle for further positive earnings surprises has risen considerably and earnings revisions have flattened out in September.

- Liquidity conditions remain supportive in the near term but are set to become notably tighter in a month or two.

- For some time therefore, the current equity pullback could be the last one that rewards short-term dip-buying.

Europe

- Natural gas prices in the UK remain close to highs. Winter is approaching and the EU’s energy crunch remains unfixed. Higher input costs increase EPS downgrade risks.

- European clean energy stocks could see renewed inflows following the elections in Germany.

Switzerland

After recovering somewhat in the previous month, Swiss goods exports again suffered a setback in August. Adjusted for prices, exports decreased by 0.4% in the reporting month. Overall, the export sector has gradually lost momentum since the beginning of the year. Since March of this year, exports of goods have declined in three out of six months.

Last time, we wrote about the possible transition to a more volatile and uncertain environment. Markets are currently being driven by rapidly changing narratives, all of which are filled with immense uncertainty.

To name just a few: stagflation, the China real estate crisis, the energy crunch, political chaos in Washington, and a possible taper tantrum. As a consequence, financial news flow and investor sentiment has become very negative, despite markets remaining within 5% of their all-time highs.

In our view, the overarching backdrop that breeds such narratives is characterized by declining global growth, supply chain bottlenecks and weakened consumer sentiment, given the fact that the pandemic is still very much present. The divergence between “real world” and market-implied expectations is playing a key role in this regard. For example, based on a New York Fed Survey, US consumers are expecting a one-year forward inflation of +5%, whereas the market-implied 1-year forward expectation is “just” +2.6%, a substantial divergence.

Likewise, another New York Fed Survey shows a significant divergence in the expected path of QE tapering. While Jerome Powell hinted at a fast-paced reduction of asset purchases – possibly ending by the middle of next year, the survey among primary dealers (the biggest US banks) shows an average expected length of 10-11 months, which represents a striking difference.

We believe it is this potential rapid tightening of financial conditions that is the most important driver of markets at the moment. This would also explain the notable increase in nominal bond yields while breakeven inflation expectations have remained stable.

Further developments that support the notion of tightening liquidity conditions towards the end of the year:

- The drawdown of the Treasury General Account is now more or less complete (no more “on-the-shelf liquidity”).

- Treasury issuance will pick up significantly once the US debt ceiling is eventually extended (potentially exceeding monthly Fed purchases).

While not our base case, a 5-10% correction in equity markets (back to the 200-day moving average in the S&P 500) wouldn’t be extreme in any way, given the backdrop described and given how far and quickly stocks have risen from their pandemic lows.

The key question is: what would it take to knock the U.S. recovery off course and send Federal Reserve policy makers back to the drawing board for monetary stimulus?

Compared to the hopeful optimism at the start of the year (remember the “roaring 20s” headlines?), it is now a twilight zone for markets as 2021 approaches its end. The ongoing supply shock, big shifts in Chinese policy, a persistently endemic COVID-19, fiscal delay in the US and approaching QE tapering are complex forces that need to be navigated.

Ironically, the immense “wall of worry” associated with these narratives has considerable potential to push equity markets higher once more, just when everyone is looking to the downside. Liquidity conditions will still support the “no alternative” mantra for stocks at least for the next 1-2 months.

Looking further into the future, the prospect of liquidity-tightening after nearly two years of U.S. and European quantitative easing could create a potential challenge in the case of valuation premiums associated with our preferred equity segment – high-quality stocks.

We are therefore considering taking profits in selective single names and moving some equity exposure into broad market ETFs.

Stock investors (proxied by the S&P 500) show a degree of worry that is largely absent in bonds. While the VIX recorded a four-month high on the basis of “Evergrande fears”, the yield spread for the Bloomberg U.S. Corporate High Yield Index remained near a 14-year low that it reached in July.

Sources: Bloomberg, Barclays, Morgan Stanley, Kepler Cheuvreux, Nordea, Goldman Sachs, The Market Ear, ZKB, Credit Suisse

FINAD CIO Team