Executive Summary

- Global equities continued their upward momentum in February, with US mega-cap tech stocks leading the market.

- Economic indicators in the US are showing signs of strength, with the Leading Economic Index no longer signaling a recession ahead. In addition, prominent figures have expressed confidence in AI’s ability to sustainably boost productivity.

- Inflationary pressures in the US have resurfaced, prompting a more cautious approach from the Federal Reserve regarding interest rate cuts.

- In our view, the market environment favors US risk assets (in particular high-quality growth stocks) when we look at factors such as excess fiscal spending, rising liquidity and improving productivity growth.

- Stretched sentiment and technical factors, however, suggest an increased likelihood of tactical corrections. At this time, we consider those as buying opportunities.

- The cryptocurrency market has experienced a resurgence

- The Swiss National Bank may opt for rate cuts ahead of the European Central Bank.

- Key risks include geopolitical tensions and a potential revival of inflation, which could strain economic conditions. However, our prevailing assumption is that disinflation will continue over time.

US exceptionalism continues on macro and equity level

- The trends observed in January continued. Momentum stocks in the US outperformed while the broader US market experienced a 5% increase. Global value stocks trailed behind growth stocks by more than 3%, as reported by HCP Asset Management.

- So far this year, the equal-weighted S&P 500 has trailed the capital-weighted version by close to 4%.

- Gains in the S&P 500 index were largely influenced by the top five stocks, which accounted for half.

- Despite talk of a possible US tech bubble, it’s interesting to see that much of the US mega-cap tech dominance continues to be justified by earnings, according to ).

- In the Q4 2023 earnings season, aggregate earnings for European companies fell short by 2% while their US counterparts exceeded expectations by 7%.

- JPM further highlighted that much of the impressive earnings performance could be attributed to the “Magnificent 7” stocks. When excluded, S&P 500 earnings per share (EPS) growth stands at -2% year on year.

- Analysts also concluded that since mid-2023, the superior earnings and sales performance in the US contributed to substantial outperformance when compared with European equities.

Market Development

World

- The Conference Board’s Leading Economic Index is no longer signaling a US recession. For the first time in two years, six of ten component indicators have made positive contributions to growth over the past six months.

- More big names in finance, notably Jamie Dimon and Bill Gross, voiced their conviction that AI does increase productivity growth. We agree but more hard data is needed to answer this question conclusively.

- After several months of disinflation, the Fed’s preferred gauge of underlying inflation rose in January at the fastest pace in nearly a year, explaining policymakers’ more patient approach to cuts.

- Core personal consumption expenditures (PCE), excluding volatile food and energy, increased 0.4% since December – and 2.8% year on year.

- This was the last PCE report issued before Fed officials meet on March 19-20. Chair Jerome Powell and his colleagues have effectively ruled out a rate cut, with investors now leaning towards June.

Europe

Steno Research took a closer look at wage trends in Germany vs. the US. The German IFO employment barometer, known for its reliability in indicating wage trends, has significantly dropped. The decline is evident across the services, manufacturing and construction sectors, and well below pre-pandemic levels. This stands in stark contrast to the US, where the NFIB (National Federation of Independent Business) compensation plan survey suggests a potential acceleration in wage trends among small and medium-sized enterprises, particularly the 80% that are heavily reliant on services.

Switzerland

Will the SNB cut rates before the ECB? Swiss inflation dropped (the CPI was at 1.3% year on year in January) and is expected to stabilize around 1%, in line with the SNB’s target of less than 2%. SNB currency objectives, crucial for policy decisions, need to align with other central banks’ rate cuts to prevent currency appreciation and the threat of deflation. Pantheon Economics anticipates the SNB may act first, starting with cuts of 25 basis points on March 21, 50 in June and 25 in September.

A brief look at top-of-mind questions for investors at the moment

Is a new US tech bubble forming?

We agree with Citi analysts who, in response to comparisons between the current bull market and tech bubble, highlight that today’s valuation multiples are notably lower than those in 1999-2000. The underlying market fundamentals have changed, setting the current scenario apart from that period in time. However, they believe it is premature to judge whether spending increases on generative AI infrastructure and products will result in additional revenue and growth drivers. Fidelity’s Jurrien Timmer also notes that the top 50 companies in the S&P 500 are trading at a trailing earnings multiple of 27.8x, while the bottom 450 are at 21.2x. In effect, the P/E premium of the top 50 has dropped to 31%, down from 44% last year. These relative valuations are lower than the 90% premium seen in 2000 – or in 1975, when the original “nifty 50” term was coined.

How is China doing?

China is experiencing outright deflation and struggling to stabilize its property market. Chinese policymakers have adopted a strategy reminiscent of Japan’s approach in the 1990s, aiming to lower interest rates in the hopes of encouraging the private sector to deleverage and take on more debt. However, this strategy may prove ineffective as seen in Japan, where despite the slashing of interest rates from 8% to nearly 0%, housing prices continued to decline as households were hesitant to take on new mortgages, regardless of low rates. Investor newsletter The Macro Compass argues that China should consider implementing targeted fiscal stimulus, and we agree. By pursuing the wrong policy mix, China risks pushing yields lower without effectively supporting its economy, which could have adverse effects on countries with significant trade relationships with and a heavy reliance on Chinese foreign direct investments. It also notes that the next major volatility event may occur in emerging markets (e.g. Brazil) or countries closely linked to China (e.g. Australia).

What happens if the Republicans sweep the US elections?

Unless one party gains control of both Congress and the White House, major domestic policy changes that directly affect investors are unlikely. But if one party takes control, there could be significant policy implications, according to Morgan Stanley. A GOP sweep could, for example, increase the likelihood that the 2022 Inflation Reduction Act is repealed, posing a challenge to the clean-tech sector. Tax cuts could also be extended to potentially benefit small caps and domestically focused sectors. Finally, a sweep could drive foreign policy that disrupts trends in global trade through tariffs and reconfigured geopolitical alliances. This could incentivize on- and near-shoring, creating incremental cost challenges for multinational companies.

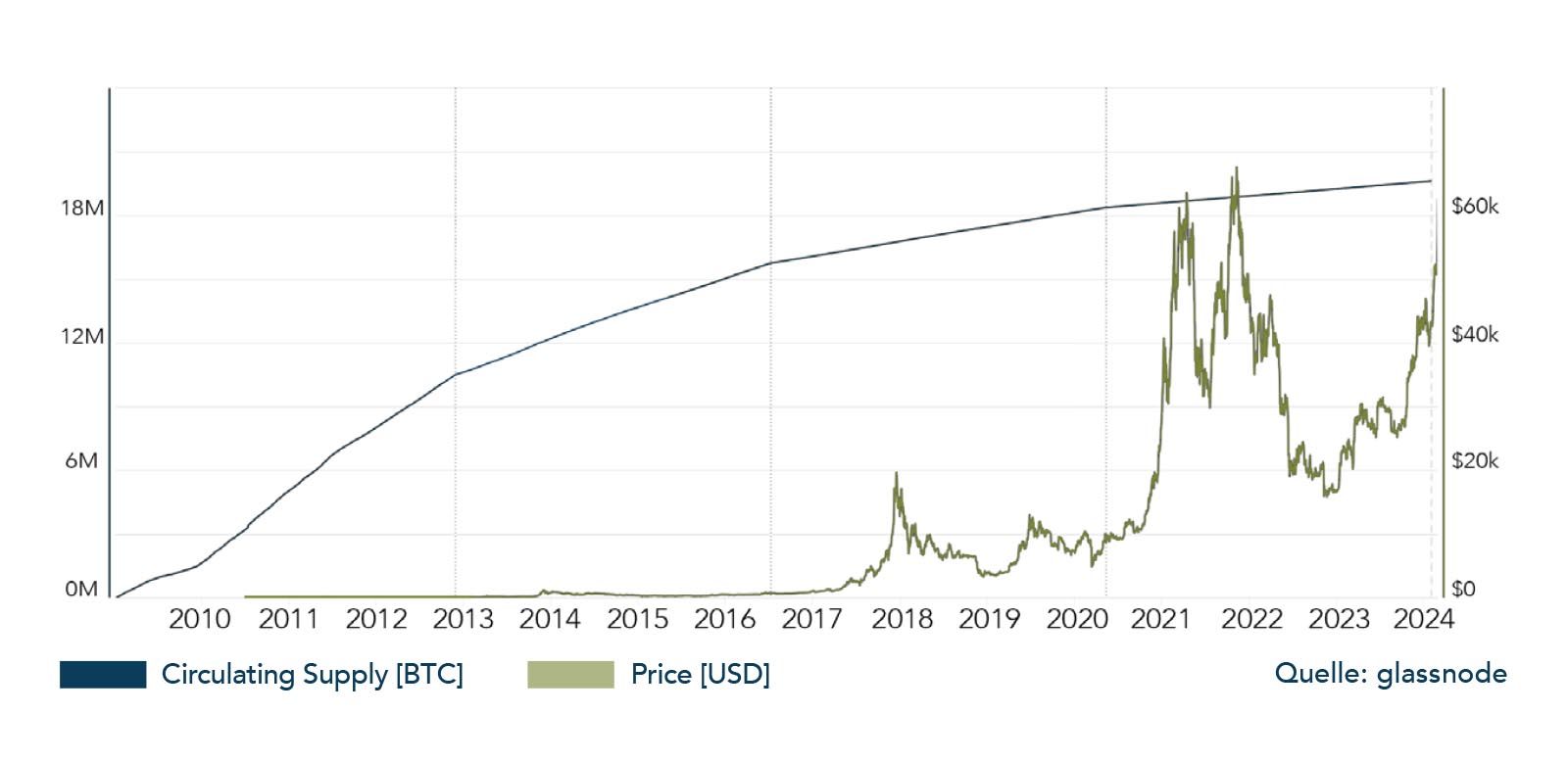

Is the crypto market roaring again?

Driven by the launch of several spot ETFs in the US, Bitcoin has been up by almost 50% in the first two months of 2024. At the time of writing, the price stood at USD 63,000, the highest level since November 2021 and about 7.5% below its all-time high. Since approval on January 10, the AUM of ten ETFs swelled to USD 20 billion, half of which are from BlackRock’s product. If demand stays constant – with the supply of new coins cut in half at the next halving in late April – we expect Bitcoin to reach a new record this year. Another important milestone will be the potential SEC approval of the first two Ethereum ETFs in the US at the end of May. Should this happen, a similar supply-demand imbalance could unfold for Ether.

Positioning

We are observing a combination of factors, including excess fiscal spending, rising liquidity, improving productivity growth, driving market stories (e.g. AI and anti-obesity drugs) and the Fed’s more market-friendly stance, all of which result in heightened investor confidence and a generally favorable backdrop for risk assets. We expect this to persist in the coming months.

While we like the fundamentals of this new bull market, which started in November 2023, we also recognize that much has been quickly priced in – and the sentiment and technical factors are beginning to look stretched from a tactical perspective. For that reason, we are waiting for price pullbacks of 5-10% to increase our quota further. We note that markets can also correct through time via prolonged choppy sideways movements, thereby working off overbought conditions and moderating sentiment.

While many investors hope for a broadening equity market, we recommend keeping the focus on high-quality growth stocks. In the absence of extreme valuations or a significant catalyst, the “Magnificent 7” (or 6) are likely to maintain their dominance.

- Nvidia continued to impress with its staggering year-over-year earnings growth of nearly 500% in the latest quarter, with earnings expected to double again in the current fiscal year. This underscores the significant investments being made, particularly by large data-center companies in their infrastructure.

- In our opinion, the AI theme and anticipated productivity gains are likely to remain prominent topics throughout much of 2024.

- However, it’s crucial to note that investors are heavily immersed in this theme, with hedge funds showing substantial net long positions and retail investors engaging in speculative activities, including zero-day expiration options. The situation creates vulnerability, and any negative news could prompt sharp sell-offs.

We maintain that the key risks to our bullish outlook are geopolitical escalations and a revival of inflation that could scare the Fed into prolonged tightening or tightening further, thereby putting too much strain on the economy. For now, our working hypothesis is that January will prove to be an outlier, and disinflation will continue over time – just not in a straight line.

Chart

Since approval on January 10, the ten new spot ETFs have acquired more than 310,000 Bitcoins, or nearly seven times the number of 45,000 new coins mined. Within this short period of time, these ETFs have scooped up approximately 1.6% of all Bitcoins in existence. At the next Bitcoin halving in late April, the number of new coins mined daily will drop from 900 to 450.