The attentive reader of the current economic news notices that the media write mainly about the stock markets. Even in private discussions among investors, there is often a discussion about which stocks are currently being bet on and which stocks have realized large profits in the past. But the world of financial investments does not only revolve around exchange-traded shares.

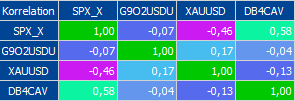

Basically, the different areas in which investments are made are divided into different asset classes, such as liquidity, equities, bonds, real estate, precious metals and alternative investments. Each asset class has its own characteristics and the exposure to certain risks is different. As a result, asset classes react differently depending on market conditions and the correlation between them is either synchronous (positive correlation) or opposite (negative correlation). However, this applies not only to individual asset classes, but also to individual security selection within these classes.

Source: S&P 500, NYSE US 10 Year Treasury Futures Total Return Index, ounce of gold, WTI Oil

The chart shows that gold (XAUUSD), for example, correlated negatively with the performance of the S&P500 Index (SPX_X) in the first two months 2020 by a factor of -0.34. Thus, it can be stated that in that for equities negative timeframe, gold has developed positively. The same applies to the 10-year US Treasuries, which increased less than gold, but still performed positively.

For this reason, diversification, i.e. the distribution of risk, is a key element in strategic asset allocation. Diversification should not only distribute risk among asset classes, but also among countries, currencies, industries, issuers, maturities, etc. Diversification also aims to smooth volatility (the extent of price fluctuations).

To avoid getting lost in the tactical details, it is necessary to define the basic strategy. The strategic orientation depends strongly on the customer situation, risk tolerance and risk capacity. For this purpose, the risk and investment profile is defined together with the customer in personal meetings to define the appropriate strategic orientation. In this context, further wishes are also defined, such as the exclusion of certain industries, the inclusion of sustainable investments or conformity with Islam.

Above a certain asset size, it makes sense to have several asset managers managing the assets. This can be done either by managers specialized in one asset class (“single asset class manager”) or by managers specialized in several asset classes (“multi asset class manager”). On the one hand, the expertise of certain asset classes can thus be distributed (also with regard to industry, geography or subject area) and, on the other hand, tactical risk is spread across several shoulders. When using several managers, it is even more important not to lose the overall strategic overview. This means that a consolidated view of all assets must be available and compliance with the strategic asset allocation must be constantly monitored. This usually involves defining an overall strategy across all assets, which is broken down to the individual managers.

FINAD can help you to define a strategic asset allocation based on your personal situation, taking into account your risk capacity and tolerance and any other wishes and restrictions. FINAD is also able to select and monitor other asset managers through its network using our own consolidation software. Thus, FINAD can help you to smooth the volatility of assets through diversification and risk distribution in order to achieve long-term asset preservation or growth through the right strategy.