Executive Summary

- The S&P 500 is trading near all-time highs thanks to strong earnings and a handful of well-known stocks that have staged a tremendous rally so far in 2024.

- Politics are driving markets in the US and Europe. Biden’s weak performance in the June presidential debate intensified doubts about his candidacy and questions about a possible replacement.

- No matter the election outcome, the US is experiencing an era of fiscal dominance, characterized by deficits amounting to around 5-8% of GDP with no end in sight.

- Meanwhile, US economic growth surprises have been trending lower. So far, large cap equities have taken the weaker data in stride as it is still considered good for quality stocks. The market also anticipates rate cuts by the US Federal Reserve (Fed) over the next six to nine months.

- The bottom line is that we are still observing generally positive conditions for risk assets, with slowing but not crashing US growth from high nominal levels, slowing inflation, improving earnings growth and easy liquidity conditions – and without extreme complacency in sentiment, despite the political uncertainty.

- We will be closely monitoring any changes against this backdrop, in particular a potential slowdown in US growth.

Market surge with a narrow base as Biden’s nomination odds plummet

- Betting markets are asking serious questions about the probability of a Biden nomination in August (86% before the US presidential debate vs. 46% now). Vice President Harris’s chances of securing the Democratic nomination have risen to approximately 39% (source: PredictIt).

- The bond market reacted to the debate with a yield curve steepening, based on heightened expectations of a Trump win and, more specifically, his anticipated inflationary policies.

- In the first half of the year, five stocks accounted for about 60% of the S&P 500’s 15.3% gain (total return in USD). Nvidia alone contributed 32% of the return, according to Strategas.

- The weight of the top 10 companies in the index is at a record high which was last reached in 1929.

- The market remains narrow, with only 5% reaching new highs.

- Small cap companies have struggled this year, with the Russell 2000 up barely 2% while large caps are up 15%.

- Over the last 45 years, this kind of bad streak occurred only once, in 1997−

- As a result, small caps are at their cheapest in over two decades, relative to large caps.

- We expect S&P 500 Q2 earnings to be good. The FactSet Q2 EPS growth estimate consensus – approximately 9% – is now the highest since 2021.

Marktentwicklung

World

- Both Trump and Biden ran massive budget deficits: Trump via tax cuts and Biden via deficit spending.

- The US is spending over a trillion dollars on debt servicing, and the Congressional Budget Office projections offer little hope for improvement. The key question now is the role the Fed will play in this new long-term macro regime.

- The timing of the Fed’s policy needs to be nearly perfect to avoid a mistake. There is a risk of lagging tightening effects if they cut too late and unanchored inflation expectations if they act too soon.

- The US elections are further complicating the rate path as growth is slowing down.

- US manufacturing contracted for a third-straight month in June.

- The June ISM Services index was at 48.8, the lowest since May 2020.

- The increase in continuing jobless claims is also notable.

Europe

- France has voted and now faces the challenge of forming a new government. This may prove difficult as none of the three main camps –e. the victorious leftist coalition, President Macron’s centrist alliance and the far-right RN –secured an absolute majority in parliament. From a French financial market perspective, however, we do not expect additional volatility.

- The European Central Bank (ECB) does not seem to be in a hurry to cut rates further in July. This is at least how recent comments made by ECB chief economist Philip Lane and president Christine Lagarde can be interpreted.

Switzerland

In June, the gap between the purchasing managers’ index (PMI) in the manufacturing and service sectors widened again. However, both PMIs have shown increased volatility in recent months, without any clear direction. Over a somewhat longer period, the PMIs have continued to point to a two-tier Swiss economy: robust services and weaker industry.

As Bill Clinton once said: Americans prefer “strong and wrong”to “weak and right”

Historically, the market has tended to experience higher volatility in the one to two months preceding US elections – which normally coincide with the first presidential debate. But the timing of this year’s debate (the earliest in modern US political history) and Biden’s dismal performance could hasten a period of higher volatility. The voices of Democratic strategists and donors calling for a potential replacement are also getting louder.

The clock is ticking as the Democratic National Convention (DNC) begins on 19 August. The deadline to confirm the candidate on the ballot might in fact be 7 August, based on Ohio state law. The search for a new candidate would increase uncertainty around the election outcome and could elevate equity volatility from rock-bottom levels.

According to a new Strategas note detailing the process for changing the Democratic nominee, only Biden has the authority to remove himself from the ticket in one of two ways:

- Option A: Biden can release his delegates at the DNC, letting them choose the nominee. This would likely be an attempt to focus the convention on Biden’s legacy while honoring his public service and preserving his dignity.

- Option B: After the convention, the 100-member Democratic National Committee can select the nominee by majority vote. This method would give Biden more control, but risk delayed selection and legal challenges in battleground states, such as Wisconsin and Nevada.

The results in the Senate and House of Representatives are also important for the trajectory of fiscal policy and the debt outlook. Our base case remains that control of the Congress will be split between Democrats and Republicans, regardless of who is elected president.

Democrats are slightly favored to win the House and Republicans the Senate. A divided government would likely result in legislative gridlock as far as enacting superlative fiscal policies are concerned. A unified Republican Congress and presidency (“red sweep”) is potentially the least favored outcome for financial markets – particularly for fixed income – as the market could face more fiscal largesse and grave concerns about the budget deficit and debt outlook. Up until the debate, this was an unlikely scenario (15-20%). We will continue to monitor the developments.

- The corporate tax rate is likely to remain at or around 21% as the Democrats will aim to extract concessions for an extension of the Tax Cuts and Jobs Act (TCJA, also known as the Trump tax cuts of 2017). Come 2025, the White House may resort to executive and regulatory actions, where possible, to advance certain policies that do not require legislation (e.g. tariffs).

- Tariff risks remain a major bearish wildcard as trade tensions with China would further intensify, especially with a Trump administration.

- According to an April JPMorgan Chase panel with insiders from both parties, there is a high probability of a second CHIPS act. It is reasonable to expect ongoing fiscal support for the tech-manufacturing sector in any outcome.

- Even more questions about the Inflation Reduction Act (IRA) abound as it is the only major program that is not bipartisan. A full legislative repeal of the act’s EV-related subsidies seems unlikely – especially since Republican-held congressional districts account for 71% of the total investment received for clean vehicle and battery technologies. But the consumer element of the IRA (e.g. tax breaks for EVs) could be altered or eliminated.

Positioning

Our market outlook remains generally positive for risk assets in the third and fourth quarters. We believe they will be characterized by softening nominal growth, a potential return to disinflation, a proactive Fed looking to implement rate cuts should growth or inflation weaken more abruptly, and an improving outlook for corporate earnings.

We think US large cap quality stocks will continue to outperform in this environment until something material changes in the macro set-up. While gold is likewise expected to remain bid-driven by central bank demand in emerging markets, China has recently shown price sensitivity and halted buying.

- According to Goldman Sachs, the S&P has risen by more than 15% in the first half of the year only 25 times since 1900. There has been a 72% success rate for a median return of 8.9% in the second half of the year.

That said, we see higher risks for US equity markets in the medium term due to elevated valuations and growth that is close to stalling. As political risks increase, the high concentration in equity markets only amplifies these risks. In addition, concern over government borrowing and debt levels continues to rise.

In terms of fixed income markets, the yield curve has noticeably steepened since the presidential debate and with it, the growing possibility of a second Trump presidency.

- Extrapolating the move in nominal and real yields, we think markets could see a mix of stronger economic growth, higher inflation and more Treasury supply, if Trump wins.

- A tougher stance on immigration would hamper the labor supply and drive upward pressure on wages, which is inflationary, as are tariffs and protectionist policies.

Implementing such inflationary policies while potentially pushing the Fed towards a more accommodative monetary stance is likely to create higher volatility in the macroeconomic cycle. As we do not believe this is favorable for long-duration investments, we maintain our underweight position in bonds.

On an equity sector level, a Trump victory would likely increase the chances of extending a larger portion of the expiring tax cuts. This would most clearly benefit key sectors such as energy and telecoms.

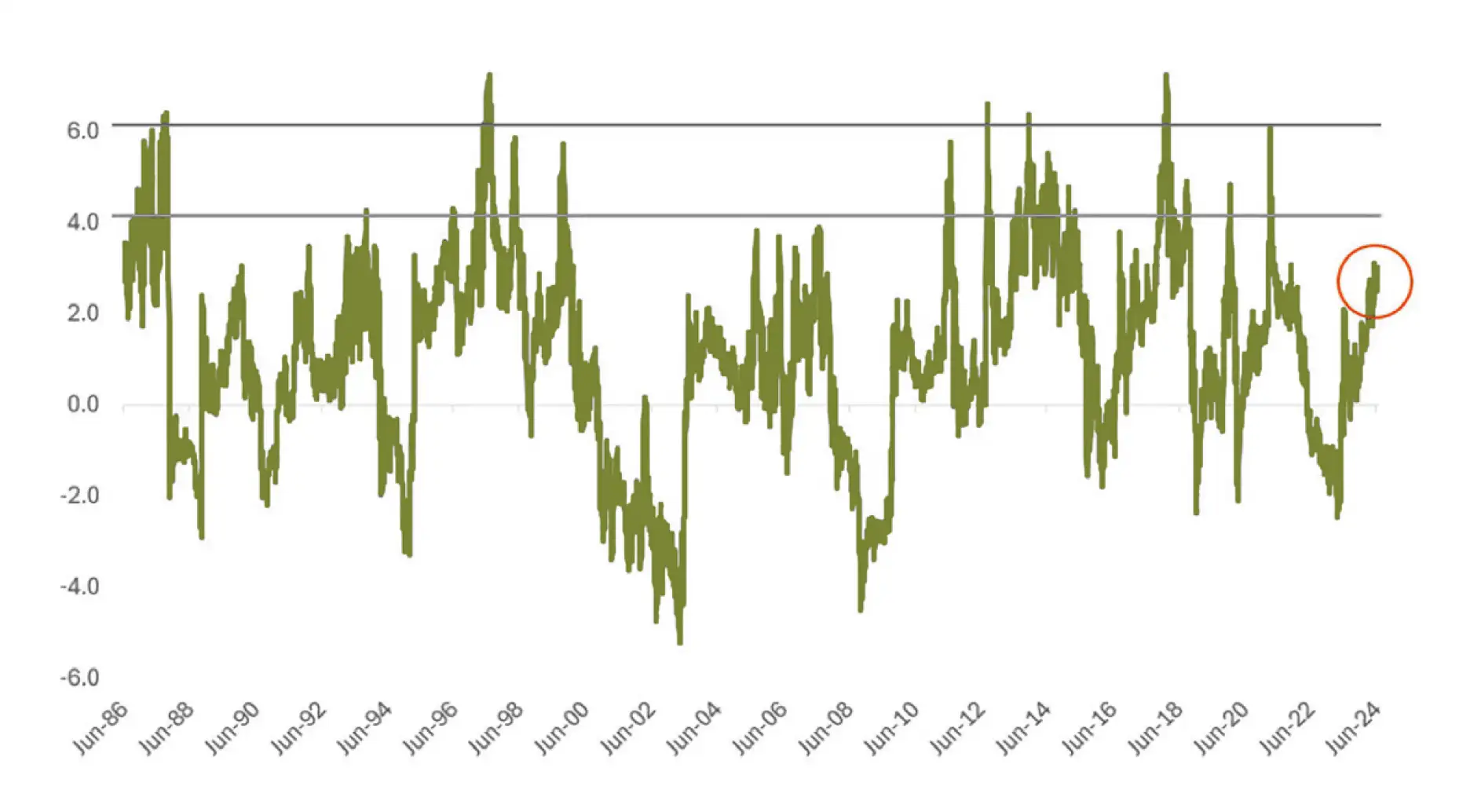

Chart

This chart shows the 12-month rolling, volatility-adjusted S&P 500 returns in excess of the risk-free rate, known as the Sharpe ratio. We can note the higher ratios before big drawdowns, with a ratio above 4 indicating an increasingly fragile market and above 6 excessive market euphoria. If the current ratio of 3 rises further, reassessing risk exposures will be crucial.