Executive Summary

- After reaching new all-time highs in May, global equities are consolidating and could further rise over the summer.

- The path of inflation dominates the macroeconomic discussion, as do questions around when and how much central banks will be able to loosen monetary policy.

- Our outlook remains positive because of recently softening growth data (but not so weak as to indicate a recession) as well as promising prospects for a return to disinflation, the US Federal Reserve (Fed) still leaning towards rate cuts and an improving outlook for corporate earnings.

- Nvidia’s latest business results make a case for the tech industry’s immense investments in data centers that host artificial intelligence (AI) applications. Less obvious beneficiaries of this build-out include the renewable energy, heating, ventilation and air conditioning (HVAC), and electrical equipment industries.

- We believe that quality-growth stocks will outperform.

- We are cautious about high-yield and long-duration bonds, instead preferring sovereign and high-grade corporate bonds with a shorter duration (especially in the US)

- Gold continues to be a sizeable long-term conviction holding, having overtaken the euro as the second largest reserve asset held by central banks.

- Due to the forecast of structurally higher inflation in the coming years, we expect to add exposure to commodities.

Inflation and monetary policy still dominate the macro discussion

- After three months of hotter US inflation from January to March, April’s softer inflation data cleared the way for global stocks to reach new all-time highs.

- The upward dynamic was strongest for large cap US companies, which got an additional boost from Nvidia’s stellar earnings.

- Equities are now consolidating close to recent breakout levels and have a good chance of rising over the summer – in part because rallies from June to August are common in US election years.

- The Fed will mainly look for further decreases in inflation to determine when and how much to loosen monetary policy. Investors are scrutinizing each release of macroeconomic data, with the discussion shifting from cuts (several, one, none) to hikes. Even the latest Fed minutes capture a degree of confusion and disagreement among members.

- We expect a favorable development of inflation over the coming months as the lagging shelter subcomponent, which accounts for 35% of the consumer price index and 43% of the core index, finally looks set to come down. Without a recession, a sustained return to the 2% inflation target seems unlikely, though is not necessary for stocks to perform well.

Market Development

World

The US government budget is running at a 6% deficit – an unprecedented level outside of an economic recession – and is forecast to continue doing so over the next few years, raising concerns over long-term debt sustainability. Goldman Sachs projects that the US debt-to-GDP ratio will climb to 130% by 2034. In 2019, their projection was 97%.

The US yield curve has been inverted for a record of more than 400 trading days, prompting an increasing number of market commentators to dismiss the yield curve as a failed recession indicator. While we do not expect an imminent recession, we find this assessment is false and premature. In the past, the unwinding of the inversion, rather than the inversion itself, signaled a recession. We are not yet there.

Europe

Elections for the European Parliament take place from 6 to 9 June. Current polls suggest a shift to the right, which could change current policy priorities and complicate decision-making in an increasingly fragmented Parliament. From an investor perspective, regaining competitiveness should be top of mind for politicians as structurally higher energy prices, less favorable demographics and more complex regulations contribute to the growing gap between the EU and the US. Unfortunately, there are no easy solutions to waning competitiveness – especially in a political union of 27 member states.

Switzerland

Since the beginning of 2024, the Swiss franc has fallen against the euro and US dollar. The March cut in interest rates contributed to the depreciation. Further franc weakness is the most likely source of higher Swiss inflation, according to Swiss National Bank chief Thomas Jordan. He argues that the SNB could counteract the risk by selling foreign exchange reserves, and this may already be happening. Inflation seems to be under control – which is why another interest rate cut in June would make sense – yet weakness in the franc may defer the next step.

Nvidia, artificial intelligence and data centers

Nvidia delivered another outstanding business update, confirming its currently unrivaled position as the prime beneficiary of AI. Since the launch of ChatGPT in November 2022, Nvidia’s sales have quadrupled, and its net income has increased ninefold. Over the same period, its market capitalization has risen almost sevenfold, from USD 420 billion to USD 2.8 trillion. This unprecedented growth has turned Nvidia into the world’s third most valuable company behind Microsoft and Apple, and ahead of Alphabet and Amazon. The stock is responsible for 4% of the 11% the S&P 500 has gained in 2024 so far.

To be able to bring generative AI models to customers, the US big tech companies are investing billions into improving and building out their data centers. For example, Microsoft recently announced a USD 3 billion investment into data center infrastructure in both Japan and the UK. As investors slowly start to understand the wider ramifications of this massive global build-out, we can shed some light on the underappreciated impact across certain industries.

Electricity demand from data centers is expected to increase substantially. According to the International Energy Agency, data centers consumed approximately 460 terawatt-hours (TWh) in 2022. In 2023, the growth in electricity demand that could be attributed to data centres was comparable to that of air conditioning – and higher than that of electric vehicles. By 2026, electricity demand is projected to be between 620 and 1050 TWh. Not only will there be more data centers, but each will consume more energy. For example, whereas one Google search requires approximately 0.3 watt-hours (Wh), one ChatGPT request consumes 2.9 Wh. What’s more, the most advanced chips require more electricity, leading to an overall increase despite the relative improvement. While Nvidia’s A100 delivers 5 petaflops (unit of computer processing speed) and consumes 6.5 kilowatts (kW), the newer H100 delivers 32 petaflops and consumes 10.2 kW. The power intensity (kW per petaflops) may drop, but overall consumption rises.

Computing is responsible for about 40% of a data center’s electricity consumption. Cooling accounts for another 40% and the associated IT equipment for the remaining 20%. The renewable energy industry should benefit from higher electricity demand since all hyperscalers (e.g. Microsoft, Amazon, Google, Meta) and their many co-locators (e.g. Equinix) have committed to using only carbon-free energy by 2030. Electricity is procured through corporate power purchase agreements (CPPAs), which over the past five years accounted for nearly 80% of all utility-scale solar installations in the US.

Heating, ventilation and air conditioning (HVAC) companies are also well-positioned to benefit as efficient cooling is crucial to running a data center profitably. A data center’s capacity is in fact directly related to how well it cools the servers – the closer together the systems and equipment can be stacked, the more productive per square meter. Cooling technology has improved from air conditioning entire rooms to specialized systems which use fans to draw away the heat emitted by servers and cools it with water or a refrigerant. Yet even better performance is required because today’s more advanced systems can struggle to control the temperatures associated with global warming (Google and Oracle, for instance, both faced downtime during a heatwave in Europe last summer). Finally, companies offering a broad range of electrical or technical components and solutions are needed, for instance electrical switchgear, ethernet systems and specialized cable systems.

Positioning

Our market outlook remains generally positive for risk assets. This is due to recently softening growth data (but not so weak as to indicate a recession) as well as promising prospects for a return to disinflation, a Fed still leaning towards rate cuts and an improving outlook for corporate earnings. As a result, we expect global equities to continue performing well in the coming months. Beyond this time horizon, certain factors are likely to become less supportive – and the US election will probably cause some short-term market volatility.

We favor companies with solid balance sheets and promising growth outlooks. In our view, Nvidia’s strong results increase the likelihood that quality-growth stocks will outperform for the remainder of this business cycle.

Our cautious stance regarding fixed income still applies. We do not like high yield bonds as because credit spreads are too tight to adequately compensate for the additional risk. We prefer sovereign bonds and high-grade corporate bonds. Overall, we keep duration short, particularly in the US where heavy new Treasury bond issuance could weigh on yields. In the Eurozone, we are gradually becoming more positive towards longer-duration bonds since the ECB will likely cut interest rates for the first time in June.

We reiterate our conviction that gold represents the best asset to diversify our portfolio. In our view, gold acts as a hedge against a range of risks: money-supply growth, inflation, surging sovereign deficits, geopolitical uncertainty and dwindling central bank credibility. Interestingly, gold has overtaken the euro as the second most important reserve asset held by central banks, a position it had lost in the late 1990s. Central banks in China and other emerging markets are increasing their gold holdings because gold is a politically neutral and safe asset which is not subject to US dollar-based sanctions.

Within the asset class of commodities, we are looking to add to our existing exposure. Although we expect a slowdown in inflation over the next few months, we believe that we are in a structurally higher inflation environment than in the 2010s. Commodities have historically performed well during heightened inflation.

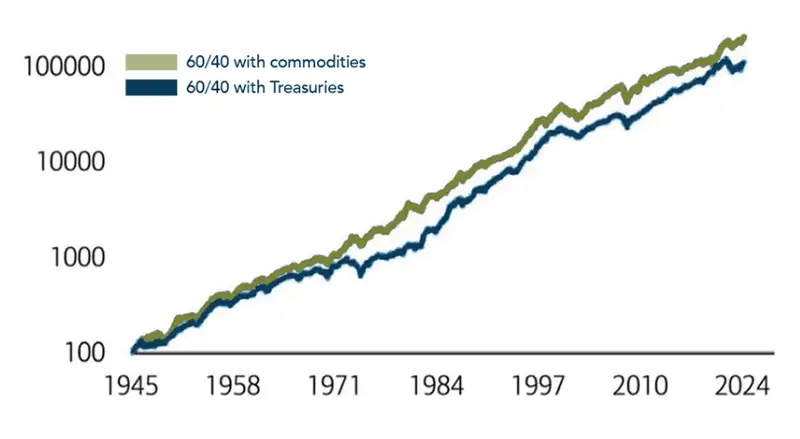

Chart

Commodities may be a better portfolio diversifier than bonds. From 1945 to the present, a portfolio of 60% stocks and 40% commodities, instead of 40% bonds, would have outperformed and exhibited less downside risk. The benefits of commodities were strongest during periods of higher inflation, such as the 1970s and 1980s.